WFLI Launch: After the Meme Craze, the PoliFi Narrative Ushers in the Era of "Official Players"

The WFLI token deeply binds the Trump family to the crypto world, marking the entry of the political finance (PoliFi) narrative into the 2.0 era, shifting from the cultural appeal of Meme coins to a structured financial ecosystem. Summary generated by Mars AI. This summary was generated by the Mars AI model, and its accuracy and completeness are still being iteratively improved.

Introduction: On the night of September 1, 2025, the eyes of the crypto world will be focused on a single code—WFLI. However, this is far from just another launch party for a new token. When the Trump family name becomes deeply tied to a governance token that “may never be tradable,” and eventually makes its way to global mainstream exchanges, what we are witnessing may be a watershed moment in the evolution of the crypto industry. It forces us to ponder a deeper question: is this the ultimate form of the “PoliFi” narrative, or is it a strategic “taking sides” by this digital world—born from cypherpunk idealism—towards real-world power?

From Symbol to Asset: A Carefully Orchestrated Narrative Evolution

The story begins with a touch of irony. In its early “Gold Paper,” World Liberty Financial (WLFI) left a thought-provoking statement, hinting that its token might forever remain a non-transferable governance symbol. At the time, this was interpreted as a clever gesture—consolidating supporters’ identity while drawing a clear line from direct financial speculation. However, as Trump family members—Eric, Donald Jr., and Barron—stepped forward as “Web3 Ambassadors,” and the project raised an astonishing $550 millions through two rounds of sales, the weight of this “symbol” had already far surpassed its mere representational meaning.

Tonight’s unlocking marks the crucial turning point from the first act to the second in this grand narrative. WFLI has made a daring leap from “political totem” to “tradable asset.” This transformation is no accident, but a carefully planned evolution. It clearly shows that WFLI’s ambition is far more than being a voting tool—it aims to build a financial ecosystem deeply embedded in the crypto economy, with the Trump IP as its gravitational core.

The brilliance of this evolution lies in its unprecedented fusion of the two most familiar success paradigms in the crypto world.

First is the cultural appeal of meme coins. Last year, $TRUMP, a purely community-driven meme coin, reached a jaw-dropping fully diluted valuation (FDV) of $73 billions, despite having almost no utility, relying solely on market sentiment and cultural symbolism. It proved the immense traffic value of the Trump name in the crypto world.

WFLI, on the other hand, is the “officially certified version” of this value. It is no longer a bottom-up emotional frenzy, but a top-down strategic deployment. As Dennis Liu, partner at Momentum 6, put it, WFLI is “not only officially recognized, but also linked to US Treasury bonds,” which greatly enhances its credibility and potential ceiling. WFLI has absorbed the spiritual core of meme coins, but wrapped it in a hard shell composed of institutions, stablecoins, and real-world companies.

PoliFi 2.0: When “Guerrillas” Meet the “Regular Army”

If meme coins like $TRUMP were the “guerrillas” of the PoliFi 1.0 era, stirring up market sentiment with flexible, grassroots power, then WFLI is more like the “regular army” of the PoliFi 2.0 era. Its emergence is setting a brand new—and much higher—bar for the “Political Finance” track.

The core of PoliFi lies in the direct linkage between political influence and financial assets. In the 1.0 era, this linkage was loose and emotional, with prices swinging wildly around news, tweets, and polls. But PoliFi 2.0, as represented by WFLI, is a new, structured, and capitalized paradigm. Its arsenal is no longer empty slogans, but a luxurious lineup made up of real money and top industry resources. Looking at WFLI’s investor list, what we see is no longer the frenzy of retail investors, but the cool calculation of institutions:

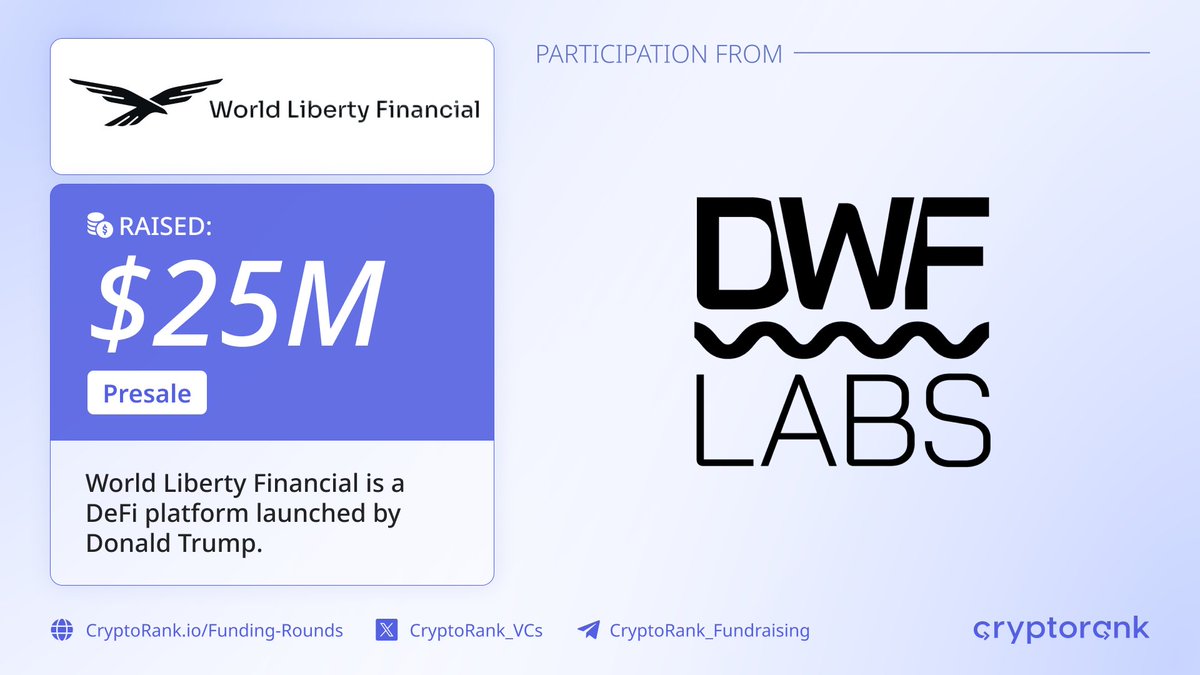

DWF Labs, a crypto investment and market-making firm known for its shrewdness, entered with a $25 millions investment.

