With XRP gaining strength from potential ETF developments and XLM showing technical resilience, the race for high-return cryptos in 2025 is heating up. The Q3 wallet beta launch scheduled for September 15 is boosting buzz around Remittix. XRP and XLM feature prominently as analysts compare momentum across these tokens.

Sponsored

As speculation about XRP’s breakout meets promise from Stellar’s chart setups, Remittix emerges with both promotional and structural appeal tied to real-world functionality.

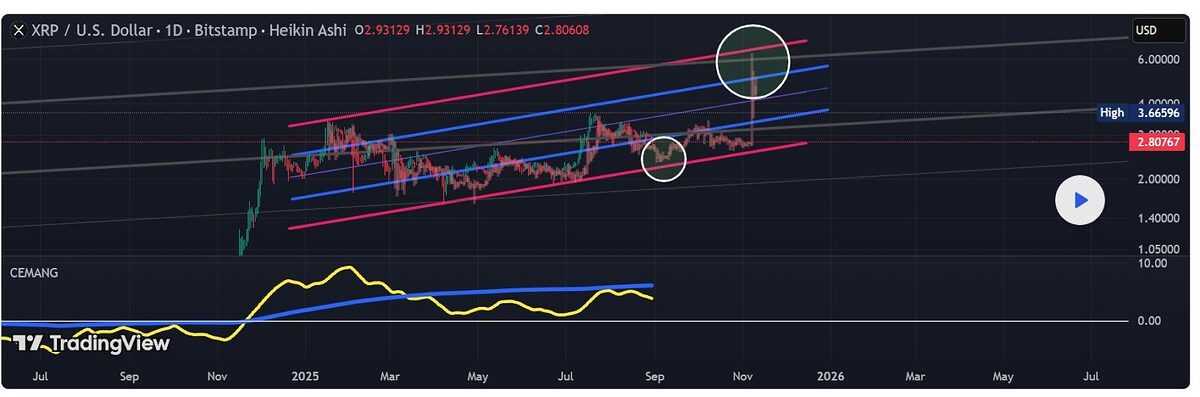

XRP Gathers Heat on ETF Breakout Odds

XRP is trading near $2.81 and recently formed a technical bull flag, suggesting a potential leap to $5 if it breaks above $3, a 77% upside opportunity. Market watchers note that ETF approval odds are climbing toward 87%, adding fuel to the narrative of a major rally.

Institutional filings and a cooling legal backdrop have strengthened the outlook despite cautious sentiment. That pattern puts XRP on watch as a classic breakout candidate amid rising investor interest.

XLM Climbs Toward Resistance with Stellar Momentum

XLM is holding just below $0.36 with bullish chart setups forming, including a possible inverse head and shoulders that could propel it past resistance toward higher levels. Weekly activity shows mixed sentiment, while some technicals hint at waning buying pressure, others support a breakout when volume returns.

XLM’s correlation with XRP often plays out in bull runs, giving it speculative alignment with XRP’s momentum. That builds a case for XLM as a potential mid-cap surprise if conditions align.

Remittix Carries Real World Promise That Outpaces XRP and XLM

When XRP and XLM rely on technical setups and macro triggers, Remittix stands apart with tangible payment utility. XRP chases ETF approval and XLM eyes chart geometry, but Remittix is already building infrastructure with real adoption in mind.

Remittix has sold over 647 million tokens, sits at $0.103 per token, and has pulled in more than $24 million in funding. Following the $20 million threshold, it landed a BitMart listing, and after crossing $22 million, it secured LBank. Now it is preparing for a third centralized exchange. That places Remittix ahead of both XRP and XLM in terms of listing momentum and adoption readiness.

The features below show why Remittix may be the pick of the three:

- Designed as a cross-border crypto utility, not another speculative token

- Audited by CertiK to ensure trust and security ahead of user rollout

- Wallet beta is live on September 15 for seamless payments and exchange

- Global reach with direct crypto to bank transfers in more than 30 countries

- Momentum building ahead of third exchange listing

Those attributes give Remittix not just promotional sizzle but a sturdy structural foundation that XRP and XLM, at their current stages, do not fully match.

Remittix Emerges as the Balanced Pick for 2025 Growth

XRP offers a powerful upside if ETF developments break through, and XLM could ride secondary momentum via chart patterns. Yet Remittix combines real-world utility, strong funding, CEX listings, and the upcoming wallet beta to form a more balanced argument for 2025 growth.

In the battle between speculation and structure, Remittix may be the more compelling pick for those seeking a blend of innovation and actual use.