Author: Wajahat Mughal

Translation: TechFlow

“You wasted all your time and effort.”

— August 2025, someone said to me.

This is a photo of the first batch of books I took during my first week as a medical student, but I never actually opened or read these books.

Let me tell you a little story. About ten years ago, I started my studies in medical school. At that time, I often thought about what I wanted to do in the future. These books in the picture were borrowed from the library, and the first week’s cases started with embryology and anatomy. The excitement was real. I would think about the vastness of the medical field, imagine my life as a doctor, and the choices I would have to make after graduation.

The charm of a medical career lies in its diversity:

-

You can be hands-on like a trauma surgeon;

-

Focus on technology, such as radiology;

-

Be communication-centered, like family medicine or psychiatry;

-

Or combine various elements through emergency or acute medicine;

-

And there are dozens of other specialties, each with its own unique perspective, characteristics, and pros and cons.

At that time, I initially wanted to become a surgeon and thought being an ophthalmologist was cool too. But I quickly realized that anatomy wasn’t for me. Although I was good at hands-on operations, I found that I didn’t enjoy spending time in the operating room. Later, I wanted to go into radiology, then general practice (family medicine), and even briefly considered gastroenterology. The point is, back then I only saw myself on the path of medicine, without considering any other possibilities at all.

Captured a beautiful sunset during a busy post-graduation surgical shift.

I never thought I would work in finance, let alone in crypto and decentralized finance (Crypto/DeFi). But life is always full of changes. I experienced new things, made new friends, explored new hobbies, and in the blink of an eye, almost ten years have passed and I am standing at today’s starting point. In fact, when I first entered medical school, I had no concept of what crypto was. Looking back, the journey from who I was then to who I am now is truly amazing.

A few days ago, at an event, someone said to me: “You wasted all your time and effort leaving medicine.” Over the past few years, I’ve heard many similar comments, as I gradually reduced my medical practice and turned to the crypto field. I understand that sometimes these words come from concerns about safety and stability, but they are wrong. In one word, it’s “human capital.” All the learning, experiences, skill development, and memory accumulation have made me who I am today. These have not disappeared! For me, this includes everything from communication skills to critical thinking, memory ability, and the actual ability to treat acute or chronic patients. These abilities are still a part of me.

Sunk Cost Fallacy

The main message I want to convey is: don’t fall into the sunk cost fallacy. In the medical field, I often see this situation, and maybe some of you have encountered it as well. Just because you’ve invested a lot of time and effort into something doesn’t mean you have to make it your lifelong career.

The sunk cost fallacy is our tendency to stick with something—whether emotionally, financially, educationally, or psychologically—even when better opportunities are available. For example: you invested in a newly launched altcoin, which was thought to be the next big thing, and you put some money into it. However, after a few months, you find that it’s underperforming, other projects in the market are developing better, and the team’s plans for the next product update are seriously delayed. Even so, you still choose to hold onto these coins.

Why don’t we just sell and move on to other opportunities?

Ever been “bagholding”? You might have experienced something like this…

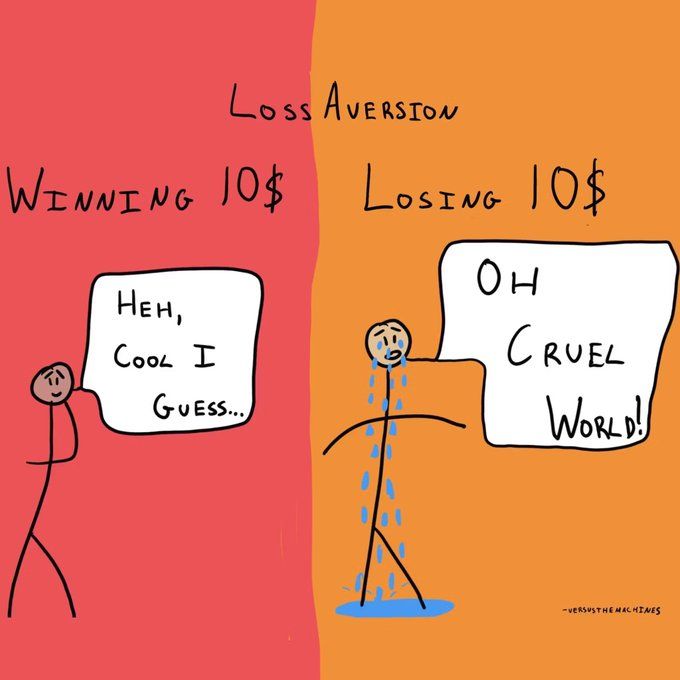

The sunk cost fallacy becomes the “winner” again because it makes us focus more on the costs already paid when making decisions, rather than future opportunities. We are too focused on the resources we’ve already put in and ignore other options (for example, in many cases, simply selling that altcoin and switching to bitcoin would be a better decision). This phenomenon is driven by our irrational behavior, and we are often overly influenced by emotions. This fallacy is also closely related to commitment bias and loss aversion, which every crypto investor or person in the investment field may have experienced.

What Can We Learn From This?

Take my experience as an example. When @0xBobdbldr contacted me and invited me to join him and do something completely different in DeFi, I was already working part-time in crypto but still practicing medicine. I was at a crossroads in my life: should I go full-time into crypto? For me, DeFi was a once-in-a-lifetime opportunity to participate at an early stage, create impact, and, importantly, change my own life and the lives of others. This choice was based on future returns, and by avoiding commitment bias, it helped me overcome my inner struggles.

It’s perfectly okay to let go of things from the past. Some things are irreversible and may involve high costs, but the potential benefits of another choice may far outweigh what you’re holding onto. As mentioned above, this could be a job, an upcoming event, or even an investment you’ve already made.

-

Accept and learn: You may have made mistakes, made poor choices, or simply have a brighter alternative waiting for you. Embracing change and letting go of irreversible costs is a great thing.

-

Try to think rationally, not just emotionally, especially when making investment decisions.

-

Focus on future returns, whether it’s new investment opportunities or a new career waiting for you, and use data and metrics to support your decisions.

I like people who ask this question: “If you sold your holdings today, would you buy them back tomorrow?” I think in many cases, the answer might be no!