Jack Ma becomes an E-Guardian, with Xiao Feng’s support? A quick read on Yunfeng Financial’s Web3 strategy

ForesightNews 速递2025/09/03 06:52

ForesightNews 速递2025/09/03 06:52Carbon Chain Project, purchase of ETH, cooperation with Ant Digital Technologies, strategic investment in Pharos.

Carbon Chain Initiative, purchasing ETH, partnering with Ant Digital Technologies, strategic investment in Pharos—who is leading Yunfeng Financial’s Web3 strategy?

Written by: KarenZ, Foresight News

On September 2, 2025, Hong Kong-listed Yunfeng Financial Group announced that the company had used $44 million of its own cash reserves to purchase a total of 10,000 ETH on the open market as a strategic reserve asset.

In fact, as early as July, Yunfeng Financial’s board of directors announced that the group planned to lay out strategies in Web3, Real World Assets (RWA), digital currencies, ESG zero-carbon assets, and artificial intelligence (AI), and would increase its investment in digital currencies.

Behind this series of bold moves, two key figures—Jack Ma and Xiao Feng—have become the focus of industry attention. Jack Ma may be an indirect shareholder of Yunfeng Financial. As an independent non-executive director of Yunfeng Financial, Xiao Feng is also likely to play a crucial role in the company’s strategic decision-making process.

What is Yunfeng Financial?

According to its official website, Yunfeng Financial is an innovative fintech group listed on the main board in Hong Kong, with business segments in securities brokerage, asset management, insurance, and fintech.

Yunfeng Financial’s predecessor was Reorient Group, a long-established Hong Kong securities firm. In 2015, Yunfeng Fund’s controlling shareholder Jade Passion Ltd acquired about 56% of Reorient’s shares for HK$2.68 billion, and in 2016, Reorient was renamed Yunfeng Financial.

Yunfeng Fund was jointly initiated in 2010 by Alibaba founder Jack Ma and Focus Media founder Yu Feng. It is a private equity investment institution focusing on hard technology, enterprise services, green energy, modern agriculture, biotechnology, and consumer sectors.

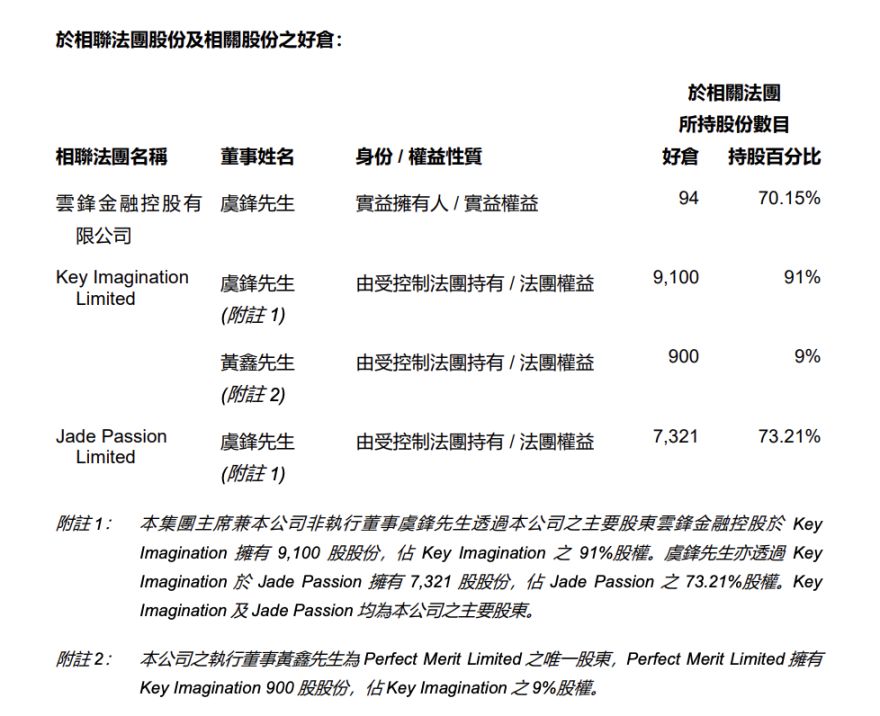

Yu Feng is currently the chairman of Yunfeng Fund, chairman and non-executive director of Yunfeng Financial Group, and also a director of Yunfeng Financial Holdings, Key Imagination, and Jade Passion. Yunfeng Financial Holdings, Key Imagination, and Jade Passion are the main shareholders of Yunfeng Financial.

