WLFI Endorsed by Trump’s Team: Why Is It Called a “New Scam”?

Author: The Smart Ape

Translation: Tim, PANews

Original Title: Cherish Your Life, Stay Away from WLFI

I feel like people in this ecosystem never learn their lesson. Do you remember how we got completely wiped out by TRUMP? If you’ve already forgotten, what’s happening now is the most typical example.

Compared to what they’re doing with WLFI now, TRUMP was nothing. I’ve seen far too many red flags to list them all here—otherwise, I could write a whole book. Here are just a few examples, which are enough to explain why you should stay away from this project.

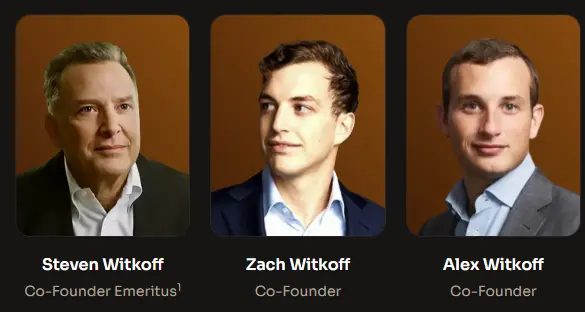

1. The Team

The first time I saw that picture, I wondered why there were nine co-founders. That alone is suspicious.

There isn’t a single person in this team who inspires confidence. Obviously, the Trump family is just here for marketing, purely as a communication tool, with no indication that they’re involved in operations or technical work. It’s clear as day that they don’t understand this business, but they definitely know how to profit from it.

Zach Witkoff has drawn special attention due to his political background. His company facilitated a $2 billion deal with MGX (an Emirati fund) through the USD1 stablecoin. This has raised concerns about a “money-for-privilege” channel.

Chase Herro is more well-known in the crypto space. He calls himself “internet scum,” has served time for drug charges, launched several crypto projects that ended up as scams or got hacked, and sold “get rich quick” courses. This is definitely not the ideal co-founder for your project.

Then there’s Zach Folkman, whose background is very similar to Herro’s. He was involved in the Dough Finance project, which suffered a major DeFi exploit. Overall, he’s a rather controversial entrepreneur, even hosting dating “pickup” seminars.

Among the nine co-founders, seven are billionaire heirs, and the other two have questionable backgrounds—definitely not a dream team.

2. Lies

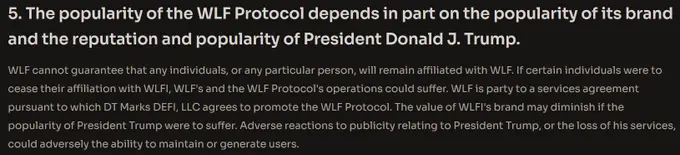

The worst part is that they make you believe this is a project designed and operated by the Trump family, but it’s not. They’re just marketing figures meant to make you feel at ease. Their own disclosures basically say as much.

To go further: the Trump family bears no contractual responsibility. Legally, they have no liability. If someone runs off with the money tomorrow, the Trump family can legally distance themselves, and you won’t be able to hold them accountable.

So who is responsible?

No surprise—it’s Chase Herro and Zak Folkman, through their Puerto Rico-based entity, Axiom.

Although the Trump family bears no legal responsibility, they hold 22.5% of the supply and receive 75% of the profits. The Witkoff family gets 7.5% of the supply and 25% of the profits.

Herro and Folkman also get a cut from the token allocation (not directly from the revenue share). Essentially, these are two people skilled at extracting value, who have struck a deal with the Trump family. The Trump family takes the biggest piece of the pie, while these two get the scraps—but even those scraps are quite substantial for them.

