Countdown 50 Days: Bitcoin Bull Market May Enter Final Chapter, Historical Cycle Signals Issue Warnings

In the past few months, the price of bitcoin has fluctuated above $100,000, with investor sentiment running high. However, multiple on-chain data points and historical cycle patterns are simultaneously pointing to a common conclusion: the bull market may only have about 50 days left in its final "frenzied peak" phase.

1. The Script of Market Cycles

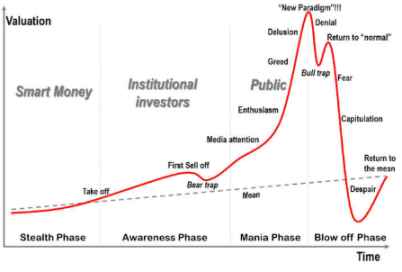

Each bitcoin bull market is roughly divided into four acts:

Accumulation phase: prolonged sideways movement, with capital slowly entering the market;

Rising phase: the market continues to rise, with institutions and retail investors gradually participating;

Frenzy phase: profits are generally abundant, and market greed reaches its peak;

Collapse phase: capital flees, and prices enter a prolonged downturn.

Currently, we are deep in the third act, and almost all indicators show that the market is already in an overheated state.

2. On-chain Data Signals a Peak

About 90% of bitcoin supply is now in profit, and indicators such as MVRV and NUPL are approaching historical extremes;

This "everyone is in profit" state usually only appears at the top of the cycle, and is typically followed by large-scale profit-taking.

3. ETF and Capital Flows

The assets under management for spot bitcoin ETFs have reached $142 billion. In September, capital flows turned positive again, but the increase was not frenzied, resembling more of a cautious "final sprint," which matches the characteristics of late-stage capital behavior.

4. Seasonality and Price Trends

Historically, the fourth quarter is often the last explosive point of a bull market:

November 2020: +42.9%

October 2021: +25.5%

November 2024: +37.3%

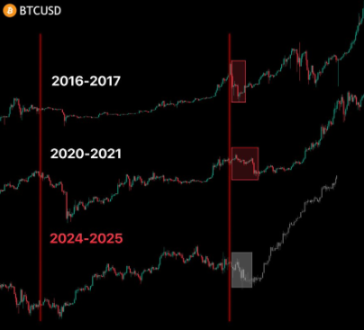

This year's new high of $124,000 in August, followed by a pullback to $110,000, is also very similar to the late-stage trends of 2017 and 2021.

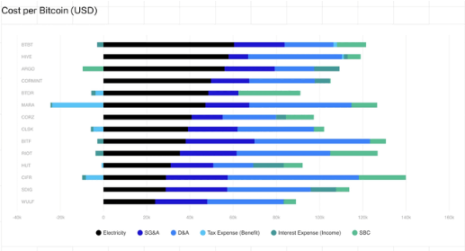

5. Miners and Cost Support

The average cost for miners is around $95,000, and the current price still keeps them profitable. This means miners will not become a source of selling pressure for now, leaving room for the final stage of the rally.

6. Countdown of the Time Cycle

It has been 1,020 days since the bottom in November 2022, while in past cycles, the top usually appears at 1,060–1,100 days, which means the peak may occur between late October and mid-November 2025;

At the same time, it has been 510 days since the 2024 halving, and historical data shows that the top usually appears 520–580 days after the halving.

Both timelines point to about 50 days in the future.

7. The Script After the Peak

If the BTC peak appears around $120,000:

A subsequent drop of 70–80% is expected;

The bottom may be in the $30,000 range, with the timing likely before the end of 2026.

At the same time, altcoins often experience a brief frenzy after bitcoin peaks, but their corrections are more severe, with historical drops often exceeding 90%.

Conclusion

The final stage of the bitcoin bull market is already in countdown:

On-chain indicators are comprehensively overheated;

ETF capital inflows are cautious;

The fourth quarter is historically the "ultimate peak";

Both the time cycle and halving patterns point to the next 50 days.

For investors, this means:

There may still be a final surge in the short term, possibly peaking in the $120,000 range;

In the long term, one must be alert to a deep correction, with a bear market drop expected at 70–80%;

Altcoins are even riskier, often serving as the final exit point in liquidity rotations.

The conclusion is clear: keeping profits is more important than chasing the final high. In the most frenzied moments of the market, discipline and risk management will determine who laughs last.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ADA, ETH, XRP Climb as Bitcoin Zooms Above $93K, But Traders Warn of ‘Fakeout Rally’

Last Cycle’s Signal King Murad: 116 Reasons Why the 2026 Bull Market Will Come

I do not agree with the view that the market cycle is only four years; I believe this cycle may extend to four and a half or even five years, and could last until 2026.

Ethereum completes Fusaka upgrade, team claims it can unlock up to 8x data throughput

Major upgrades, which used to take place once a year, are now happening every six months, demonstrating that the foundation still maintains strong execution capabilities despite recent personnel changes.

Glassnode: Is Bitcoin Showing Signs of a 2022 Crash Again? Beware of a Key Range

The current bitcoin market structure is highly similar to Q1 2022, with over 25% of on-chain supply in a loss, ETF capital flows and spot momentum weakening, and the price relying on key cost basis areas.