Equity and Control Structure

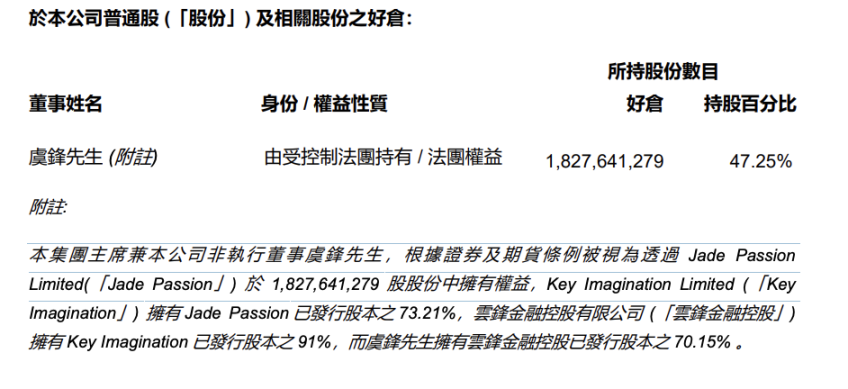

First, the shareholding of directors and key executives:

1. According to the 2025 mid-year report, Yu Feng (Group Chairman and Non-Executive Director) actually controls 47.25% of Yunfeng Financial’s shares through a multi-layered holding structure. Specifically: Key Imagination Limited owns 73.21% of Jade Passion’s issued share capital; Yunfeng Financial Holdings owns 91% of Key Imagination’s issued share capital; and Yu Feng owns 70.15% of Yunfeng Financial Holdings’ issued share capital. Both Key Imagination and Jade Passion are major shareholders of Yunfeng Financial.

2. Yunfeng Financial Executive Director Huang Xin is the sole shareholder of Perfect Merit Limited, which holds 900 shares of Key Imagination, accounting for 9% of Key Imagination’s equity.

3. Apart from the above disclosures, Yunfeng Financial’s mid-year report states that as of June 30, 2025, the company’s directors, executives, and their associates had no holdings in the company or its affiliates’ shares or bonds that require special disclosure.

Source: Yunfeng Financial 2025 Mid-Year Report

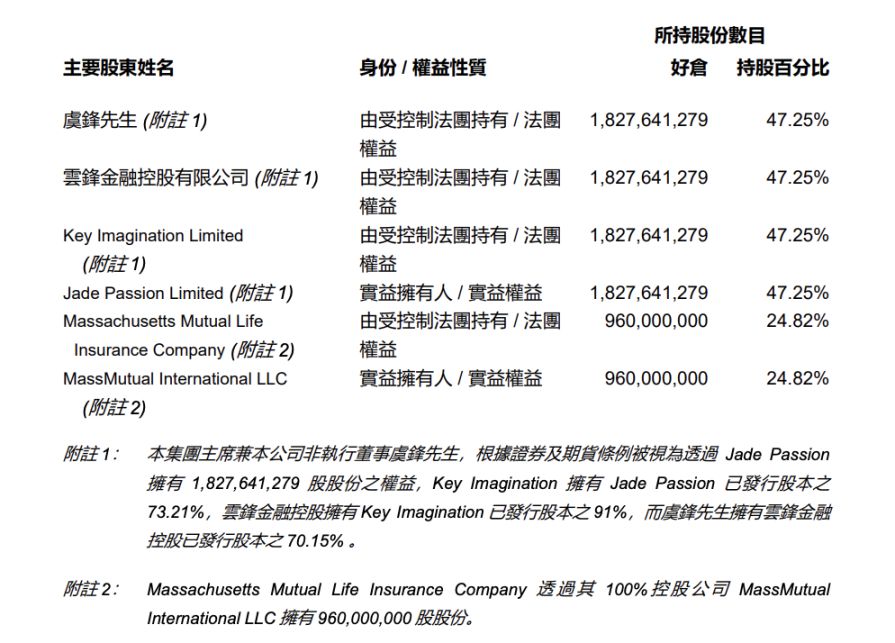

Next is the shareholding of Yunfeng Financial’s major shareholders and other parties. The equity status of major shareholders and other parties holding 5% or more of Yunfeng Financial’s issued shares is as follows:

1. As mentioned above, Yu Feng actually controls 47.25% of Yunfeng Financial’s shares through a multi-layered holding structure.

2. Massachusetts Mutual Life Insurance Company (MassMutual) holds 960,000,000 shares through its wholly-owned subsidiary MassMutual International LLC, accounting for 24.82% of the shares.

3. Other than the two major shareholders above, no other party holds 5% or more of the company’s equity or short positions.

Actress Zhao Wei’s ex-husband Huang Youlong once held 26.79% of Jade Passion Limited’s equity and was also one of Yunfeng Financial’s non-executive directors. In January 2018, Huang Youlong resigned from his position as non-executive director of Yunfeng Financial.

