Ethereum ETFs Outflow Four Day Straight: ETH Price Stalls

Spot Ethereum ETFs have seen their first consecutive outflows in months, suggesting investor sentiment is turning more conservative despite continued accumulation by major crypto-holding companies.

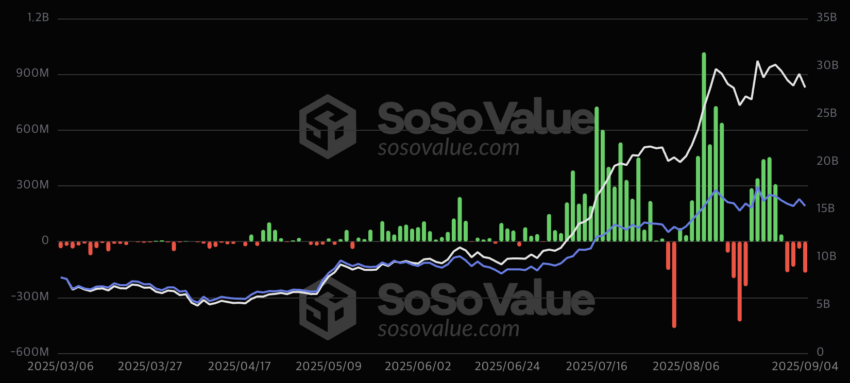

After months of consistent inflows, the US spot Ethereum ETF market shows signs of a changing tide, with capital flowing out for the fourth consecutive trading day.

According to the on-chain data service platform Soso Value, the US spot Ethereum ETF market experienced a net outflow of $167.41 million on Thursday, bringing the price of ETH to a close of $4,275.

ETHA Stands Alone with Inflows: All Others Outflow

The primary driver of the outflows was Fidelity’s FETH, which saw a staggering $216.68 million in investment capital exit the fund. Bitwise’s ETHW also recorded a significant net outflow of $45.66 million. BlackRock’s ETHA was the only fund to maintain a positive flow, which saw a net inflow of $148.8 million.

ETH Spot ETF Daily Flows. Source: SoSo Value

ETH Spot ETF Daily Flows. Source: SoSo Value

This marks the fourth straight day of outflows for the Ethereum spot ETF market. The trend began on August 29 with a net outflow of $164.64 million, followed by $135.37 million on September 2, and $38.24 million on September 3.

DAT Companies Continue Accumulation

For the past five months, a surge in capital from spot ETFs and aggressive buying by Digital Asset Treasury (DAT) companies acted as two key engines, driving Ethereum’s price up by more than 2.5 times its previous low.

While ETF flows have reversed, DAT companies show no signs of slowing down. Bitmine, the public company with the most extensive ETH holdings, purchased 78,000 ETH on August 28 and another 74,300 on Tuesday. SharpLink Gaming bought 39,000 ETH on the same day, while The Ether Machine accumulated 150,000 ETH on Tuesday.

Despite the continued buying from institutional players, the recent four-day outflow from spot ETFs has coincided with a 1.4% drop in the ETH price. This suggests that the ETF outflows weigh heavily on short-term investor sentiment, creating a stalemate in a price that has otherwise seen a strong rally for months.

All eyes are now on Friday’s US Non-Farm Payroll (NFP) report. Should the NFP figures fall below expectations, it could revive hopes that the Federal Reserve will embark on consecutive interest rate cuts. The market is now waiting to see if this macroeconomic signal can reverse the outflow trend and reignite the Ethereum spot ETF market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

2025 TGE Survival Ranking: Who Will Rise to the Top and Who Will Fall? Complete Grading of 30+ New Tokens, AVICI Dominates S+

The article analyzes the TGE performance of multiple blockchain projects, evaluating project performance using three dimensions: current price versus all-time high, time span, and liquidity-to-market cap ratio. Projects are then categorized into five grades: S, A, B, C, and D. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Mars Finance | "Machi" increases long positions, profits exceed 10 million dollars, whale shorts 1,000 BTC

Russian households have invested 3.7 billion rubles in cryptocurrency derivatives, mainly dominated by a few large players. INTERPOL has listed cryptocurrency fraud as a global threat. Malicious Chrome extensions are stealing Solana funds. The UK has proposed new tax regulations for DeFi. Bitcoin surpasses $91,000. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively updated by the Mars AI model.

How much is ETH really worth? Hashed provides 10 different valuation methods in one go

After taking a weighted average, the fair price of ETH exceeds $4,700.

Dragonfly partner: Crypto has fallen into financial cynicism, and those valuing public blockchains with PE ratios have already lost

People tend to overestimate what can happen in two years, but underestimate what can happen in ten years.