In recent times, the cryptocurrency market has been experiencing significant selling pressure, yet an impending new era is on the horizon. ETF expert Nate Geraci has hinted at strong and substantial price movements expected for XRP and other altcoins. In this emerging phase, Bloomberg analyst James Seyffart highlights that the SEC is currently reviewing 96 cryptocurrency ETF applications, underpinning this market transition.

ETF Applications Highlight Ripple and Solana

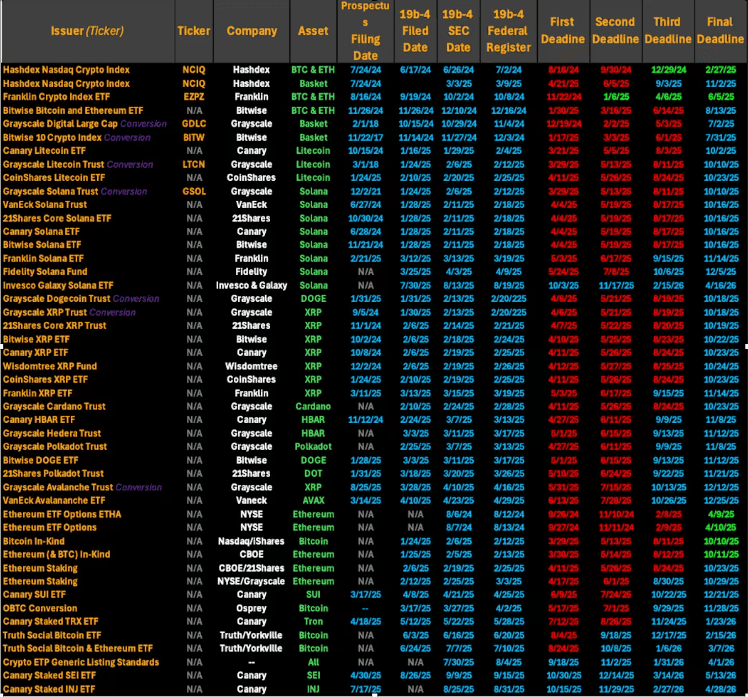

Nate Geraci, in his social media discourse, asserted that the barriers for cryptocurrency ETFs are about to burst open. This impending change is largely driven by institutional investors and asset management companies showing a keen interest in regulated investment vehicles. Seyffart identified Solana $204 , with 16 applications, as leading the charge, closely followed by XRP with 15. Other significant players in the application queue include Ethereum $4,486 , Bitcoin $108,805 , Dogecoin $0.218334 , and Litecoin.

ETFs are known for providing investors access to cryptocurrencies without the need for technical complications like wallets or custody solutions. Geraci foresees that ETF approvals will attract substantial institutional capital, significantly boosting market liquidity and hastening adoption. Seyffart reads the increase in ETF applications as a sign of cryptocurrencies maturing into a recognized asset class. Especially for XRP, this could signal a stronger presence in capital markets upon approval.

SEC Delays Yet Surge in Applications

Despite the slow progress of the SEC’s decision-making process, the influx of cryptocurrency ETF applications continues unabated. Notably, 21Shares recently sought approval from regulators for the first SEI ETF. Meanwhile, Grayscale’s Cardano $0.827023 ETF application, submitted in February, is still pending with no decisive action from the SEC, despite public feedback.

In April, Seyffart’s colleague Eric Balchunas was tracking 72 applications, but this escalated quickly to 96 over the summer. This rise reflects issuers’ ambitions to leverage market momentum directly for profit. BlackRock’s initiatives have been particularly noteworthy, with its iShares Bitcoin Trust ETF attracting over $58 billion in assets and controlling more than 3% of Bitcoin supply since launch. Moreover, a $13 billion demand for Ethereum ETFs underscores the pronounced influence of institutional investors in the market. Analysts anticipate similar approvals could spark significant altcoin surges, specifically in Cardano, Solana, and XRP.