Solana Price Prediction: Can SOL Ride Nasdaq News to $300?

Solana price is once again in the spotlight as SOL Strategies, a major player in the ecosystem, secures final approval to uplist its shares on the Nasdaq Capital Market. This move doesn’t just mark a turning point for the company but also signals a deeper level of institutional recognition for Solana itself. With a treasury of nearly 400,000 $SOL valued at $84 million and more than CAD $1 billion in delegated assets under its validator model, SOL Strategies represents one of the strongest institutional endorsements of Solana’s infrastructure to date. The big question now is how this uplisting will shape Solana’s market perception and price trajectory in the weeks ahead .

Solana Price Prediction: The Significance of SOL Strategies’ Nasdaq Uplisting

SOL Strategies, formerly Cypherpunk Holdings, has secured final approval to list on the Nasdaq Capital Market under the ticker STKE. This is not just a milestone for the firm but also a symbolic endorsement of Solana’s growing role in institutional finance. Nasdaq listings bring higher visibility, stricter reporting standards, and access to a much broader investor base compared to OTC or Canadian exchanges. For Solana, this uplisting indirectly represents a stamp of legitimacy that could attract new capital flows.

The firm already manages CAD $1 billion in delegated assets, 7,068 unique staking wallets, and holds a treasury of nearly 400,000 SOL valued at $84 million. These fundamentals strengthen Solana’s image as a blockchain with institutional-grade infrastructure.

Market Sentiment and Institutional Legitimacy

Institutional participation remains a critical driver of long-term crypto valuation. The uplisting of SOL Strategies signals that the Solana ecosystem is maturing into an investable asset class. Retail investors often interpret such developments as validation, creating momentum for price appreciation. More importantly, institutional players now have a listed vehicle to gain exposure to Solana without directly holding the token, which could indirectly increase demand for SOL itself.

Galaxy Digital ’s earlier uplisting on Nasdaq showed similar psychological and liquidity impacts, helping boost market sentiment across the crypto sector. Solana could benefit from a comparable wave of attention.

