US Treasury volatility hits highest since "Liberation Day" as markets worry about US fiscal situation and feel uneasy about non-farm payrolls

Due to uncertainties surrounding the U.S. government's fiscal situation and market concerns that Friday's non-farm payroll data may impact Federal Reserve rate cut bets, volatility in the U.S. Treasury market has intensified.

According to an indicator from the Intercontinental Exchange, the one-month implied volatility of U.S. Treasuries has surged by 12.12 points over the past three days, marking the largest consecutive increase since April 2, the "Liberation Day" when Trump announced reciprocal tariffs.

Unless tariff revenues continue, the Trump administration's spending and tax cut plans are expected to worsen the U.S. fiscal situation. In addition, Friday's non-farm employment report is being closely watched by the market for clues related to Federal Reserve policy, as officials will soon enter the blackout period ahead of the September 17 rate decision.

Trump's attempts to exert greater control over the Federal Reserve have also heightened market unease, including efforts to remove Governor Lisa Cook. JPMorgan strategists noted that these concerns are more reflected in rates, gold futures, and stocks than in exchange rates.

Eugene Leow, Senior Rates Strategist at DBS Bank in Singapore, stated that the rise in U.S. Treasury volatility is "very likely due to the high uncertainty surrounding the non-farm data, coupled with concerns about the Federal Reserve's independence," and "the market may also be worried about seasonal factors in September."

According to data compiled by Bloomberg, over the past decade, bonds with maturities of ten years or more have recorded their largest monthly declines in September, suggesting that seasonal factors indicate this asset class may face challenges.

Recommended reading: Bearish bets on U.S. Treasuries increase as traders await key employment data

Due to concerns about the U.S. government's fiscal situation and persistently high inflation, the yield on the 30-year U.S. Treasury rose to nearly 5% on Wednesday, the highest level since July. Subsequently, weaker-than-expected U.S. job openings prompted traders to almost fully price in a rate cut this month, causing yields to fall back.

"In terms of absolute direction, we maintain considerable flexibility," said Shinji Kunibe, Chief Global Fixed Income Portfolio Manager at Sumitomo Mitsui DS Asset Management. "If you are too short, as was the case yesterday, you may be forced to exit, so we do not take on too much directional exposure."

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Opinion: L2 is supposed to be secured by Ethereum, but this is no longer true

Two-thirds of L2 assets have left Ethereum's security protection.

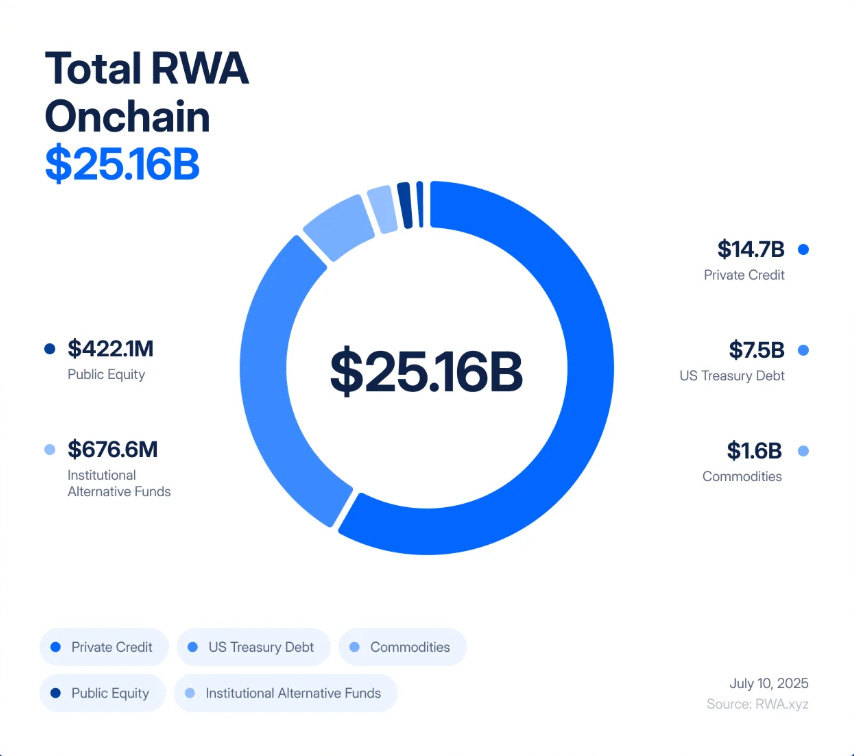

When Slow Assets Meet a Fast Market: The Liquidity Paradox of RWA

Illiquid assets wrapped in on-chain liquidity are repeating the financial mismatches of 2008.

XRP Ledger Activates Credentials Amendment for Compliance and Identity

Solana Emerges as Top Crypto Performer Amid Altcoin Rotation