BIS calls for "moderate long-term interest rates", Bank of America’s Hartnett: Return to the "Nixon era", go long on gold, cryptocurrencies, and US Treasuries, short the US dollar

As US Treasury Secretary Yellen made a rare public call to control interest rates, top Wall Street strategist Hartnett believes that history is repeating itself and the current market environment closely resembles the "Nixon era."

As U.S. Treasury Secretary Bessent makes a rare public call to control interest rates, Wall Street's top strategist Hartnett believes history is repeating itself, and the current market environment is strikingly similar to the "Nixon era."

Written by: Long Yue

Source: Wallstreetcn

From political pressure to the latest warnings from Wall Street giants, the script of the "Nixon era" seems to be repeating itself.

Recently, U.S. Treasury Secretary Bessent made a rare public "rebuke" of the Federal Reserve, urging it to return to its statutory mission of "moderate long-term interest rates," and criticizing its unconventional policies for exacerbating inequality and threatening its own independence.

Soon after, Bank of America Chief Investment Strategist Michael Hartnett released a report pointing out that the current situation is highly similar to the "Nixon era" of the 1970s, and that political pressure will force the Federal Reserve to pivot, possibly even adopting the extreme tool of yield curve control (YCC).

Before the Federal Reserve formally commits to YCC, Hartnett is bullish on gold and digital currencies, bearish on the U.S. dollar, and believes investors should prepare for a rebound in bond prices and a broadening of the stock market rally.

Is the "Nixon Era" Repeating Under Political Pressure?

According to Wallstreetcn, in her signed article, Bessent for the first time placed "moderate long-term interest rates" alongside maximum employment and stable prices as the three statutory responsibilities the Federal Reserve must focus on to rebuild its credibility.

The United States is facing short- and medium-term economic challenges, as well as long-term consequences: a central bank that is putting its own independence at risk. The Federal Reserve's independence comes from public trust. The central bank must recommit to maintaining the confidence of the American people. To safeguard its own future and the stability of the U.S. economy, the Federal Reserve must reestablish its credibility as an independent institution focused on its statutory mission: maximum employment, stable prices, and moderate long-term interest rates.

Traditionally, long-term interest rates are more determined by market forces, so the Treasury Secretary's "naming" is seen by the market as a highly unusual signal. It suggests that, in the Trump administration's policy agenda, lowering long-term financing costs has become a priority. This statement is seen by the market as a call for the Federal Reserve to take a more active role in managing long-term interest rates, and as a prelude to a possible major shift in U.S. monetary policy.

Coincidentally, Hartnett reached a similar conclusion in his latest report, but he believes that the main force driving the Federal Reserve's pivot will be political pressure.

Hartnett wrote in his report that this scene is identical to the early 1970s during the Nixon era. At that time, in order to create economic prosperity before the election, the Nixon administration pressured then-Federal Reserve Chairman Arthur Burns, leading to massive monetary easing.

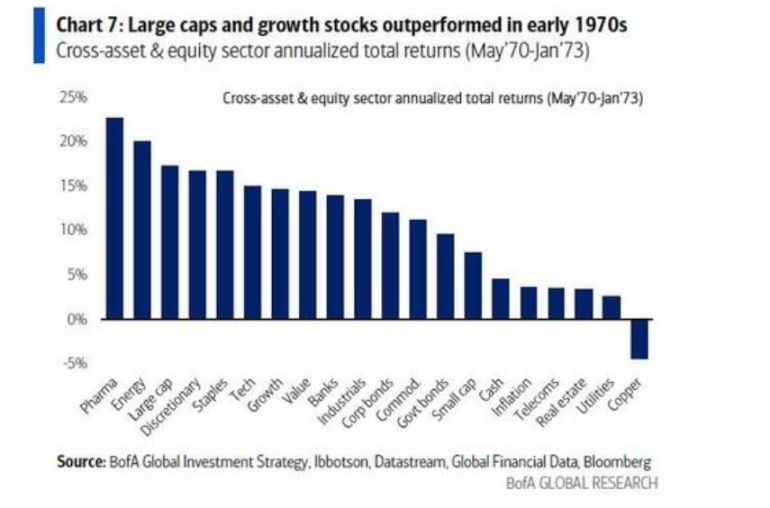

The result was that the federal funds rate dropped from 9% to 3%, the U.S. dollar depreciated, and a bull market in growth stocks represented by the "Nifty Fifty" was born. Hartnett believes history is repeating itself, and that pre-election political motives will once again dominate monetary policy.

