Trump's WLFI Hits $5,6 Billion, Raising Questions About Its Usefulness

- WLFI reaches market cap of $5,6 billion

- Token offers only governance without clear economic rights

- Stablecoin USD1 and Aave proposal still in initial phase

World Liberty Financial (WLFI), an initiative linked to current US President Donald Trump, reached a market value of approximately $5,6 billion after unlocking the WLFI token on September 1st. However, experts and investors continue to question what the project actually delivers beyond governance and plans not yet implemented.

WLFI was launched as a governance token, allowing holders to vote on proposals, including the one that authorized its own tradability. Despite this, there are no documents linking the asset to cash flows, revenue sharing, or equity rights. This lack of direct economic utility remains the main criticism of its multi-billion dollar valuation.

Among the deliverables related to the WLFI ecosystem is the USD1 stablecoin, already listed on Binance and with custody guaranteed by BitGo. However, this infrastructure does not confer any economic advantages to WLFI holders. Another element under development is the proposed Aave v3-based money market branded as WLFI, but so far there is no functional frontend or public market in operation.

Aave logs show only preliminary discussions, while users await actual implementation Without an active market, the token's usefulness remains limited to voting on internal decisions, with no direct impact on revenue or protocol operation.

The initial distribution of WLFI is also noteworthy. Only a fraction of the offering was released to the market, concentrating the float among early investors. Reports indicate that entities linked to the Trump family hold nearly 25% of the supply, resulting in significant equity exposure and further gains in the stock after trading began.

Reuters highlighted although DT Marks DEFI LLC, a company associated with the family, has capital and revenue rights over World Liberty Financial, although these benefits are not passed directly to holders of the WLFI token.

With its current market capitalization, WLFI already surpasses established DeFi projects such as Aave, Lido, and Curve, and is very close to overtaking Uniswap. However, unlike these platforms, which offer operational decentralized products, WLFI still lacks concrete deliverables beyond a custodial stablecoin and token governance.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

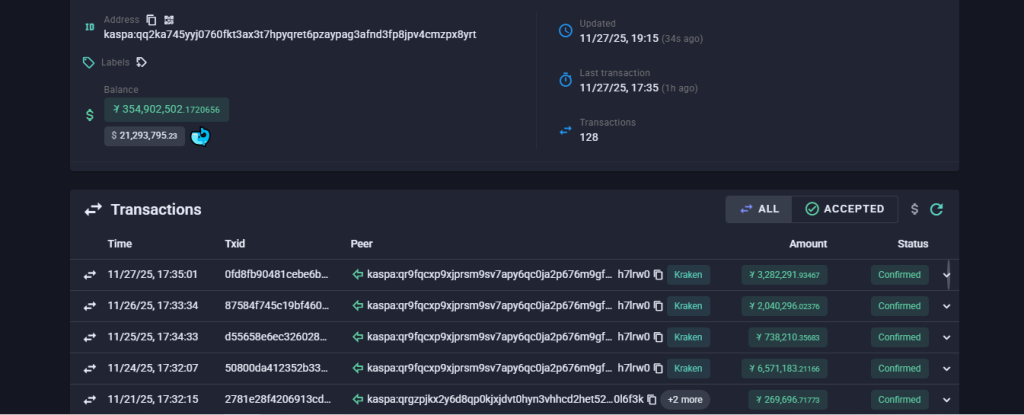

KAS Price Jumps 66%: Can Momentum Push Kaspa Toward December’s Bigger Targets?

VIRTUAL Price Jumps 17% as Falling Wedge Breakout Signals December Upside

Pi Network News: Can the CiDi Games Partnership Push Pi Beyond $1?

Charles Hoskinson Reveals When Altcoins Like ADA, XRP and ETH Will Hit New All-Time Highs