Crypto Inflows Hit $2.48 Billion Last Week as Ethereum Continues to Outpace Bitcoin

Ethereum dominated August with $3.95B in inflows, outpacing Bitcoin’s losses, as crypto investment products saw $2.48B in weekly inflows.

Ethereum remained in the driver’s seat throughout August, pushing crypto inflows to $2.48 billion last week. The surge pushed August flows to $4.37 billion, and year-to-date (YTD) inflows to $35.5 billion.

However, despite this positive momentum, total assets under management (AUM) slipped 10% from recent peaks to $219 billion amid Friday’s macroeconomic woes.

Ethereum Dominates Crypto Inflows as Bitcoin Trails Amid August Recovery

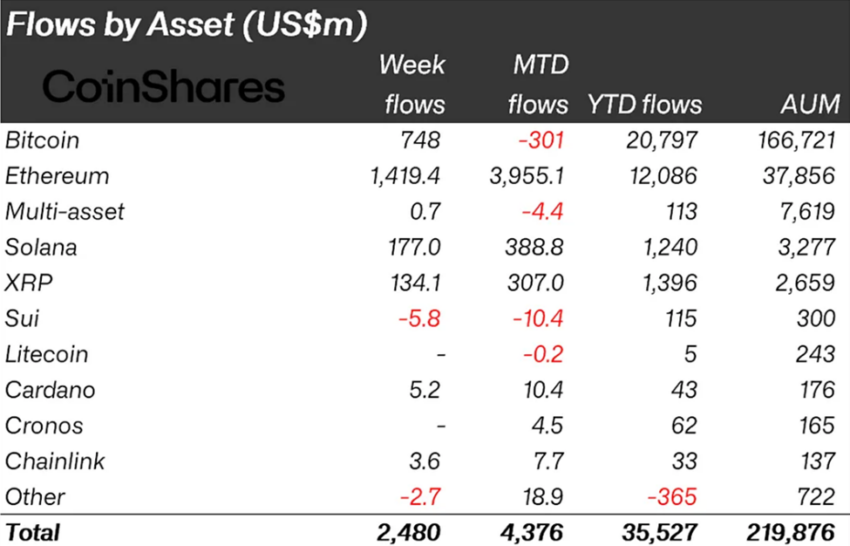

The latest CoinShares report shows Ethereum continued to dominate Bitcoin in investor preference. Last week, it attracted $1.4 billion in positive weekly flows as crypto inflows reached $2.48 billion. Meanwhile, Bitcoin inflows reached $748 million.

Crypto Inflows Last Week. Source:

CoinShares Report

Crypto Inflows Last Week. Source:

CoinShares Report

Ethereum has accumulated $3.95 billion in inflows throughout August, after a series of altcoin-led positive flows.

Meanwhile, Bitcoin recorded net outflows of $301 million in August, while other altcoins benefited from optimism surrounding potential US ETF (exchange-traded fund) launches.

However, according to CoinShares head of research James Butterfill, last week’s crypto inflows could have been higher, save for negative price movements and Friday’s outflows following the release of Core PCE data.

The macroeconomic data point dampened expectations of a Federal Reserve (Fed) rate cut in September.

“Core PCE rises to 2.9% YoY. Inflation is not falling. It is rising. Q2 GDP revised up to 3.3%. And some think the Fed should cut 50 bp? The data does not support a cut. But politics may force it,” Mainstay Capital Management CEO & CIO David Kudla stated.