Yield Curve Control: An Inevitable Policy Tool?

Hartnett believes that in the context of soaring global long-term bond yields, policymakers cannot tolerate a disorderly rise in government financing costs.

Currently, global sovereign bond markets are under tremendous pressure. Long-term government bond yields in the UK, France, and Japan have all hit multi-decade highs, and the yield on the U.S. 30-year Treasury once tested the psychological threshold of 5%. However, Hartnett believes that risk assets have reacted calmly because the market is already "betting" that central banks will eventually intervene.

Therefore, he predicts that to prevent government financing costs from spiraling out of control, policymakers will resort to "price maintenance operations," such as Operation Twist, quantitative easing (QE), and ultimately, yield curve control (YCC).

Bank of America's August global fund manager survey showed that 54% of respondents expect the Federal Reserve to adopt YCC.

Go Long U.S. Treasuries, Gold, and Digital Currencies, Short the Dollar!

Based on the judgment that the "Nixon era is repeating" and "YCC will eventually arrive," Hartnett outlined a clear trading strategy: go long bonds, gold, and digital currencies, and short the U.S. dollar until the U.S. commits to implementing YCC.

Step One: Go Long Bonds

The direct consequence of YCC is the artificial suppression of bond yields. Hartnett believes that as U.S. economic data shows signs of weakness, such as a 2.8% year-on-year decline in construction spending in July, the Federal Reserve already has enough reason to cut rates, and political pressure will accelerate this process. He judges that the trend for U.S. bond yields is toward 4%, rather than continuing to surge to 6%. This means there is significant upside potential for bond prices.

Step Two: Go Long Gold & Crypto

This is the essence of the entire strategy. YCC is essentially debt monetization, i.e., "printing money" to finance the government. This process will severely erode the purchasing power of fiat currencies. Hartnett makes it clear that gold and digital currencies, as stores of value independent of sovereign credit, are the best tools to hedge against such currency depreciation. His advice is straightforward: "Go long gold and cryptocurrencies until the U.S. commits to implementing YCC."

Step Three: Short the U.S. Dollar

This is the inevitable result of the first two steps. When a country's central bank announces unlimited money printing to suppress domestic interest rates, its currency's international credibility and value will inevitably suffer. The 10% depreciation of the dollar during the Nixon era is a historical lesson. Therefore, shorting the dollar is the most logical part of this grand narrative.

The core logic of this strategy is: YCC means the central bank prints money to buy bonds and suppress interest rates, leading to currency depreciation. Gold and digital currencies will benefit from this. At the same time, forcibly suppressed interest rates will benefit bond prices and open up upside potential for interest-rate-sensitive sectors such as small-cap stocks, real estate investment trusts (REITs), and biotech stocks.

After the Boom: Inflation and Collapse?

Hartnett also reminds investors that every historical script has a second act.

Just like in the Nixon era, the easing and prosperity of 1970-72 was followed by runaway inflation and a market crash in 1973-74. He recalls that the boom ultimately ended with inflation soaring from 3% to 12% and the U.S. stock market plunging 45%.

This means that while the current trading window is tempting, it also harbors enormous long-term risks. But before that, the market may follow the "visible fist" of policy and stage a policy-driven asset feast.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

KAS Price Jumps 66%: Can Momentum Push Kaspa Toward December’s Bigger Targets?

VIRTUAL Price Jumps 17% as Falling Wedge Breakout Signals December Upside

Pi Network News: Can the CiDi Games Partnership Push Pi Beyond $1?

Charles Hoskinson Reveals When Altcoins Like ADA, XRP and ETH Will Hit New All-Time Highs