Project Ensemble: Hong Kong adopts a new sandbox to achieve asset tokenization

In August 2024, the Hong Kong Monetary Authority officially held the launch ceremony for the Ensemble Sandbox project, aiming to...

In August 2024, the Hong Kong Monetary Authority officially held the launch ceremony for the Ensemble Sandbox project to support institutions in experimenting with the tokenization of traditional securities and real-world assets (RWA). This marks an important step forward for the HKMA and the industry in exploring the application of tokenization in real business scenarios.

What is Asset Tokenization

Asset tokenization refers to the process of converting real-world assets (such as real estate, gold, and other tangible assets, as well as intangible assets like bonds and equities) into digital tokens on the blockchain. These tokens represent ownership of the original assets and can be traded and circulated on-chain.

Through asset tokenization, real-world assets (RWA) can be traded in smaller units and with greater flexibility, with the process being transparent and efficient. This allows small investors to participate in high-value asset investments, such as dividing real estate into smaller units so that more people can invest in property. As an international financial center, Hong Kong’s Monetary Authority hopes to use the Ensemble Sandbox asset tokenization experiment to explore more integrations between fintech and blockchain technology.

Ensemble Sandbox Overview

Ensemble Sandbox is a "testing ground" created by the HKMA, allowing fintech companies to experiment with asset tokenization and to test and develop innovative solutions based on blockchain technology in a secure and controlled environment. The goal of Ensemble Sandbox is clear: to explore and promote the digital transformation of Hong Kong's financial market, focusing on testing the interoperability of tokenized assets, identifying related risks, and exploring scalable regulatory frameworks.