Web3 native fund Aqua1 Fund announced a strategic purchase of $100 millions worth of WFLI in June.

Additionally, Nasdaq-listed company ALT5 Sigma also participated, with its CIO Matthew Morgan also serving as an advisor to WFLI.

Behind these names lies a consensus reached between the “old money” and “new elites” of the crypto world. What they are investing in is not just a token, but the possibility of combining with powerful real-world influence. This combination has given WFLI a resource network from its inception that other projects can hardly match. It is not fighting alone, but, as a “leader,” rapidly building a vast ecosystem. From Ondo Finance and Plume Network, paving the way for the RWA narrative, to stablecoin projects like Ethena and Lista DAO, and even to core DeFi protocols on the Solana chain such as Raydium and Kamino. Through its stablecoin USD1 as a hub, WFLI radiates its liquidity and influence to every corner of the crypto world. This approach clearly shows that it is not aiming to be a short-term hype target, but a long-term financial infrastructure.

A Strategic “Taking Sides” by the Crypto Industry

This leads to a core question: when the top capital, technology, and talent in the crypto world begin to build on such a large scale around a political symbol, what signal does this send?

Rather than seeing WFLI as a “Trump family business” currying favor with Washington, it is better understood as: key players in the crypto industry, through the vehicle of WFLI, have made a strategic investment and alliance with a specific political force.

This is no longer a revolution about code, but a convergence of capital. The crypto world was born out of distrust for the traditional centralized financial system, with decentralization and censorship resistance as its spiritual core. However, as the industry grows larger, it becomes increasingly impossible to avoid collisions with the real world. From Wall Street giants like BlackRock issuing bitcoin ETFs, to tightening regulatory policies around the globe, all point to an irreversible trend: the crypto industry is being incorporated into the global financial and power landscape.

In this process, rather than passively waiting in the complex lobbying of Washington, it is better to proactively seek strong “allies.” The emergence of WFLI happens to provide a perfect sample for such an alliance. For crypto capital seeking certainty amid regulatory fog, supporting WFLI is, in a sense, a clear “taking sides.” It’s as if to say: not only can we create technology and wealth, but we also understand and respect the power games of the real world, and we are willing to use capital to become players in it. When TRON DAO, under Justin Sun, became one of its largest independent investors with $30 millions, and when DWF Labs added it to their portfolio, their decisions had already gone beyond pure technical or financial analysis—they were judgments about future political trends and power structures.

The Direction of the Tide and Speculation on the Future

Tonight’s launch comes at a subtle moment. According to CoinGecko data, on the eve of listing, the crypto market saw a general decline, with total market cap evaporating by 1.5% within 24 hours. However, the market’s coolness did not stop the inflow of capital. Coinglass data shows that WLFI’s total open interest across the network has soared to $900 millions, with a 24-hour increase of nearly 50%. The interweaving of ice and fire signals a highly volatile start.

Market expectations have also shown an interesting divergence. In a Discord group with over a million WLFI holders, many small investors see $0.47 as a key selling point, while large holders have longer-term goals, generally aiming for above $1. This divergence is reflected in every individual: holder Bruno Ver said he plans to sell 10% of his position after trading starts, predicting the price may be between $0.35 and $0.5. “I’ve already told my wife we’re taking a cruise in September,” he admitted.

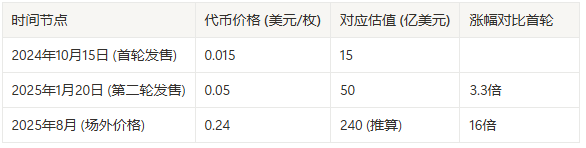

From Bruno Ver’s cruise holiday, to the long-term visions of whales, and the ever-rising contract data, all together form the complex picture on the eve of WFLI’s launch. The following valuation evolution chart clearly shows the trajectory of rising market expectations.

This chart is less about price growth and more about a narrative being continuously accepted and amplified by the market. The leap in valuation from $1.5 billions to $24 billions reflects capital’s recognition of the power of the “Trump + crypto” combination.

However, regardless of how tonight’s price plays out, it is only the beginning of this grand experiment. The real test for WFLI does not come from the first few hours of candlesticks after listing, but from whether it can truly deliver on its narrative—successfully transforming a massive political IP into a sustainable, scalable, and widely adopted decentralized financial ecosystem.

This is not just a test for the WFLI project, but the ultimate test for the entire PoliFi track. It will answer a question that has long troubled the industry: are cryptocurrencies tools to subvert real-world power, or will they ultimately become new levers for real-world power to consolidate its influence?

Tonight, there is no answer, only a prologue.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Stacks Nakamoto Upgrade

STX has never missed out on market speculation surrounding the BTC ecosystem, but previous hype was more like "castles in the air" without a solid foundation. After the Nakamoto upgrade, Stacks will provide the market with higher expectations through improved performance and sBTC.

Do Kwon Wants Lighter Sentence After Admitting Guilt

Bitwise Expert Sees Best Risk-Reward Since COVID

Stellar (XLM) Price Prediction: Can Bulls Push Toward $0.30 in December?