NBER | Using Models to Reveal How the Expansion of the Digital Economy is Reshaping the Global Financial Landscape

Research findings indicate that, in the long term, the reserve demand effect outweighs the substitution effect, resulting in lower U.S. interest rates and an increase in U.S. external borrowing.

Author: Marina Azzimonti and Vincenzo Quadrini

Source: NBER

Translation: Li Yujia

I. Introduction

This paper focuses on the impact of digital economic development on the central position of U.S. debt in global financial markets and the role of stablecoins. U.S. government debt maintains low interest rates for dollar-denominated assets due to its liquidity, convenient services, and value storage functions. Stablecoins, as a special type of cryptocurrency, are pegged to the U.S. dollar or reserve currencies and have relatively stable value. Although their current market size is smaller than that of U.S. Treasury bonds, it is expected to grow significantly in the future, potentially changing the holding patterns of dollar-denominated assets and U.S. government debt. To explore the impact of stablecoins and related factors, this paper constructs a multi-country model including the U.S., the rest of the world, and the digital economy. The growth of the digital economy is driven by agents' familiarity and other factors, affecting the economy through two channels: "financial demand" (agents include digital assets in their savings portfolios, increasing demand for digital assets) and "real demand" (agents purchase services produced by the digital economy, increasing demand for digital production). In the long run, the "financial demand" channel dominates, leading to lower U.S. interest rates and increased global imbalances , and the growth of the digital economy is associated with increased volatility in U.S. consumption and decreased volatility in the rest of the world. At the same time, the type of collateral for stablecoins affects the demand for dollar and other reserve assets. The development of stablecoins has complex impacts on international financial markets, and factors such as collateral instruments need to be considered.

To explore the impact of stablecoins and related factors, this paper constructs a multi-country model including the U.S., the rest of the world, and the digital economy. The growth of the digital economy is driven by agents' familiarity and other factors, affecting the economy through two channels: "financial demand" (agents include digital assets in their savings portfolios, increasing demand for digital assets) and "real demand" (agents purchase services produced by the digital economy, increasing demand for digital production). In the long run, the "financial demand" channel dominates, leading to lower U.S. interest rates and increased global imbalances , and the growth of the digital economy is associated with increased volatility in U.S. consumption and decreased volatility in the rest of the world. At the same time, the type of collateral for stablecoins affects the demand for dollar and other reserve assets. The development of stablecoins has complex impacts on international financial markets, and factors such as collateral instruments need to be considered. II. Literature Review

There has been considerable research on cryptocurrencies, stablecoins, and related fields. The value of cryptocurrencies often stems from their use as a medium of exchange, while stablecoins, as safe assets, highlight their value storage function. Related research covers comparisons with traditional tools, arbitrage dynamics, speculation risks, and also involves the impact of central bank digital currencies (CBDCs) and digital economy-related models, including multi-country models analyzing the impact of stablecoins on monetary policy. This paper focuses on the transitional and long-term effects of the digital economy as a provider of digital services and new savings tools, viewing its expansion as a potential mechanism to alleviate the global shortage of safe assets, thus contributing to the relevant literature.