The Roles of Jack Ma and Xiao Feng

The market speculates that although Jack Ma does not hold a management position in Yunfeng Financial or Yunfeng Fund, he still has significant influence over the company’s strategy through his equity in related Yunfeng Fund entities.

According to a report by Shanghai Securities News in October 2024, Yunfeng Fund’s affiliate Shanghai Yunfeng Investment Management Co., Ltd. underwent a business registration change on October 16, 2024, with its registered capital reduced from 290 million yuan to 10 million yuan, a decrease of over 96.55%. Yunfeng Investment was established on July 1, 2010, as the RMB fund manager of Yunfeng Fund’s first phase, with an initial registered capital of 10 million yuan. On December 9, 2013, after the first phase fund completed fundraising and entered the investment stage, the company’s registered capital increased to 290 million yuan. At that time, Yu Feng held 60% and Jack Ma held 40%.

Shanghai Securities News reported that after several changes in investors, prior to this capital reduction, Huang Xin contributed 174 million yuan, holding 60% as the largest shareholder, while Jack Ma contributed 116 million yuan, holding 40% as the second largest shareholder. After the capital reduction, Huang Xin and Jack Ma’s contributions dropped to 6 million yuan and 4 million yuan, respectively, still holding 60% and 40%. The subsequent equity changes are unclear, as is Jack Ma’s specific shareholding in Yunfeng Financial.

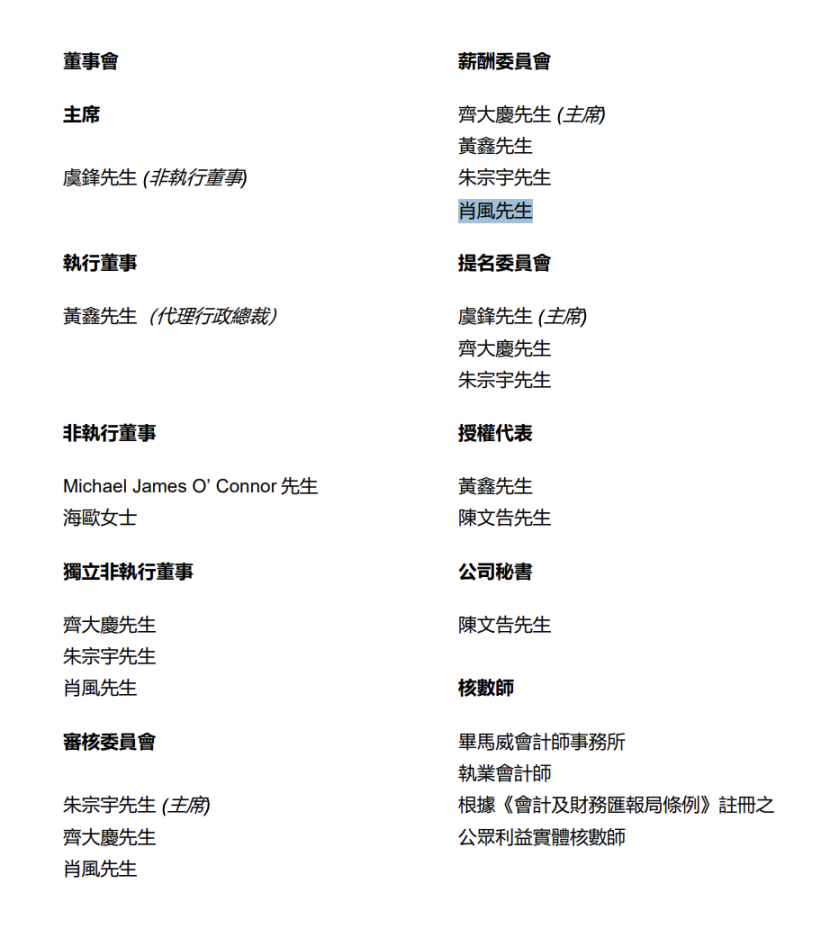

Another key figure, Xiao Feng, has served as an independent non-executive director of Yunfeng Financial since March 2019. As a leading figure in China’s blockchain sector and chairman of Wanxiang Blockchain, although he does not participate in daily operations, he may provide professional judgment and oversight on major strategic decisions at the board level, especially regarding Web3, digital currency, and blockchain investments. The market generally believes he provided important guidance in Yunfeng Financial’s recent investment decisions in ETH and the Pharos public chain.

Source: Yunfeng Financial

Yunfeng Financial’s Recent Web3 Initiatives

Since July 2025, Yunfeng Financial has been steadily advancing its Web3 blueprint with clear rhythm and strong execution:

In July, Yunfeng Financial Group announced that, based on its existing insurance and fintech businesses, it would strategically lay out Web 3.0, Real World Assets (RWA), digital currencies, ESG zero-carbon assets, and artificial intelligence (AI), as well as explore innovations connecting these cutting-edge fields with the group’s insurance business application scenarios.

