Inflation Spikes, Fed Cuts Loom – What Happens to XRP Next?

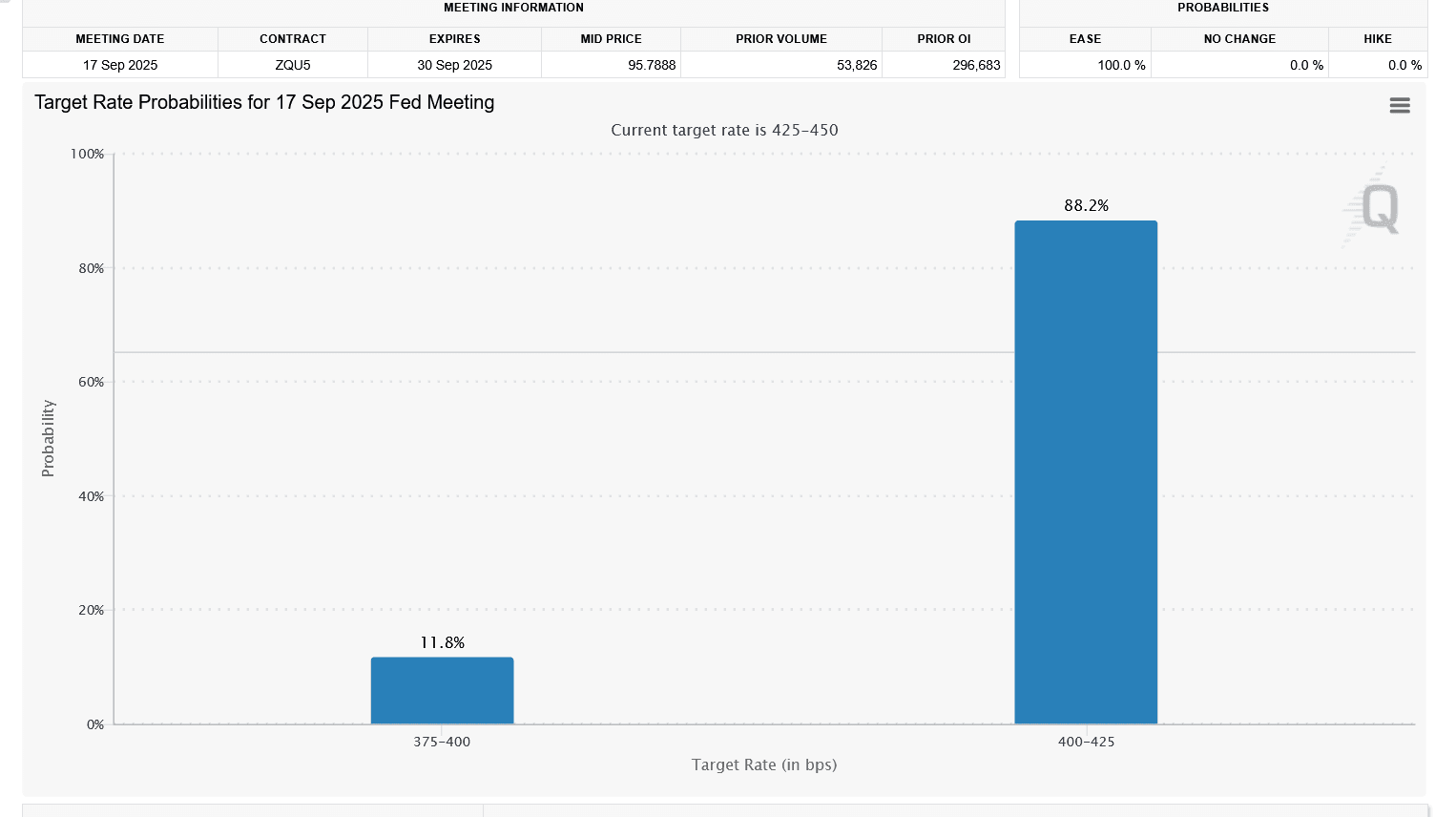

The latest economic signals out of the United States point to a tricky balancing act for markets. Inflation is expected to climb to 2.9% year-over-year in August, its highest since January, while core inflation remains stubborn at 3.1%. Rising tariffs are fueling price increases, squeezing households, and complicating the Federal Reserve’s mission. Despite this, markets expect a 25-basis-point rate cut in September, with more to follow by year-end. For risk assets like XRP , this policy shift could be pivotal.