III. Overview of the Digital Economy

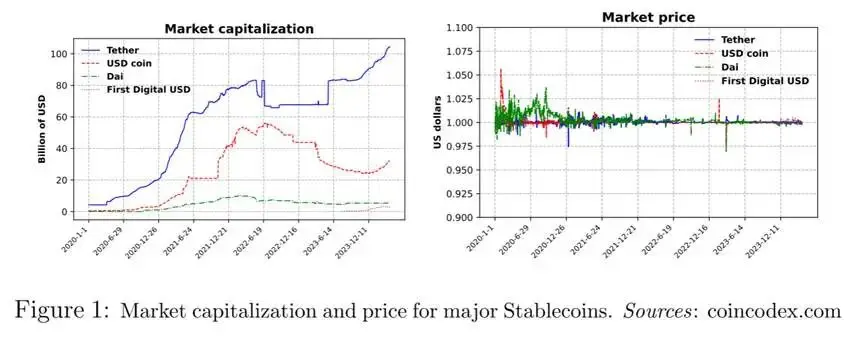

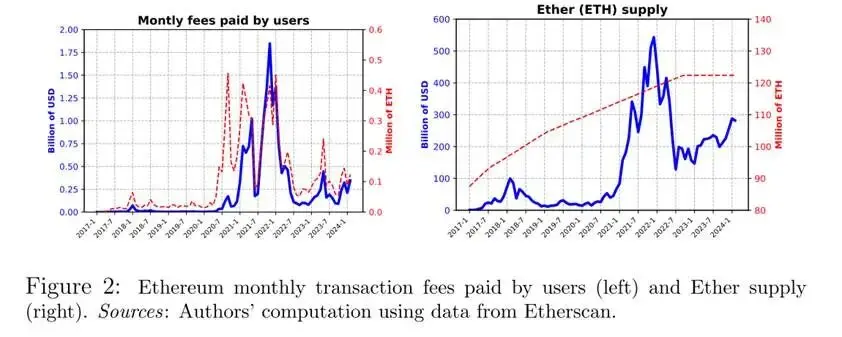

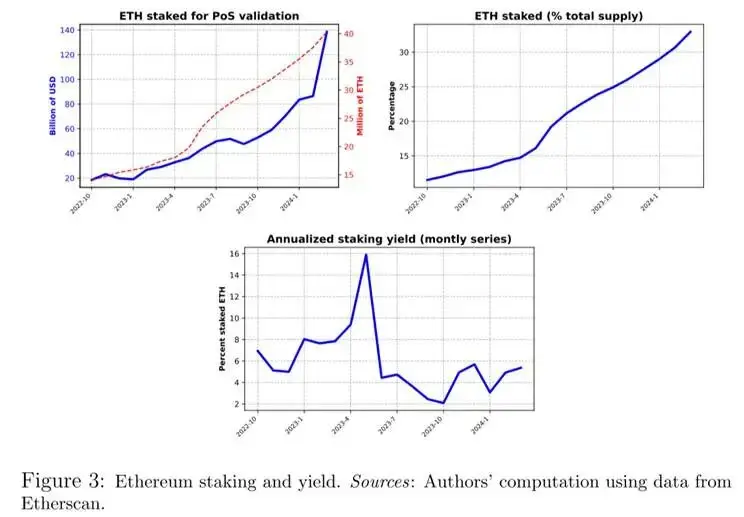

3.1 Blockchain and Digital Production Foundation of the digital economy and blockchain: The operation of the digital economy is based on blockchain technology, which is a decentralized public ledger where nodes compete to validate transaction blocks and receive rewards. Common protocols include PoW and PoS. Bitcoin and Ethereum are well-known blockchains. Figure 2 shows Ethereum user transaction fees and ETH supply, reflecting information such as digital production and cryptocurrency market value. Production and scale of the digital economy: The digital economy is a productive "ecosystem," similar to the traditional economy in using production inputs to produce services, such as matching apartment rentals through dApps, with transaction fees quantifying service value. The Ethereum network is part of the digital economy, and Figure 2 helps illustrate its transaction fees and cryptocurrency market value. The role of cryptocurrency (ETH) as a production input : In 2022, Ethereum's validation protocol shifted from PoW to PoS, making ETH a production input for validation services. Validators stake ETH to earn fees, and the amount staked and yield are closely watched. Figure 3 shows the amount of staked ETH, its proportion of total supply, and staking yield.

Production and scale of the digital economy: The digital economy is a productive "ecosystem," similar to the traditional economy in using production inputs to produce services, such as matching apartment rentals through dApps, with transaction fees quantifying service value. The Ethereum network is part of the digital economy, and Figure 2 helps illustrate its transaction fees and cryptocurrency market value. The role of cryptocurrency (ETH) as a production input : In 2022, Ethereum's validation protocol shifted from PoW to PoS, making ETH a production input for validation services. Validators stake ETH to earn fees, and the amount staked and yield are closely watched. Figure 3 shows the amount of staked ETH, its proportion of total supply, and staking yield.  3.2 Creation of Stablecoins Stablecoins are liabilities issued by certain entities, with their value pegged to an underlying asset. This paper focuses on stablecoins pegged to the U.S. dollar and considers two common mechanisms. In the first mechanism, the peg is maintained by holding dollar reserves equal to the number of stablecoins. In the second mechanism, stablecoins are over-collateralized by crypto assets. Collateralized by U.S. dollar reserves: In this case, stablecoins are created by depositing an equivalent or similar amount of U.S. dollars into a locked account. The issuer's balance sheet is shown in Figure 4.

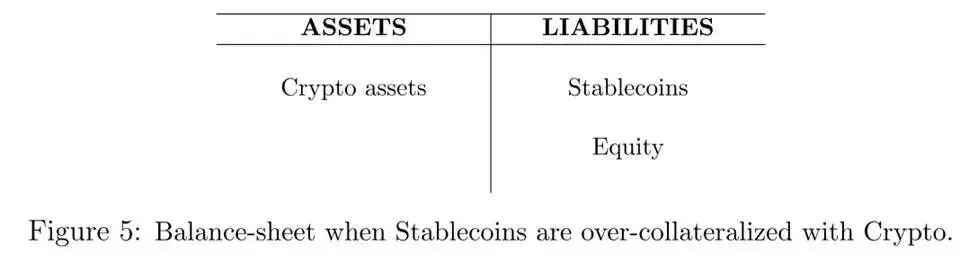

3.2 Creation of Stablecoins Stablecoins are liabilities issued by certain entities, with their value pegged to an underlying asset. This paper focuses on stablecoins pegged to the U.S. dollar and considers two common mechanisms. In the first mechanism, the peg is maintained by holding dollar reserves equal to the number of stablecoins. In the second mechanism, stablecoins are over-collateralized by crypto assets. Collateralized by U.S. dollar reserves: In this case, stablecoins are created by depositing an equivalent or similar amount of U.S. dollars into a locked account. The issuer's balance sheet is shown in Figure 4.  Collateralized by crypto assets: In this case, the issuer faces a balance sheet mismatch because the currency of denomination of assets and liabilities differs. Due to the large fluctuations in the market value of cryptocurrencies over time, stablecoins must be over-collateralized. Therefore, for each stablecoin, the value of crypto assets held by the issuer exceeds $1. The issuer's balance sheet is shown in Figure 5.