Solana Price Prediction: Solana’s Current Price Action

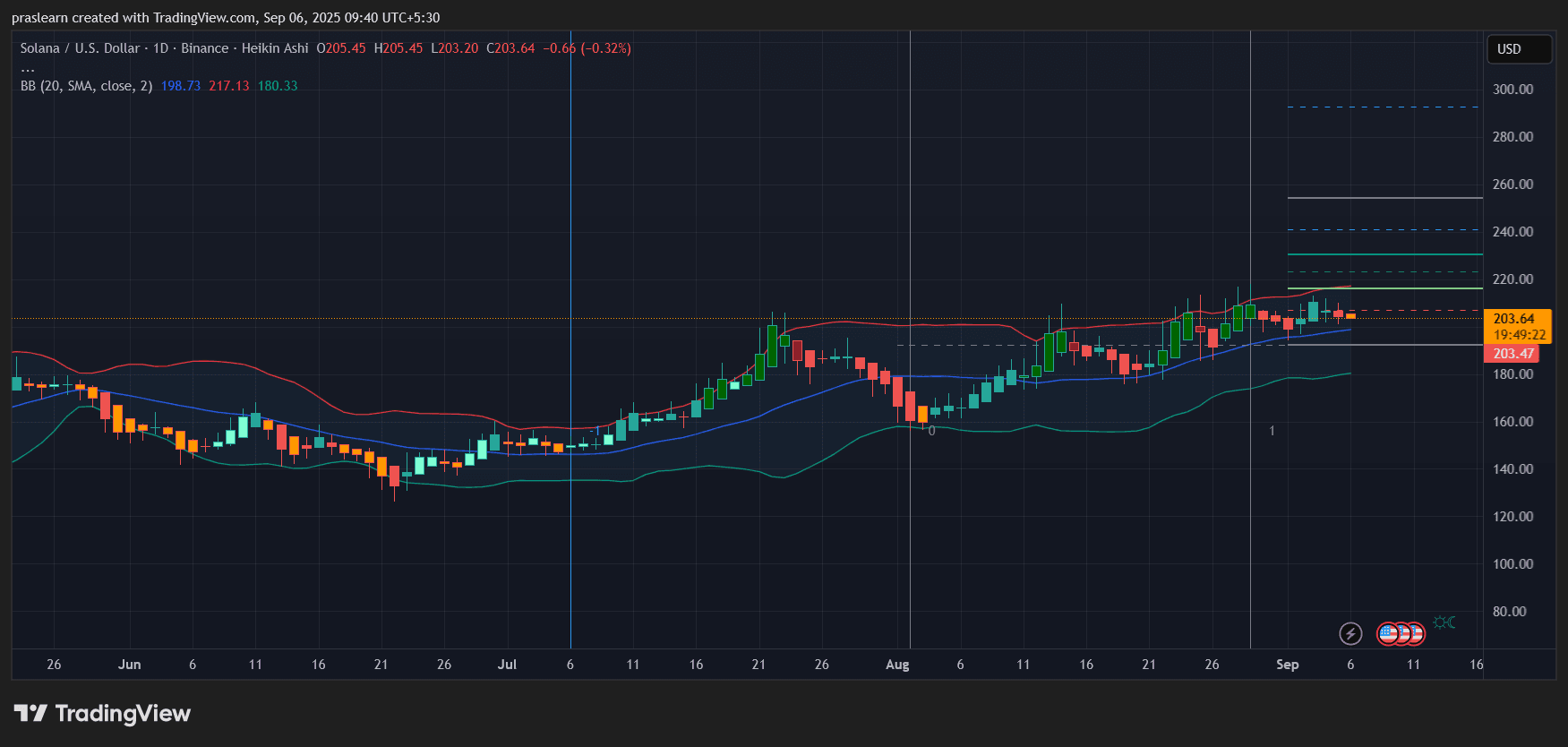

SOL/USD Daily chart- TradingView

SOL/USD Daily chart- TradingView

Looking at the daily chart, Solana price is consolidating around $203 after a steady uptrend from the $150–$160 range earlier in the summer. The price is riding the middle Bollinger Band (20 SMA) near $198, while the upper band sits at $217, indicating room for a breakout if buying pressure strengthens.

Key technical levels:

- Immediate support: $198 (SMA line) and $180 (lower Bollinger band).

- Resistance: $217, followed by Fibonacci targets at $240, $260, and $300.

- Momentum: Heikin Ashi candles show some indecision, but the overall structure remains bullish as long as SOL price stays above $198.

This consolidation phase looks like base-building before the next leg higher. If the Nasdaq uplisting news injects renewed enthusiasm, SOL price could challenge $217 quickly and push toward $240.

How High Can Solana Price Go?

The uplisting of SOL Strategies creates a near-term narrative boost for Solana. Historically, legitimacy events like ETF approvals or uplistings trigger short-term rallies, but sustainability depends on broader market conditions. If Bitcoin maintains stability above key psychological levels, Solana price could ride this momentum into the $240–$260 range over the coming weeks.

However, if macroeconomic headwinds return—such as tighter liquidity or risk-off sentiment—SOL price could retest $198 or even $180 before resuming upward movement.

The Nasdaq approval of $SOL Strategies is more than a corporate update—it is a reflection of Solana’s increasing institutional acceptance. With technicals showing a bullish bias and sentiment aligning with fresh legitimacy signals, $Solana appears positioned for another breakout attempt. Traders should watch $217 as the immediate pivot level, with $240 and $260 as logical next targets if momentum follows through.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

By sniping altcoins on DEX, we made a crazy profit of $50 million

A real story of getting rich in one year, growing from $50,000 to $50 million.

A Guide to Profiting in the Crypto Market During a Sentiment Shift

Project visibility, transaction speed, and early conviction are more important than patience.

Why is the current crypto market operating at a hell-level difficulty?

More than 90% of crypto assets are essentially driven by speculation. However, pure speculation is not a perpetual motion machine; when market participants lose interest or are unable to continue profiting, speculative demand will diminish.