CARDS token surges 200%+ as Raydium brings its tokenized Pokemon cards onchain

Raydium brings real-world Pokémon card trading to Solana by powering Collector Crypt, a tokenized marketplace where physical cards are vaulted, verified, and traded on-chain.

- Collector Crypt uses Raydium’s AMM infrastructure to enable on-chain trading of its tokenized Pokémon cards with instant liquidity.

- More marketplaces are joining the trend, including Courtyard (over $100M in Pokémon volume), Phygitals, Beezie, Grailed, and others ahead of the Pokémon franchise’s 30th anniversary in 2026.

- The marketplace’s native token CARDS tripled in value to a $140M FDV within 12 hours as tokenized Pokémon card trading heats up.

Tokenized Pokémon cards debut for trading

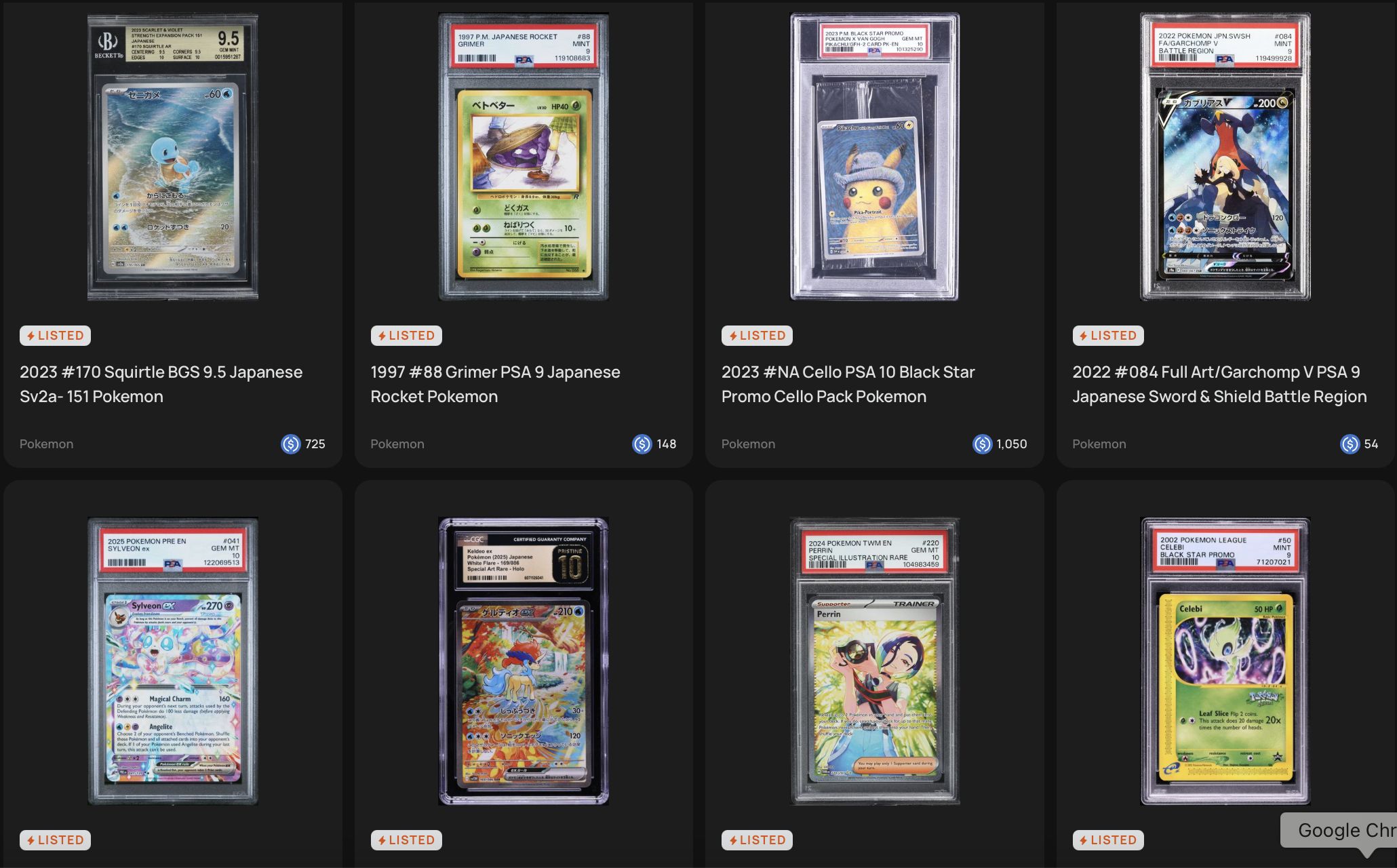

Raydium ( RAY ) has just brought real-world Pokémon card trading to the Solana blockchain by supporting Collector Crypt, a marketplace that securely stores physical Pokémon cards, authenticates them through professional grading, and converts them into digital tokens representing ownership.

By providing automated market maker infrastructure, Raydium enables these tokenized Pokémon cards to be traded efficiently and transparently on-chain. According to Raydium , Collector Crypt has already facilitated over $70 million in Pokémon pack sales, including a record $5 million in a single transaction cycle.

Source: Collector Crypt

Source: Collector Crypt

Meanwhile, CARDS, the marketplace’s native token, is gaining serious traction, surging over 200% in the past 24 hours, with its market cap standing at $58 million at press time.

Collector Crypt isn’t the only platform capitalizing on Pokémon nostalgia as the franchise approaches its 30th anniversary in 2026.

According to @huntersolaire , several other marketplaces are already tapping into the hype with token launches and airdrop incentives. Courtyard, for example, has seen over $100 million in Pokémon-related trading volume.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Blood and Tears Files of Crypto Veterans: Collapses, Hacks, and Insider Schemes—No One Can Escape

The article describes the loss experiences of several cryptocurrency investors, including exchange exits, failed insider information, hacker attacks, contract liquidations, and scams by acquaintances. It shares their lessons learned and investment strategies. Summary generated by Mars AI This summary was produced by the Mars AI model, and the accuracy and completeness of its generated content are still in the process of iterative improvement.

Mars Morning News | Federal Reserve officials to advance stablecoin regulatory framework; US SEC Chairman to deliver a speech at the New York Stock Exchange tonight

Federal Reserve officials plan to advance the formulation of stablecoin regulatory rules. The SEC Chair will deliver a speech on the future vision of capital markets. Grayscale will launch the first Chainlink spot ETF. A Coinbase executive has been sued by shareholders for alleged insider trading. The cryptocurrency market fear index has dropped to 23. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still in the process of iterative updates.

OECD's latest forecast: The global interest rate cut cycle will end in 2026!

According to the latest forecast from the OECD, major central banks such as the Federal Reserve and the European Central Bank may have few "bullets" left under the dual pressures of high debt and inflation.

MSTR, the leading Bitcoin concept stock, plunges up to 12% intraday after first signaling possible "coin selling"

MicroStrategy has announced the establishment of a $1.44 billion cash reserve to "weather the winter," and for the first time has acknowledged the possibility of selling bitcoin under certain conditions.