Collateralized by crypto assets: In this case, the issuer faces a balance sheet mismatch because the currency of denomination of assets and liabilities differs. Due to the large fluctuations in the market value of cryptocurrencies over time, stablecoins must be over-collateralized. Therefore, for each stablecoin, the value of crypto assets held by the issuer exceeds $1. The issuer's balance sheet is shown in Figure 5.

IV. Model

The model includes three countries/regions: the United States (US), the rest of the world (RoW), and the digital economy (DiEco). The paper treats the digital economy as a unique economy with its own currency. However, the digital economy is defined not by geographic boundaries, but by the technological platform—blockchain—on which it operates.

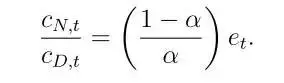

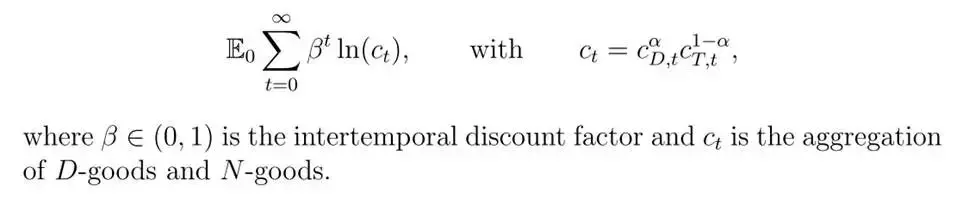

4.1 Digital Economy There are a continuum of agents in the digital economy who maximize expected lifetime consumption utility: The consumption basket includes D goods (produced in both the digital and non-digital economy) and N goods (produced only in the non-digital economy), with the consumption ratio determined by first-order conditions:

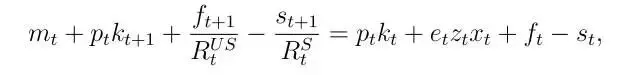

The consumption basket includes D goods (produced in both the digital and non-digital economy) and N goods (produced only in the non-digital economy), with the consumption ratio determined by first-order conditions:  Digital economy agents need to import N goods and can export D goods, which are related to cryptocurrency prices and service prices. Crypto staking is used for digital transaction validation and is subject to idiosyncratic shocks, but these shocks offset in aggregate. Residents of the digital economy can issue stablecoins (digital liabilities ), whose value is stable, and can also hold U.S. bonds . Through arbitrage analysis, in equilibrium, the yield on stablecoins is not less than the yield on U.S. bonds , and the paper derives the budget constraint and terminal wealth of digital economy agents, yielding optimal policies, including the allocation of consumption, cryptocurrencies, and fixed income assets (including U.S. bonds and stablecoins ). Different yield scenarios affect asset choices. In N goods units, the budget constraint for digital economy agents is:

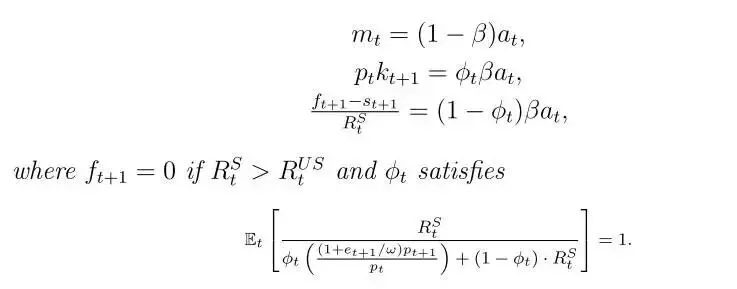

Digital economy agents need to import N goods and can export D goods, which are related to cryptocurrency prices and service prices. Crypto staking is used for digital transaction validation and is subject to idiosyncratic shocks, but these shocks offset in aggregate. Residents of the digital economy can issue stablecoins (digital liabilities ), whose value is stable, and can also hold U.S. bonds . Through arbitrage analysis, in equilibrium, the yield on stablecoins is not less than the yield on U.S. bonds , and the paper derives the budget constraint and terminal wealth of digital economy agents, yielding optimal policies, including the allocation of consumption, cryptocurrencies, and fixed income assets (including U.S. bonds and stablecoins ). Different yield scenarios affect asset choices. In N goods units, the budget constraint for digital economy agents is:  Lemma 1: Given terminal wealth and price sequences, the optimal policy chosen by digital economy agents is:

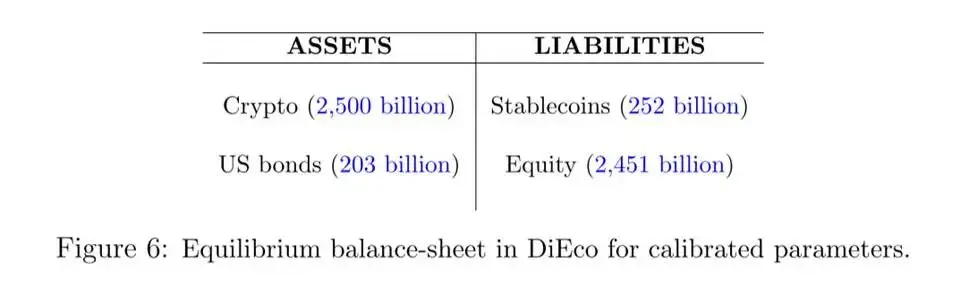

Lemma 1: Given terminal wealth and price sequences, the optimal policy chosen by digital economy agents is:  To understand the portfolio choices of digital economy agents, the paper provides a numerical overview to illustrate how these choices are affected by key variables and parameters. Figure 6 shows the consolidated balance sheet of digital economy agents in steady-state equilibrium in the calibrated model.

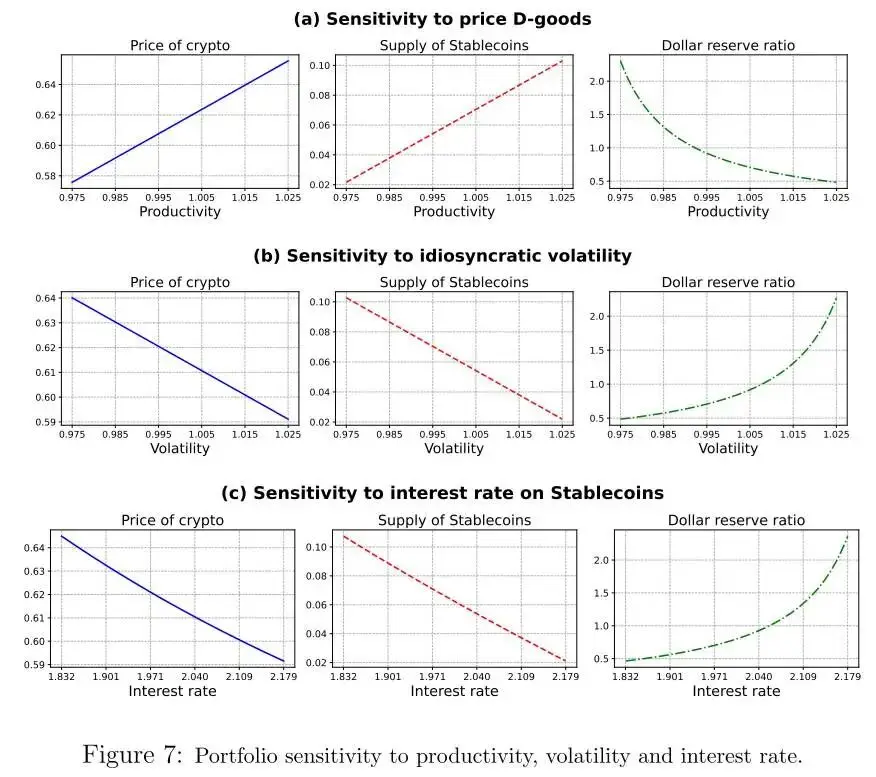

To understand the portfolio choices of digital economy agents, the paper provides a numerical overview to illustrate how these choices are affected by key variables and parameters. Figure 6 shows the consolidated balance sheet of digital economy agents in steady-state equilibrium in the calibrated model.  Starting from the baseline calibration, the study explores how the portfolio choices of digital economy agents vary with three variables: (i) the relative price of D goods produced by the digital economy (i.e., the digital economy's exchange rate); (ii) the volatility of idiosyncratic shocks in the digital economy; (iii) the stablecoin interest rate. Figure 7 shows the sensitivity of portfolios to each variable.

Starting from the baseline calibration, the study explores how the portfolio choices of digital economy agents vary with three variables: (i) the relative price of D goods produced by the digital economy (i.e., the digital economy's exchange rate); (ii) the volatility of idiosyncratic shocks in the digital economy; (iii) the stablecoin interest rate. Figure 7 shows the sensitivity of portfolios to each variable.  As the price of D goods rises, the market value of cryptocurrencies and the supply of stablecoins increase, as agents adjust their portfolios due to increased wealth. As idiosyncratic volatility increases, cryptocurrency prices and stablecoin supply decrease, with more stablecoins backed by U.S. Treasuries. As the stablecoin interest rate rises, agents issue fewer stablecoins, cryptocurrency prices fall due to reduced leverage, and high D goods prices lead to more stablecoin supply, while uncertainty and high interest rates have the opposite effect.