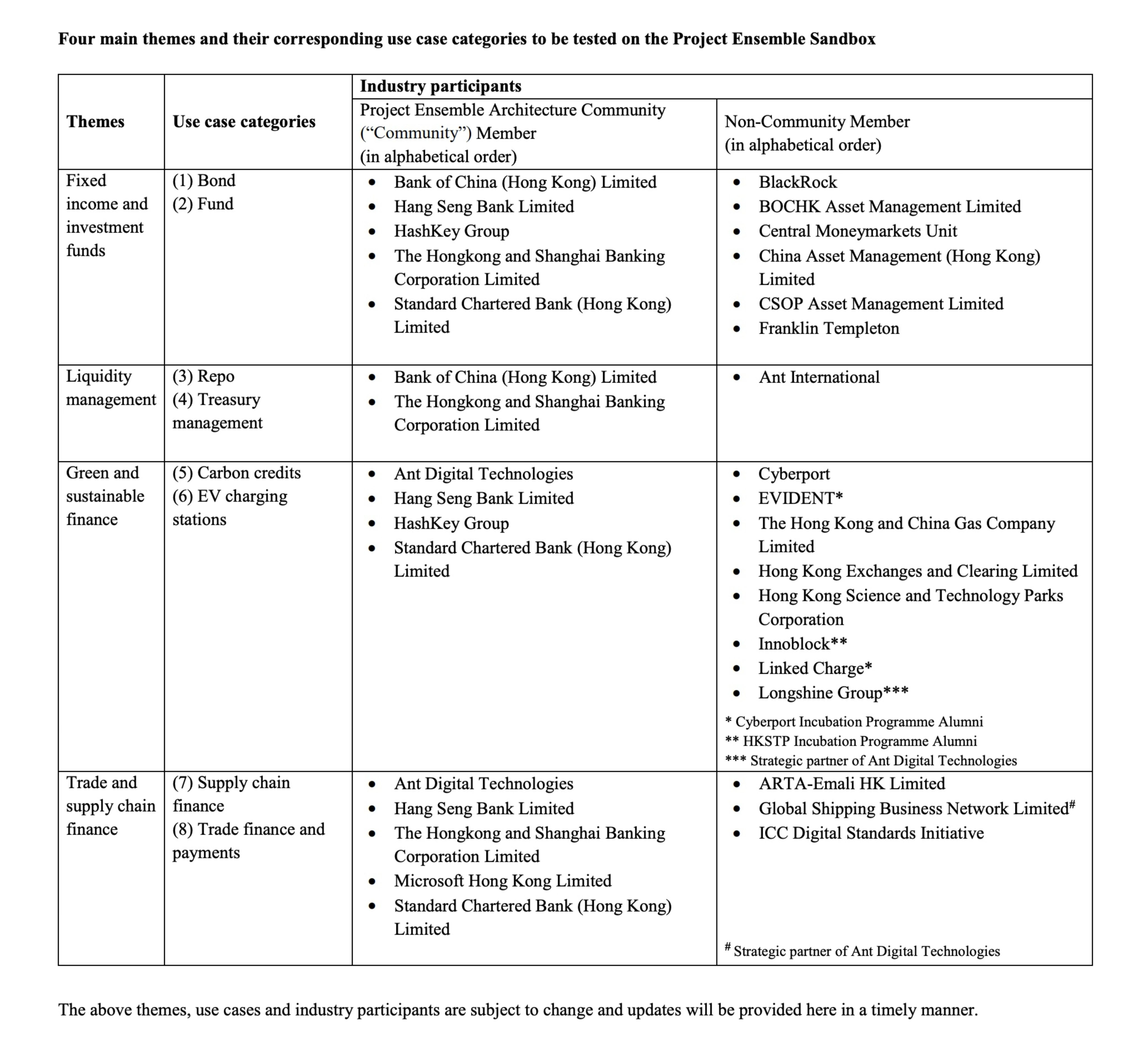

HKMA Chief Executive Eddie Yue stated that Ensemble is exploring the application prospects of tokenization in the financial sector through sandbox testing. The HKMA will continue to cooperate with regulatory bodies such as the Securities and Futures Commission and industry participants to jointly promote the healthy development of Hong Kong's tokenization market and provide a reference for the development of the global tokenization market. To explore the application prospects of tokenization in the financial sector, the first batch of experiments will focus on fixed income and investment funds, liquidity management, as well as green finance and supply chain finance, to tokenize traditional financial assets and physical assets.

Currently, there are four banks providing tokenized deposits for Ensemble: Bank of China (Hong Kong), Hang Seng Bank, HSBC, and Standard Chartered Bank (Hong Kong). Other direct participants include Microsoft Hong Kong, Ant Digital Technologies (ADT), and Hashkey Group in the digital asset sector. This further enhances the industry ecosystem of the Ensemble project, providing infrastructure support for the circulation and trading of tokenized assets and creating the premise for changing the management and trading of financial assets.

In addition, the Global Shipping Business Network (GSBN) has also joined the sandbox experiment to explore the possibility of issuing electronic bills of lading on blockchain infrastructure. In addition to the existing areas of cooperation, the HKMA stated that it will continue to collaborate with all sectors of society; internationally, it will also explore cooperation with the BIS Innovation Hub Hong Kong Centre on one or more topics, and work with the CBDC Expert Group to further advance the sandbox using their expertise.

Compliance and Innovation

Ms. Julia Leung, CEO of the Hong Kong Securities and Futures Commission, stated: "The sandbox launched today is a clear example of how innovation and regulation can go hand in hand, opening up a new path for our financial markets. As the two main architects of Hong Kong's financial market, the SFC and the HKMA share the same vision and determination to ensure that Hong Kong's financial system is future-oriented through innovative market infrastructure." The support of the SFC and HKMA for the Ensemble project demonstrates the regulators' inclusive attitude towards blockchain technology and financial innovation, providing a sound regulatory environment for industry development.

Bitrace, as one of the earliest regtech companies to enter the Hong Kong market, has always maintained close communication and cooperation with regulatory and law enforcement agencies. Bitrace CEO Isabel SHI has also repeatedly emphasized the balance between regulation and industry development—if the Web3 industry is separated from regulation, it is very difficult to develop. For an emerging industry, a balance needs to be sought during its development. If regulation is too strict, the industry will find it hard to grow; but if regulation is too loose, the space for emerging industries and the inherent attributes of cryptocurrencies can easily make it a lawless land. Formulating regulatory policies that match the level of industry development can create a healthier development environment for crypto companies and lay a solid foundation for the long-term development of Hong Kong's crypto market.

Now, the emergence of the Hong Kong Ensemble Sandbox has provided many companies with experimental opportunities. By conducting experiments in the Sandbox, industry participants ensure that the solutions they develop are scalable and can be integrated into the global market, while also providing a basis for regulators to formulate scientific and effective regulatory policies, thus promoting the healthy development of Hong Kong's fintech industry. Industry companies represented by those participating in the sandbox experiment are taking a proactive compliance stance, engaging in regulatory dialogue, flexibly adjusting business models, and proactively increasing transparency.

As the industry matures, institutions that can find a balance between compliance and innovation are more likely to become market leaders. In this context, Bitrace's KYT tool provides such companies with comprehensive blockchain security services and compliance solutions, timely blocking the inflow of risky funds, reducing the risk of business management, and playing an indispensable role in preventing illegal activities, protecting user assets, and enhancing platform reputation.

Previously, data from Bitrace on the use and scale of USDT in online criminal activities has been cited multiple times by the United Nations Office on Drugs and Crime, and its professional capabilities have been recognized by both industry and external media or research institutions. Currently, Bitrace's KYT tool, based on machine learning and pattern recognition algorithms, has accumulated a database of over 400 million address labels, including entity labels and risk behavior labels. By tracing and tracking the sources and destinations of funds, examining abnormal address transactions, and auditing the counterparty's fund risks, it can detect abnormal situations that have occurred, are occurring, or are about to occur, thereby helping operators avoid or reduce risks. In the future, Bitrace will also leverage its data capabilities and product services to effectively meet the compliance needs of crypto businesses, help regulators better understand and supervise the industry, and assist Hong Kong in building a more open and transparent financial ecosystem.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin set for ‘promising new year’ as it faces worst November in 7 years

From "whoever pays gets it" to "only the right people get it": The next generation of Launchpads needs a reshuffle

The next-generation Launchpad may help address the issue of community activation in the cryptocurrency sector, a problem that airdrops have consistently failed to solve.

After bitcoin returns to $90,000, is Christmas or a Christmas crash coming next?

This Thanksgiving, we are grateful for bitcoin returning to $90,000.