Bitcoin Investor Explains How XRP Will See a Controlled Launch to $50 Soon

Pumpius, a seasoned Bitcoin investor, has laid out a bold case for XRP path to a $50 price point.

He attributes the potential surge not to market hype, but to a regulatory milestone that could transform Ripple into a central player in U.S. finance. In particular, Pumpius sees XRP’s price explosion stemming from Ripple’s pursuit of a key banking license.

Ripple’s OCC Bank Charter Ambition

Ripple is currently in the process of acquiring a national bank charter under the U.S. Office of the Comptroller of the Currency (OCC). The application was submitted in July, and a decision could come as early as October, based on the OCC’s 120-day approval timeline.

Why Approval Could Redefine XRP

With an OCC charter, Ripple would gain direct access to the Federal Reserve, authority to custody crypto and tokenized assets, and the ability to issue stablecoins and settle securities.

According to Pumpius, this setup would bypass traditional intermediaries, allowing banks, brokers, and funds to use Ripple as their direct bridge into tokenized finance. In this model, XRP becomes the core bridge asset, central to the new liquidity network.

The $6.6 Trillion Settlement Pipeline

Pumpius’s analysis highlights that global bank settlements total around $6.6 trillion per day. Even a small fraction of this volume flowing through XRP, given its limited supply, could send the price soaring, he claimed.

Based on this liquidity model, Pumpius argues that $50 per XRP is not speculative, but a logical outcome of scaled adoption.

For context, XRP is currently trading at just $2.72, meaning Pumpius anticipates a 1,673% increase in value, driven by its utility in liquidity services. Moreover, a $50 price would give XRP a market cap of approximately $3 trillion, surpassing Bitcoin’s current market cap of $2.1 trillion.

Timely Transition

Meanwhile, Pumpius noted that Ripple’s long legal battle with the SEC has concluded, removing regulatory roadblocks that may have delayed progress. He believes the lawsuit was not the real obstacle, but rather a necessary step toward regulatory alignment and eventual OCC approval.

Interestingly, Pumpius said the day Ripple’s OCC bank charter is approved will mark XRP’s transition from a crypto asset to a foundational component of the U.S. financial infrastructure.

The analyst insists this won’t be a moonshot gamble, but rather a “controlled launch” of XRP into the heart of global banking.

Ripple Banking License Facing Strong Resistance

However, major banking and credit union groups—led by the American Bankers Association—are urging the U.S. OCC to delay decisions on federal bank charter applications from Ripple and other crypto firms such as Circle.

They argue that crypto services fail to meet fiduciary standards and warn that granting charters without public input would bypass decades of regulatory precedent.

Additionally, they claim it would give crypto firms an unfair advantage by allowing them to sidestep state-level licensing requirements.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Privacy’s HTTPS Moment: From Defensive Tool to Default Infrastructure

Summarizing the "holistic reconstruction of the privacy paradigm" from dozens of speeches and discussions at the Devconnect ARG 2025 "Ethereum Privacy Stack" event.

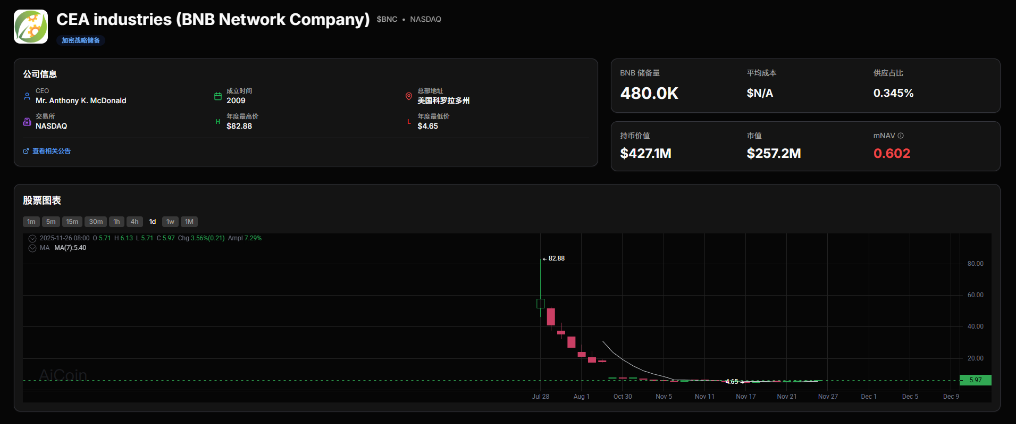

Shareholder Revolt: YZi Labs Forces BNC Boardroom Showdown

Halving Is No Longer the Main Theme: ETF Is Rewriting the Bitcoin Bull Market Cycle

The Crypto Market Amid Liquidity Drought: The Dual Test of ETFs and Leverage