In its interim results report submitted in August 2025, Yunfeng Financial stated that it plans to move toward a new era of Web3. Its licensed securities company has applied to the Hong Kong SFC to upgrade its Type 1, 4, and 9 licenses. Upon approval, it will be able to provide comprehensive virtual asset-related trading services and manage investment portfolios of virtual assets. According to Yunfeng Financial’s official website, its subsidiaries hold Hong Kong SFC Type 1, 4, and 9 financial services licenses, and the group, through its holding of MassMutual International Limited, also holds a Hong Kong Insurance Authority long-term insurance business license and Hong Kong MPF approved trustee qualification.

“Carbon Chain” Initiative: On August 29, Yunfeng Financial’s MassMutual Insurance Holdings and Macau International Carbon Exchange announced the completion of full on-chain carbon credit asset trading data, officially launching the “Carbon Chain” (Carbon Trading BlockChain) initiative focused on high-quality carbon credits.

Strategic Cooperation with Ant Digital Technologies and Strategic Investment in Pharos Public Chain: On September 1, Yunfeng Financial Group announced a strategic cooperation agreement with Ant Digital Technologies and a strategic investment in Layer1 public chain Pharos Network Technology Limited (Pharos). The two parties will leverage the high-performance Pharos public chain platform to jointly and compliantly expand into frontier areas such as RWA tokenization and the next-generation internet (Web3).

Purchase of 10,000 ETH as Strategic Reserve Asset: On September 2, Yunfeng Financial Group announced that its board had approved the purchase of Ethereum (ETH) as a reserve asset on the open market. As of the date of this announcement, the group had accumulated 10,000 ETH on the open market, with a total investment cost of $44 million (from the group’s internal cash reserves). In the future, the company will continue to increase its allocation to digital assets. The board believes that including ETH as a strategic reserve asset aligns with the group’s layout in Web3 and other cutting-edge fields and can provide key infrastructure support for RWA tokenization activities. In addition, Yunfeng Financial will explore potential application models for ETH in the group’s insurance business and innovative business scenarios compatible with Web3. At the same time, holding ETH as a reserve asset can optimize the group’s asset structure and reduce reliance on traditional currencies.

In addition to ETH, Yunfeng Financial plans to explore including a diversified range of mainstream digital assets such as bitcoin (BTC) and SOL in its strategic reserve assets.

Yunfeng Financial has made it clear that purchasing ETH is not only to optimize its asset structure but also to support the infrastructure for RWA tokenization activities, drive technological innovation in the group’s Web3 sector, and explore the potential application of ETH in insurance business (such as policy collateralization, payments, etc.).

Summary

This recent series of moves by Yunfeng Financial outlines a complete roadmap for a traditional fintech company’s transformation toward Web3: from top-level strategic design, to talent and license preparation, to building partnerships and infrastructure (Ant, Pharos), and finally to direct asset allocation (purchasing ETH).

This is far from a simple speculative investment; rather, it is a well-considered, systematic strategic upgrade. Its core purpose is to embrace blockchain technology and seize the initiative in the future Web3 finance landscape composed of RWA tokenization, digital currencies, and DeFi, becoming a bridge connecting the traditional and digital worlds.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Staking Weekly Report December 1, 2025

🌟🌟Core Data on ETH Staking🌟🌟 1️⃣ Ebunker ETH staking yield: 3.27% 2️⃣ stETH...

The Blood and Tears Files of Crypto Veterans: Collapses, Hacks, and Insider Schemes—No One Can Escape

The article describes the loss experiences of several cryptocurrency investors, including exchange exits, failed insider information, hacker attacks, contract liquidations, and scams by acquaintances. It shares their lessons learned and investment strategies. Summary generated by Mars AI This summary was produced by the Mars AI model, and the accuracy and completeness of its generated content are still in the process of iterative improvement.

Mars Morning News | Federal Reserve officials to advance stablecoin regulatory framework; US SEC Chairman to deliver a speech at the New York Stock Exchange tonight

Federal Reserve officials plan to advance the formulation of stablecoin regulatory rules. The SEC Chair will deliver a speech on the future vision of capital markets. Grayscale will launch the first Chainlink spot ETF. A Coinbase executive has been sued by shareholders for alleged insider trading. The cryptocurrency market fear index has dropped to 23. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still in the process of iterative updates.

OECD's latest forecast: The global interest rate cut cycle will end in 2026!

According to the latest forecast from the OECD, major central banks such as the Federal Reserve and the European Central Bank may have few "bullets" left under the dual pressures of high debt and inflation.