Macroeconomic Setup: Inflation vs. Rate Cuts

The inflation report due Thursday is more than a number—it’s the market’s cue on whether the Fed has enough room to cut aggressively. Tariffs are driving costs higher in core goods categories, historically a deflationary force. That stickiness means the Fed cannot afford to slash rates too quickly, but the job market slowdown leaves them little choice but to ease policy.

This sets up a mixed backdrop for cryptocurrencies: inflationary pressures traditionally weigh on risk appetite, but rate cuts often inject liquidity into markets. If the Fed signals it is willing to prioritize employment over inflation, XRP price and other digital assets could benefit from a wave of fresh capital.

XRP Price Prediction: Signs of Breakout?

On the daily chart, XRP price is showing early signs of renewed momentum:

- Price Action: XRP price is trading at $2.98 after gaining over 2% today. It’s now pressing against the middle Bollinger Band ($2.89) and flirting with the upper band ($3.06). A daily close above $3.00 would be a strong psychological and technical signal.

- Trend History: July saw a parabolic run toward $3.80 before profit-taking sent the coin lower. Since then, XRP has been consolidating between $2.70 and $3.10, building a base. The recent green Heikin Ashi candles show diminishing selling pressure and a shift toward bullish control.

- Bollinger Bands: The bands are narrowing after weeks of sideways trading. This volatility squeeze often precedes a sharp move. If XRP can break and sustain above $3.10, the next targets are $3.25, $3.45, and potentially $3.80. On the downside, $2.70 remains key support.

Consecutive bullish candles suggest buyers are regaining dominance. But confirmation requires a breakout and hold above the resistance cluster near $3.05–$3.10.

What Traders Should Watch?

- Thursday’s Inflation Report: If CPI comes in hotter than expected , markets may doubt the Fed’s ability to deliver multiple rate cuts this year, potentially weighing on crypto sentiment.

- Fed Policy Meeting: A dovish cut could inject optimism into risk assets, boosting XRP toward its upper resistance levels.

- Volume Confirmation: For XRP price breakout attempt to succeed, it needs rising volume on daily closes above $3.10. Weak follow-through could trap bulls in another range-bound cycle.

XRP Price Prediction: Short-Term Outlook

If inflation lands in line with forecasts and the Fed follows through with a rate cut, $XRP could capitalize on the broader risk-on sentiment. A push through $3.10 would open the door to $3.25 and $3.45 within weeks, with $3.80 as a medium-term target.

However, if inflation surprises to the upside and the Fed hesitates on cuts, XRP could revisit $2.80 and even test $2.70 support. The coin’s fate hinges not just on technicals but also on the Fed’s credibility in balancing inflation and employment risks.

$XRP is sitting at a decisive technical level just as macro forces reach a critical juncture. A dovish Fed could reignite its July rally, but sticky tariff-driven inflation remains the wildcard that could cap upside momentum.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

"I'm panicking, what happened?" Cloudflare outage causes global internet chaos

The incident once again highlights the global internet's heavy reliance on a few key infrastructure providers.

Mars Morning News | Starting this Thursday, the United States will fill in missing employment data and release a new batch of economic data

The United States will fill in missing employment data and release new economic data. The Coinbase CEO is looking forward to progress in crypto regulatory legislation. Market participants predict the market is nearing a bottom. Phantom has launched a professional trading platform. Trump hints that the candidate for Federal Reserve Chair has been decided. Summary generated by Mars AI This summary was generated by the Mars AI model, which is still being iteratively updated for accuracy and completeness.

Countdown to a comeback! The yen may become the best-performing currency next year, with gold and the US dollar close behind

A Bank of America survey shows that more than 30% of global fund managers are bullish on the yen's performance next year, with undervalued valuations and potential central bank intervention possibly paving the way for its rebound.