As the price of D goods rises, the market value of cryptocurrencies and the supply of stablecoins increase, as agents adjust their portfolios due to increased wealth. As idiosyncratic volatility increases, cryptocurrency prices and stablecoin supply decrease, with more stablecoins backed by U.S. Treasuries. As the stablecoin interest rate rises, agents issue fewer stablecoins, cryptocurrency prices fall due to reduced leverage, and high D goods prices lead to more stablecoin supply, while uncertainty and high interest rates have the opposite effect. 4.2 Non-digital Economy

Non-digital economy agents and production

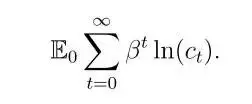

Agents in the U.S. and the rest of the world (RoW) have the same preferences as digital economy agents, seeking to maximize expected lifetime utility:

Production uses a fixed supply of non-renewable land, and agents produce D or N goods depending on idiosyncratic productivity shocks. Since technology is the same, the relative price of the two goods is 1, but the price of D goods in the digital economy may be lower. The difference between the U.S. and RoW lies in volatility; RoW agents face higher volatility, resulting in lower U.S. net foreign asset positions, consistent with data, and the distribution in RoW is more dispersed (Assumption 3.1).

Agent types and financial markets

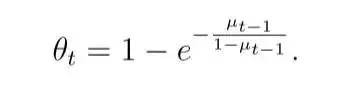

Agents are divided into habitual (familiar with the digital economy, considering buying its D goods and stablecoins) and non-habitual (unfamiliar, do not hold them). Their status evolves over time with certain probabilities, affecting the demand for D goods and stablecoins.

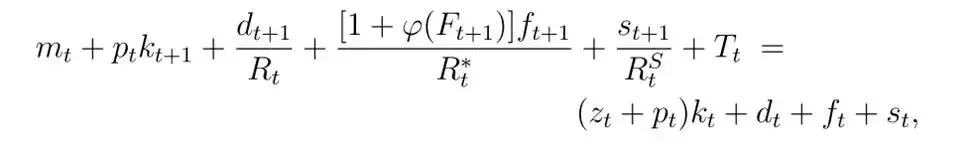

In financial markets, the U.S. and RoW governments issue bonds. Agents can hold domestic and foreign bonds as well as stablecoins. Holding foreign bonds incurs costs (Assumption 3.2), but stablecoins, due to the characteristics of the digital economy, do not have this cost. The budget constraint varies by agent type, with the habitual type's constraint given by:

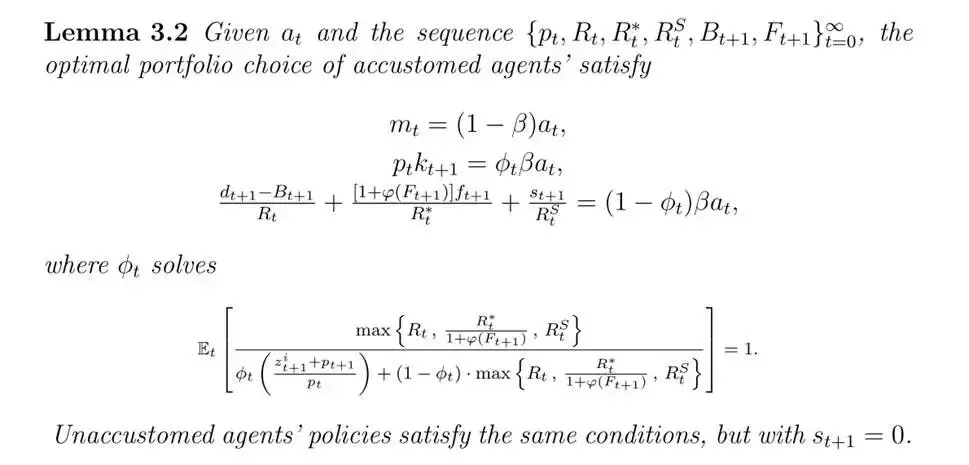

Non-habitual agents do not hold stablecoins, and their optimal policy is determined by Lemma 3.2, involving the allocation of savings between land and bonds and comparing returns on different assets.