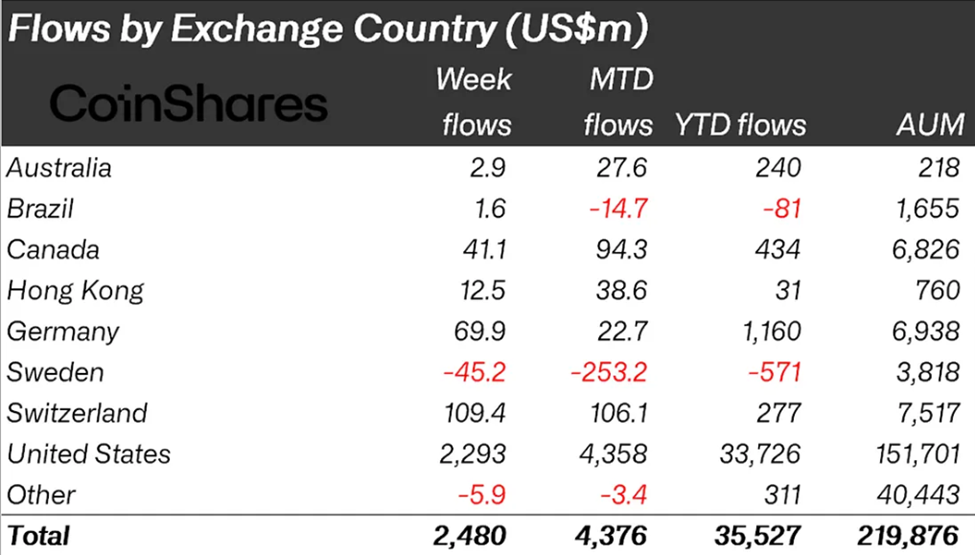

Analysts suggest the Friday pullback reflected profit-taking rather than a broader market weakness, as inflows remained diversified across geographies.

Crypto Inflows by Region. Source: CoinShares Report

Crypto Inflows by Region. Source: CoinShares Report

The rebound follows a turbulent week reported by CoinShares the week before, which highlighted $1.43 billion in outflows, the largest since March.

Bitcoin led these outflows at $1 billion, while Ethereum limited its losses to $440 million. This reflects the growing resilience of Ethereum-focused products.

Month-to-date flows showed Ethereum with $2.5 billion in net inflows versus Bitcoin’s $1 billion net outflow.

In response to US monetary policy cues, investor sentiment shifted sharply over the week. Early pessimism regarding Fed action triggered initial outflows of $2 billion.

However, following Fed Chair Jerome Powell’s address at the Jackson Hole Symposium, markets interpreted a more dovish tone than expected, sparking inflows of $594 million later in the week.

Ethereum benefited most from this shift, highlighting a distinct divergence in investor preference between Ethereum and Bitcoin.

Ethereum’s growing share of investment products across August is significant, where YTD inflows represent 26% of total AUM, compared with just 11% for Bitcoin.

This trend highlights investors’ increasing preference for Ethereum exposure, driven by the network’s ecosystem growth and DeFi adoption.

Despite Friday’s minor pullback, the broad inflows signal renewed investor confidence in digital assets, particularly Ethereum.

Altcoin optimism is further supported by ETF-related expectations, and the digital asset market appears poised for selective growth, even as Bitcoin faces headwinds from recent outflows and the overall contraction in AUM.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Kodiak launches Berachain native perpetual contract platform—Kodiak Perps, enhancing its liquidity ecosystem

The native liquidity platform of the Berachain ecosystem, Kodiak, recently launched a new product, Kodiak Perps,...

Mars Morning News | Michael Saylor calls: Buy Bitcoin now

Trump Media & Technology Group’s Q3 losses widened to $54.8 million, and it holds substantial amounts of bitcoin and CRO tokens; US consumer confidence has fallen to a historic low; a whale bought the dip in ZEC and made a profit; a bitcoin whale transferred assets; Michael Saylor called for buying bitcoin; the Federal Reserve may initiate bond purchases. Summary generated by Mars AI. The accuracy and completeness of this content is still being iteratively updated by the Mars AI model.

MEET48: From Star-Making Factory to On-Chain Netflix — How AIUGC and Web3 Are Reshaping the Entertainment Economy

Web3 entertainment is moving from the retreat of the bubble to a moment of restart. Projects represented by MEET48 are reshaping content production and value distribution paradigms through the integration of AI, Web3, and UGC technologies. They are building sustainable token economies, evolving from applications to infrastructure, aiming to become the "Netflix on-chain" and driving large-scale adoption of Web3 entertainment.

Digital Euro: Italy Advocates for a Gradual Implementation