$4.6 Billion Options Expiry Sparks Volatility Concerns for Bitcoin and Ethereum

The crypto market braces for turbulence as $4.6B in Bitcoin and Ethereum options expire. With September weakness looming, max pain levels may dictate whether BTC and ETH stabilize or face sharper moves.

The crypto market is bracing for heightened volatility as more than $4.6 billion in Bitcoin and Ethereum options expire today. This pivotal event could dictate short-term price action for both leading assets.

Analysts caution that the September expiry carries added weight, historically associated with weaker performance and lower liquidity across digital assets.

Bitcoin, Ethereum Options Expiry Looms With $4.6 Billion at Stake

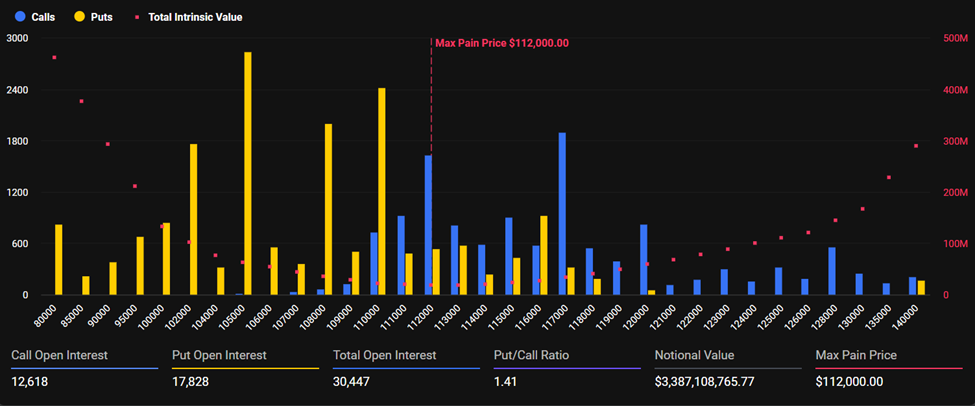

Bitcoin (BTC) dominates this round of expiring options, with a notional value of $3.38 billion. According to Deribit, total open interest stands at 30,447 contracts.

The max pain point, where the greatest number of options expire worthless, is $112,000. Meanwhile, the put-call ratio is 1.41, suggesting an edge for bearish positions and a market leaning toward caution.

Bitcoin Expiring Options. Source:

Deribit

Bitcoin Expiring Options. Source:

Deribit

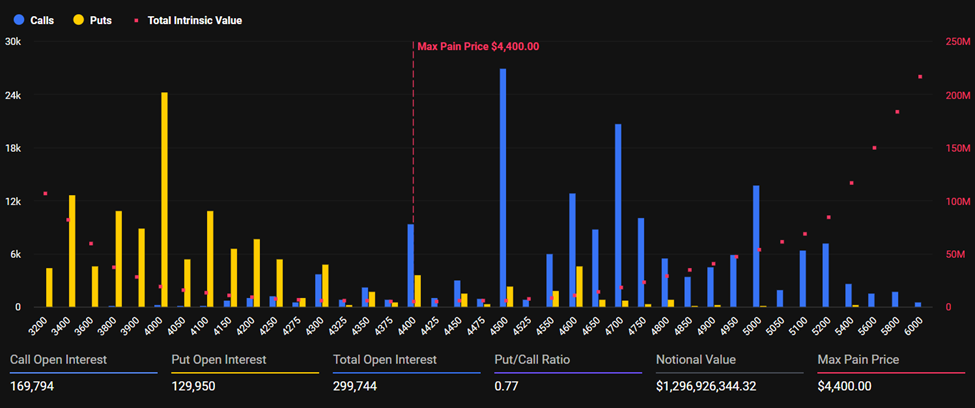

Ethereum faces a similarly crucial expiry with $1.29 billion in notional value. Open interest is 299,744 contracts, with the max pain level at $4,400.

The put-call ratio of 0.77 indicates stronger demand for calls (purchases), though analysts observe a significant build-up above the $4,500 strike. Deribit highlighted this skew.

“…flows lean more balanced, but calls build up above $4.5K, leaving upside optionality,” Deribit noted.

Expiring Ethereum Options. Source:

Deribit

Expiring Ethereum Options. Source:

Deribit

Analysts at Greeks.live highlighted Ethereum’s implied volatility (IV), indicating that short-term IV has surged toward 70%. This suggests heightened expectations for price swings after the Ethereum price corrected over 10% from its recent peak.

“Weakness in US equities and the WLFI index has intensified market skepticism,” Greeks.live analysts wrote.

In the same way, IV across Bitcoin maturities has rebounded to around 40% after a month-long correction. Notably, this pullback saw the Bitcoin price drop more than 10% from its all-time high.

However, analysts see a defensive stance among traders. Evidence of this is accelerating block trading in puts, which account for nearly 30% of today’s options volume.

Analysts Warn of September Weakness

Still, market sentiment is shifting quickly. Greeks.live stressed that September has historically been a challenging month for crypto. Institutional rollovers and quarterly settlements often subdue capital flows.

“The options market, in general, lacks confidence in September’s performance,” the analysts added.

The prevailing downtrend and declining crypto-related equities make risk aversion the primary theme.

As options near expiry, Bitcoin and Ethereum prices tend to pull toward their max pain levels. For Bitcoin, trading at $111,391 as of this writing means a modest uptick to $112,000. The same goes for Ethereum, which traded for $4,326 at press time.

With today’s third-quarter delivery month, liquidity patterns and rollover activity could amplify volatility in both directions.

Therefore, defensive sentiment may dominate as traders brace for prolonged weakness or a potential breakout once expiry clears. However, the market tends to stabilize after 8:00 UTC when the options expire on Deribit.

The critical question remains whether expiry will pin Bitcoin and Ethereum near their current levels or act as a catalyst for a recovery.

Option dynamics could exert magnetic pressure in the near term, with max pain sitting just above current prices for both BTC and ETH.

If history holds, September may continue to challenge bulls, but the market’s growing defensive posture suggests any surprise upside could be met with equally aggressive repositioning.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Perhaps as soon as next week, the term "RMP" will sweep across the entire market and be regarded as the "new generation QE".

The Federal Reserve has stopped its balance sheet reduction, marking the end of the "quantitative tightening" era. The much-watched RMP (Reserve Management Purchases) could initiate a new round of balance sheet expansion, potentially injecting a net increase of $20 billion in liquidity each month.

Enemies reconciled? CZ and former employees join forces to launch prediction platform predict.fun

Dingaling, who was previously criticized by CZ due to the failure of boop.fun and the "front-running" controversy, has now reconciled with CZ and jointly launched a new prediction platform, predict.fun.

Why is it said that prediction markets are really not gambling platforms?

The fundamental difference between prediction markets and gambling lies not in gameplay, but in mechanisms, participants, purposes, and regulatory logic—the capital is betting on the next generation of "event derivatives markets," not simply rebranded gambling.

2025 Crypto Prediction Mega Review: What Nailed It and What Noped It?

Has a year passed already? Have those predictions from back then all come true?