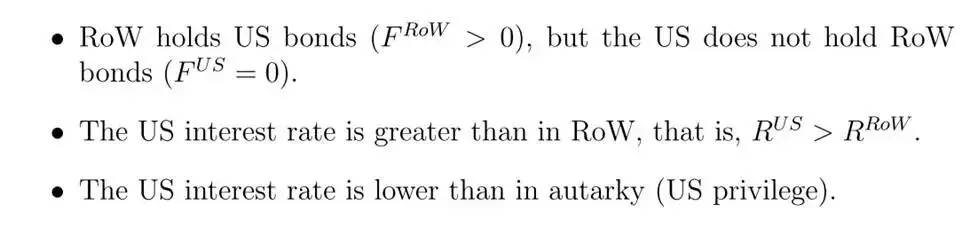

Equilibrium properties without the digital economy

Without the digital economy, since the only difference between the U.S. and the rest of the world is the volatility of idiosyncratic shocks,the steady state of the integrated economy has the following properties:

4.3 Fully Integrated World Economy

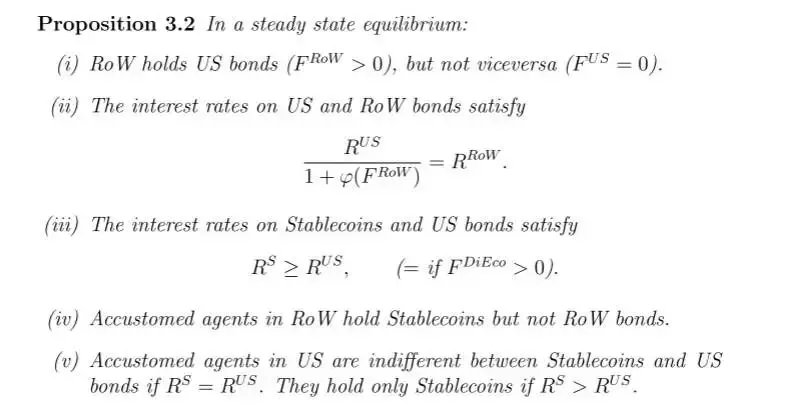

Now consider a fully integrated economy, where habitual agents in the U.S. and RoW can hold stablecoins issued by the digital economy (DiEco), and digital economy agents can hold bonds issued by the U.S. and RoW. The following proposition describes some steady-state properties.

V. Quantitative Analysis

This section focuses on quantifying the impact of digital economy growth on financial markets, with its expansion driven by the familiarity of traditional economy agents with digital activities (the share of habitual agents). The increase affects the economy through two channels: "financial demand" and "real demand," which will be separately analyzed through counterfactual simulations.

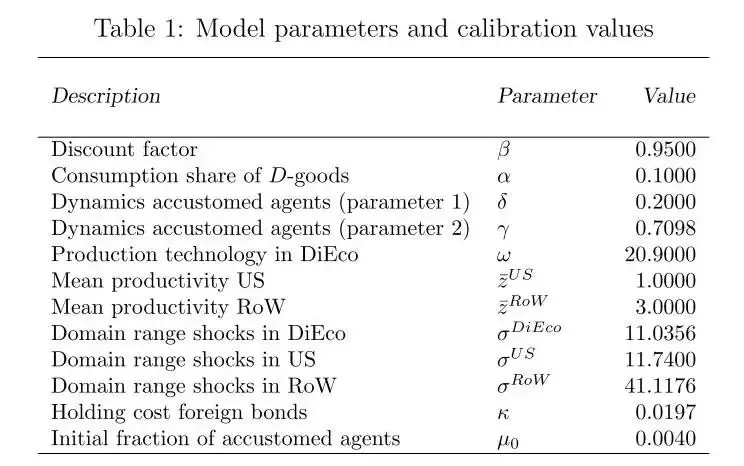

5.1 Calibration The paper calibrates initial values and steady-state targets using 2023 cryptocurrency market capitalization and other data. It further calibrates parameters related to productivity and cryptocurrency value to match six moments, including U.S. bond yields and net foreign asset positions. The parameters work together to achieve model calibration, with Table 1 presenting the complete set of calibration parameters.