3. WLFI Token

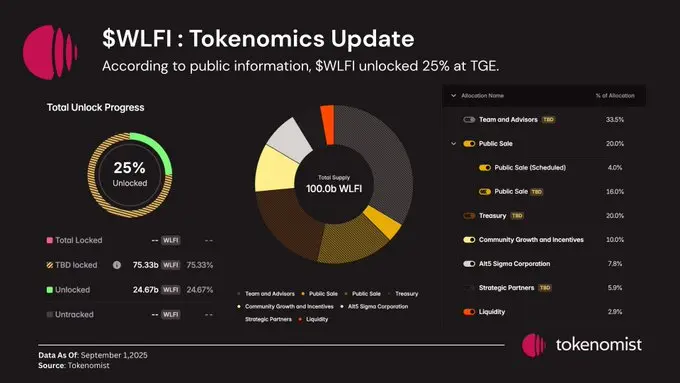

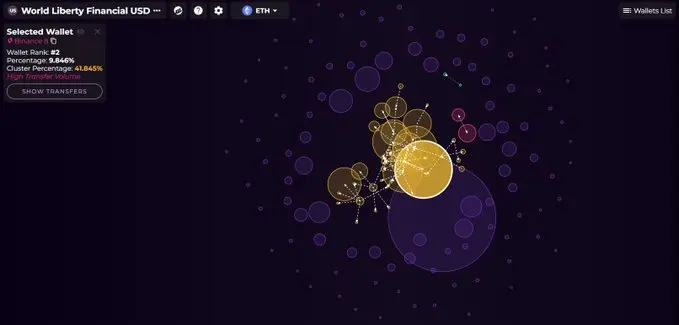

Honestly, this token is a joke. Six people hold 40% of the total supply, which is textbook centralization. Over 60% of the supply is held by fewer than ten wallets, all controlled via multisig.

At launch, only 25% of the supply was in circulation. Combined with the heavy concentration of tokens in a few hands, this leads to extreme market volatility and fragility.

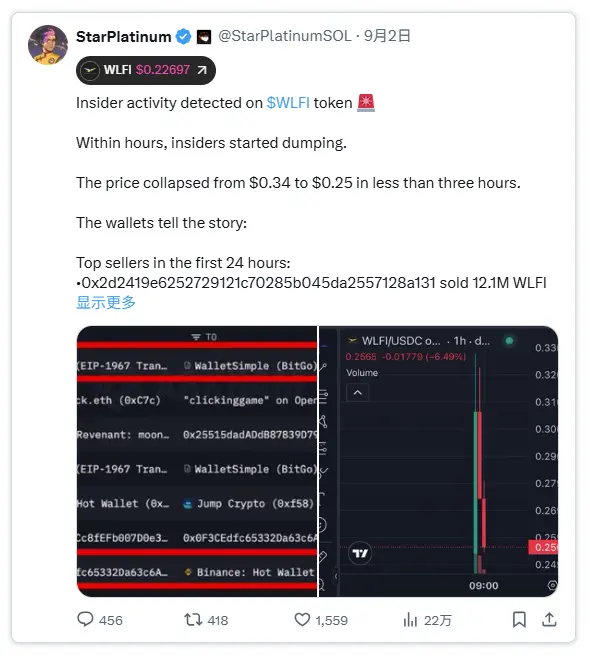

In the first few hours, there was a massive contract liquidation, with insiders dumping large amounts and cashing out hundreds of millions of dollars in just a few hours.

The token distribution process is completely lacking in transparency. Most tokens were actually available shortly after launch, allowing insiders to sell freely at any time.

Utility? Basically zero. It claims to be a “governance token,” but beyond that, it has no clear function: no revenue sharing, no fee discounts, no yield, nothing. And the official website explicitly states that they can temporarily or permanently restrict your governance rights at any time—in other words, the so-called governance is completely meaningless.

Some of you might propose allocating 100% of protocol fees for buybacks. If you’re cheering for that, just remember that 60% of the supply is controlled by insiders. Either way, they profit: when WLFI’s price rises, their holdings appreciate, allowing them to sell at higher prices.

4. USD1 Token

USD1 is the stablecoin issued by WLFI, and just looking at its logo, you can tell it’s a joke.

Seriously, couldn’t they put in a little more effort? This looks like something a seven-year-old made.

USD1’s market cap has reached $2.7 billion, making it one of the largest stablecoins, but this is mainly due to large institutional capital allocation, not real user demand. 93% of its value is concentrated on Binance, meaning the stablecoin has yet to achieve real-world adoption.

What shocked me most is that the wallet deploying USD1 on Solana also deployed several other junk tokens with almost no trading volume. They didn’t even bother to use a new address to cleanly deploy USD1, instead using one already associated with junk tokens—which says a lot.

5. Website

If you still have doubts, the simplest way is to check the disclosures on their website. That’s the only place where they’re even slightly honest. You’ll quickly find that they’re trying to shirk responsibility, basically telling you this project is unreliable and you shouldn’t be surprised if something goes wrong.

The website is full of errors—broken links, typos, image layout issues... The site is poorly made, lacks professionalism, and reeks of a careless attitude.

Conclusion

WLFI is essentially TRUMP 2.0—a highly centralized meme coin, useless except for making huge profits, with zero innovation. Its only purpose is to make the already rich even richer. In just one day of research, I found about 20 red flags, and to keep the article concise, I left out even more.

My advice: stay away. If you’ve made a profit, take it and leave.

The only reason this thing is popular is because of the Trump brand effect. But honestly, even if you asked Trump himself to explain what his own project is, he probably couldn’t tell you.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The truth behind BTC's plunge: Not a crypto crash, but a global deleveraging triggered by the yen shock

DAT: A Concept in Transition

From traditional market-making giants to core market makers in prediction markets, SIG's forward-looking layout in crypto

Whether it's investing or trading, SIG is always forward-looking.