Trump family's wealth grew by $1.3B following ABTC and WLFI debuts: Report

The family of United States president Donald Trump grew their collective wealth by $1.3 billion this week amid the trading debut of mining company American Bitcoin (ABTC), and gains from World Liberty Financial (WLFI), a decentralized finance (DeFi) protocol linked to the Trump family.

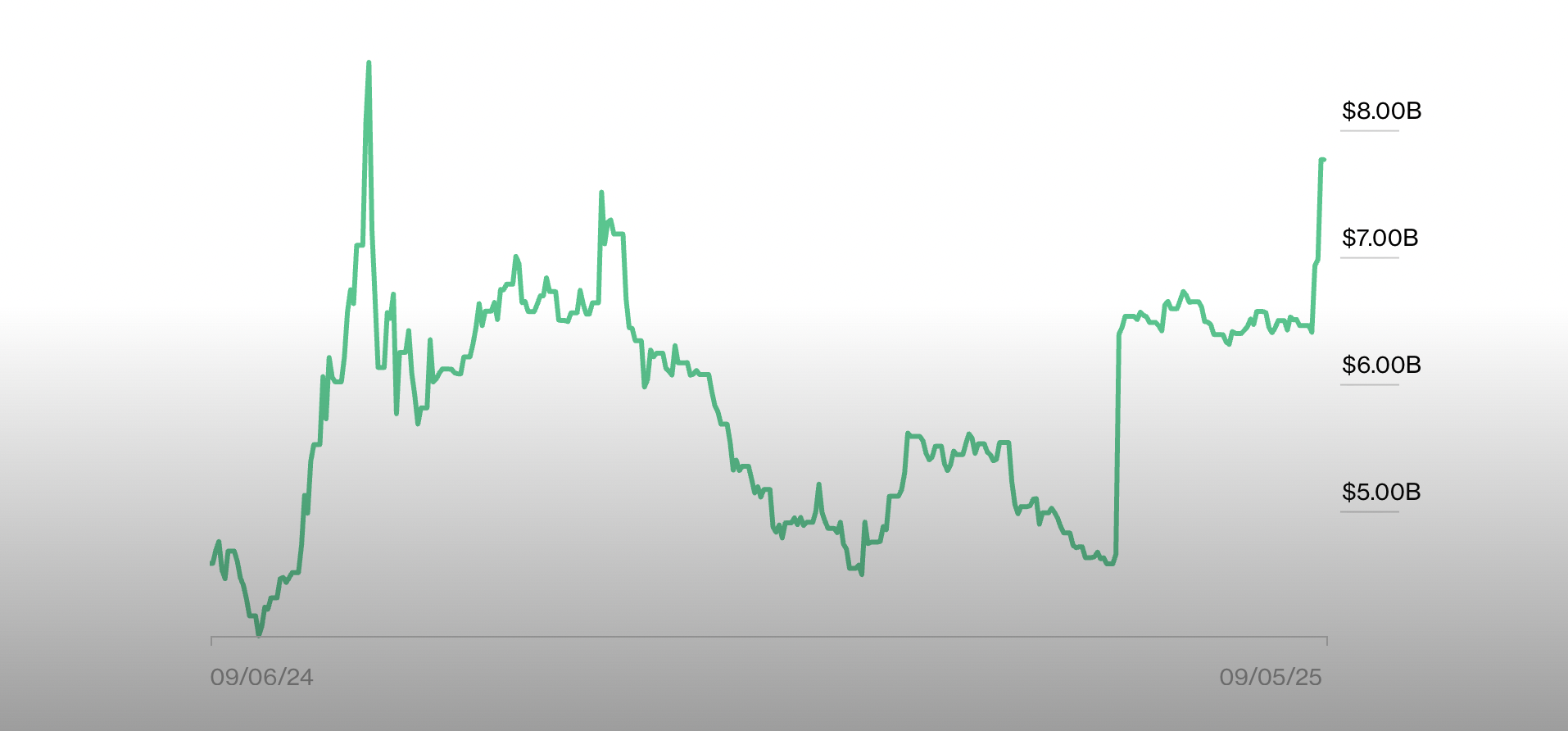

World Liberty Financial has added $670 million to the Trump family’s net worth, and Eric Trump’s stake in ABTC, which he co-founded, was valued at over $500 million following the trading debut of ABTC on Wednesday, according to Bloomberg.

The calculation measured the family’s net worth using market prices on Wednesday when shares of ABTC shot up to a high of $14 before collapsing by over 50% to a low of 6.24.

Additionally, the $1.3 billion did not account for the roughly $4 billion in WLFI tokens held by the Trump family that are subject to lock-up periods.

Using current market prices and excluding the $4 billion in WLFI tokens, the family’s collective net worth stands at over $7.7 billion, according to the Bloomberg Billionaires Index.

The Trump family’s involvement in crypto has brought an air of legitimacy to the cryptocurrency industry in the US following years of anti-crypto policies under the previous administration.

However, the US president’s crypto ties have also invited scrutiny from Democratic lawmakers in the US, who say the First Family’s involvement in the crypto sector represents a conflict of interest.

Related: Trump family went pro-crypto after Biden ‘weaponized' banks: WSJ

American Bitcoin and World Liberty made high volatility trading debuts this week

World Liberty Financial made its trading debut on major crypto exchanges on Monday, unlocking 24.6 billion WLFI tokens for the launch, which saw an initial trading spike before token prices collapsed by over 40%.

American Bitcoin was relisted on US stock exchanges, following a merger with Gryphon Digital Mining, a publicly listed crypto mining company, on Wednesday.

Trading of ABTC’s stock was halted five times on Wednesday due to heightened volatility, which saw the stock soar to a high of $14 before collapsing to current prices of about $7.36 per share.

Magazine: Crypto traders ‘fool themselves’ with price predictions: Peter Brandt

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

KAS Price Jumps 66%: Can Momentum Push Kaspa Toward December’s Bigger Targets?

VIRTUAL Price Jumps 17% as Falling Wedge Breakout Signals December Upside

Pi Network News: Can the CiDi Games Partnership Push Pi Beyond $1?

Charles Hoskinson Reveals When Altcoins Like ADA, XRP and ETH Will Hit New All-Time Highs