5.2 Transition Dynamics Equilibrium

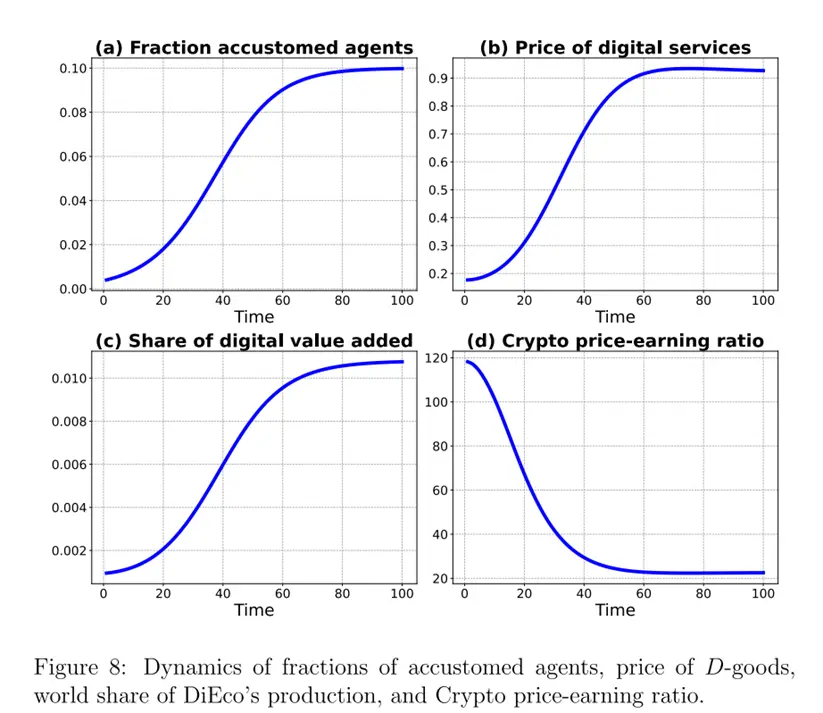

Figure8 shows the transition dynamics of four key variables. The share of habitual agents evolves exogenously, rising from an initial0.4% to a long-term10%, driving the model's transition dynamics. The price of D goods in the digital economy is initially much lower than in the non-digital economy due to limited early demand, but as the share of habitual agents increases, demand and prices rise. The value added by the digital economy as a share of global output rises from0.2% to about1.1%. The price-earnings ratio of cryptocurrencies is initially over100, driven by expectations of future growth, but falls to about20 as the industry matures, similar to valuation changes in emerging industries.

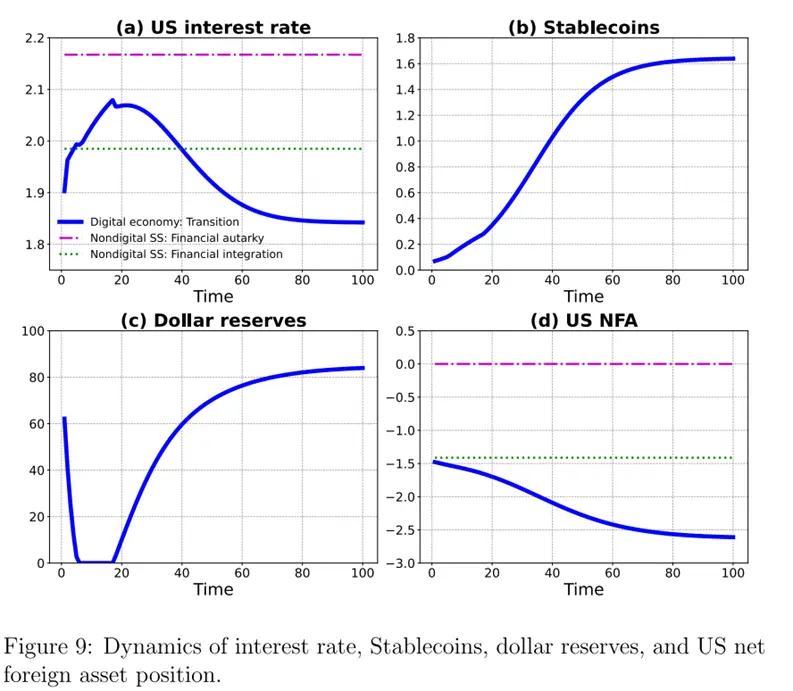

Figure 9 shows the transition dynamics of other variables. U.S. interest rates are affected by two opposing forces, resulting in a non-monotonic path—first rising, then falling. As the share of habitual agents increases, more agents in the rest of the world shift to holding stablecoins, putting downward pressure on U.S. interest rates; at the same time, higher D goods prices and cryptocurrency values increase the wealth of digital economy agents, leading to more stablecoin issuance and upward pressure on interest rates. Stablecoin issuance increases under both forces, with supply-side effects dominating early on and a low dollar reserve ratio, while the ratio rises later, strengthening demand for U.S. Treasuries.

