Bitcoin Long-Term Holders Move 97K BTC in Biggest One-Day Spend of 2025

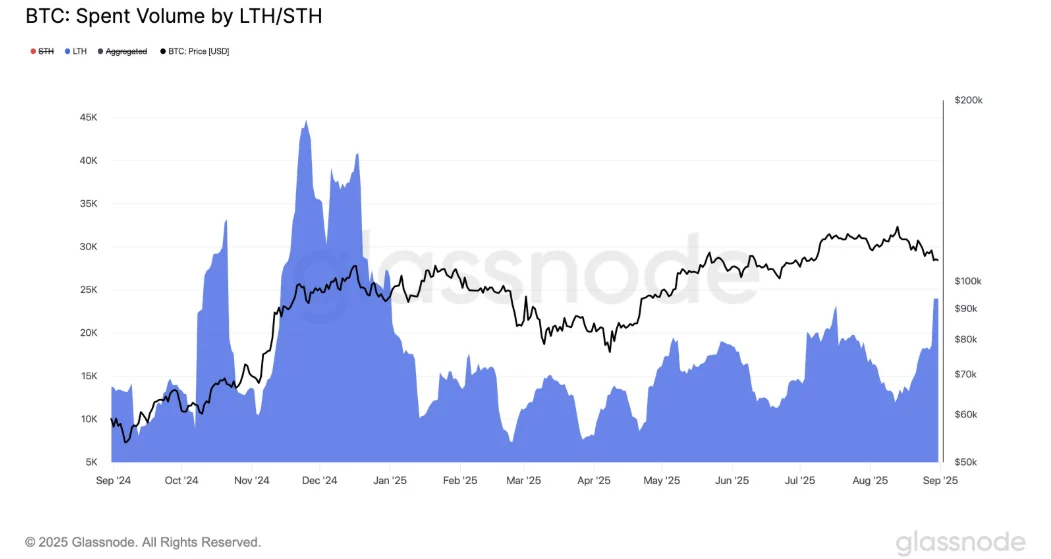

Long-term Bitcoin holders (LTHs) sharply stepped up spending late last week, with roughly 97,000 BTC moved on Friday, the largest one-day LTH outflow of 2025, according to Glassnode.

While the 14-day smoothed trend has ticked higher, Glassnode noted activity is still within the cycle’s “normal” range and remains below the large distribution spikes seen in Oct–Nov 2024. By coin age, around 34.5k BTC (1–2y), 16.6k BTC (6–12m), and 16.0k BTC (3–5y) accounted for ~70% of Friday’s total.

Bitcoin is hovering near $109k today, after dipping to the $107k area over the weekend amid a broader risk wobble. That follows a mid-August run to a record above $124k, leaving BTC roughly 12–14% below its peak.

ETF flows turned risk-off on Friday as well: U.S. spot crypto ETFs saw net outflows, with ~$127M leaving BTC funds and ~$165M exiting ETH funds, a reversal from earlier August inflows. Farside’s daily ledger also shows August’s final sessions included mixed prints and a negative day on Aug 29.

What the LTH Spending Tells Us

Glassnode’s recent research has emphasized that long-term investors have already realized multi-million BTC in profits this cycle, surpassing the 2021 cycle but still short of the 2017 peak. That backdrop helps explain why periodic waves of LTH distribution can appear around local volatility without necessarily breaking the cycle’s structure.

Crucially, Glassnode’s Week On-Chain last week flagged key tactical levels: support in the $107k–$108.9k band (now being tested), potential resistance near $113.6k, and a deeper downside $93k–$95k zone if sellers press their advantage.

In other words, LTH selling added supply, but whether the price slides further depends on how spot/ETF demand behaves around these areas. Friday’s LTH burst (+ ETF outflows) explains the swift trip toward $107k. If BTC can reclaim $113k–$114k, it would signal absorption of that supply and ease near-term pressure.

Despite bouts of distribution, the cycle trend since late 2024 remains up. Still, several analysts warn a corrective leg toward $75k–$97k is possible if momentum stalls and macro jitters persist. Meanwhile, LTH realized profits this cycle are already historically large, which often coincides with later-cycle behavior, bigger swings, faster rotations, and more sensitivity to macro/ETF flows.

Large, age-diverse LTH distributions like Friday’s often inject liquidity right where the market is vulnerable, amplifying moves when ETF flows flip negative. But the spending still sits “within norms” for this cycle rather than the kind of blow-off seen late 2024, a nuance that argues for choppy range trading unless fresh demand (spot or ETF) steps back in decisively.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

After bitcoin returns to $90,000, is Christmas or a Christmas crash coming next?

This Thanksgiving, we are grateful for bitcoin returning to $90,000.

Bitcoin security reaches a historic high, but miner revenue drops to a historic low. Where will mining companies find new sources of income?

The current paradox of the Bitcoin network is particularly striking: while the protocol layer has never been more secure due to high hash power, the underlying mining industry is facing pressure from capital liquidation and consolidation.

What are the privacy messaging apps Session and SimpleX donated by Vitalik?

Why did Vitalik take action? From content encryption to metadata privacy.

The covert war escalates: Hyperliquid faces a "kamikaze" attack, but the real battle may have just begun

The attacker incurred a loss of 3 million in a "suicidal" attack, but may have achieved breakeven through external hedging. This appears more like a low-cost "stress test" targeting the protocol's defensive capabilities.