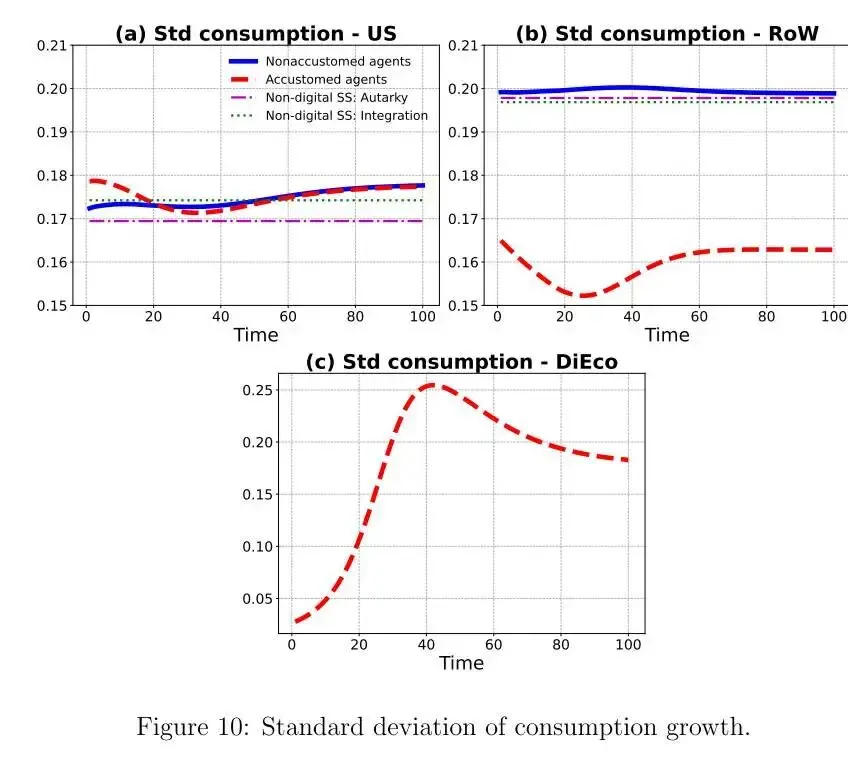

Figure 10 shows the standard deviation of consumption growth for different types of agents in each country during the transition period. The consumption volatility of habitual agents in the U.S. rises over time because U.S. net foreign assets decline and leverage increases, leading to greater volatility in net worth and consumption. Non-habitual agents initially experience high volatility due to the possibility of switching types, causing large fluctuations in D goods prices, but this effect weakens as price differences narrow. Habitual agents in the rest of the world experience lower consumption volatility because access to the digital economy allows them to buy high-yield stablecoins and adjust their portfolios to reduce net worth volatility. Digital economy agents experience significantly increased consumption volatility due to a falling price-earnings ratio, a higher share of current income (subject to idiosyncratic risk) in wealth, and greater terminal wealth volatility, all leading to higher consumption volatility.

Figure 10 shows the standard deviation of consumption growth for different types of agents in each country during the transition period. The consumption volatility of habitual agents in the U.S. rises over time because U.S. net foreign assets decline and leverage increases, leading to greater volatility in net worth and consumption. Non-habitual agents initially experience high volatility due to the possibility of switching types, causing large fluctuations in D goods prices, but this effect weakens as price differences narrow. Habitual agents in the rest of the world experience lower consumption volatility because access to the digital economy allows them to buy high-yield stablecoins and adjust their portfolios to reduce net worth volatility. Digital economy agents experience significantly increased consumption volatility due to a falling price-earnings ratio, a higher share of current income (subject to idiosyncratic risk) in wealth, and greater terminal wealth volatility, all leading to higher consumption volatility.  The growth of the digital economy has a significant impact on global risk sharing. In the long run, the U.S. expands insurance supply to the rest of the world, partly provided by virtual residents of the digital economy. Since individual consumption volatility is related to wealth volatility, U.S. wealth concentration will rise, while wealth concentration in the rest of the world (excluding digital economy residents) may fall. This reflects the complex role of the digital economy in global consumption insurance and wealth distribution.

The growth of the digital economy has a significant impact on global risk sharing. In the long run, the U.S. expands insurance supply to the rest of the world, partly provided by virtual residents of the digital economy. Since individual consumption volatility is related to wealth volatility, U.S. wealth concentration will rise, while wealth concentration in the rest of the world (excluding digital economy residents) may fall. This reflects the complex role of the digital economy in global consumption insurance and wealth distribution. VI. Conclusions and Recommendations

The U.S. dollar, by virtue of its stability, occupies a central position in international finance. This paper finds that the growth of the digital economy (especially stablecoins) affects global finance through two channels. The first channel is the increased demand for stablecoins. Since stablecoins are partly backed by dollar-denominated assets, this leads to lower U.S. interest rates and exacerbates global imbalances. The second channel is the increased supply of stablecoins backed by non-dollar assets. This raises U.S. interest rates and reduces global imbalances. Model simulations show that, in the long run, the first channel dominates the second, resulting in lower U.S. interest rates. This also means that the U.S.'s net external borrowing will continue to increase. At the same time, the paper finds that the expansion of the digital economy will increase the supply of stablecoins, helping some agents smooth consumption. Agents in the rest of the world who are familiar with the digital economy benefit more, but this comes at the cost of increased consumption volatility for U.S. and digital economy agents. Globally, the digital economy improves welfare by providing cheap services and insurance, but welfare is distributed asymmetrically across countries and agents, making the exploration of its welfare effects a direction for future research.Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Morning News | Infrared to conduct TGE on December 17; YO Labs completes $10 million Series A financing; US SEC issues crypto asset custody guidelines

A summary of major market events on December 14.

Crypto ETF Weekly Report | Last week, US Bitcoin spot ETFs saw a net inflow of $286 million; US Ethereum spot ETFs saw a net inflow of $209 million

Bitwise's top ten crypto index fund has officially been listed and is now trading as an ETF on NYSE Arca.

Banding Together in the Bear Market to Embrace Investors! Crypto Tycoons Gather in Abu Dhabi, Calling the UAE the "New Wall Street of Crypto"

As the crypto market remains sluggish, industry leaders are pinning their hopes on investors from the UAE.

Behind the Pause in Increasing BTC Holdings: Metaplanet’s Multiple Considerations