Decoding XRPi: How Legal Regimes and Behavioral Biases Shape Investor Resilience in Risk Disclosure

- Global legal regimes shape corporate risk disclosure, with the EU's CSRD mandating comprehensive sustainability reporting and the U.S. relying on fragmented state-level mandates. - Behavioral biases like the reflection effect distort investor decisions, causing overemphasis on low-probability crypto risks while undervaluing steady gains from staking rewards. - Divergent regulatory frameworks create asymmetric information, pushing companies to tailor disclosures to the strictest regime they face, often EU

In the high-stakes arena of global investing, the line between opportunity and peril is often blurred by the interplay of legal regimes and behavioral biases. Nowhere is this more evident than in the evolving landscape of corporate risk disclosure, where regulatory frameworks—from the EU's stringent Corporate Sustainability Reporting Directive (CSRD) to the U.S.'s patchwork of voluntary and state-level mandates—shape how companies communicate risk. For investors, understanding these dynamics is critical to building resilient portfolios. This article explores how behavioral finance concepts like the reflection effect and probability-range dynamics interact with legal disclosure requirements to influence investor decision-making, using the cryptocurrency sector as a case study.

Legal Regimes: The Foundation of Risk Transparency

The EU, UK, and U.S. have diverged sharply in their approaches to corporate risk disclosure. The EU's CSRD, which mandates double materiality assessments (reporting both how sustainability issues affect a company and how the company affects society/environment), creates a standardized, comprehensive framework. The UK, post-Brexit, has adopted a hybrid model, blending mandatory disclosures under the Streamlined Energy and Carbon Reporting (SECR) with voluntary alignment to international standards like the ISSB. Meanwhile, the U.S. remains fragmented, with federal inaction on ESG mandates and state-level laws like California's SB 253 imposing strict emissions reporting.

These regimes directly influence how companies frame risk. For instance, a firm operating in the EU must disclose not only financial risks but also societal impacts, while a U.S.-listed company might prioritize investor-focused disclosures under SEC rules. This divergence creates a regulatory arbitrage where companies tailor disclosures to the most stringent regime they face, often leading to asymmetric information for investors.

Behavioral Finance: The Reflection Effect and Probability-Range Dynamics

The reflection effect, a cornerstone of prospect theory, reveals how investors shift from risk-averse to risk-seeking behavior depending on whether outcomes are framed as gains or losses. In the context of corporate risk disclosures, this means investors may:

- Overweight low-probability, high-impact losses (e.g., a sudden regulatory crackdown on crypto) while underweighting high-probability, moderate gains (e.g., steady staking rewards from Ethereum).

- React irrationally to poorly framed disclosures, such as a company highlighting a 1% risk of a catastrophic event without contextualizing its likelihood.

Consider Bit Digital (NASDAQ: BTBT), which transitioned from Bitcoin mining to Ethereum staking. Its 2025 annual report discloses 105,015 ETH staked (~$511.5 million) with a 3.1% annualized yield. However, the report also warns of Ethereum's price volatility and potential underperformance. Investors influenced by the reflection effect might sell shares during short-term price dips, despite the company's strong cash reserves ($181.2 million) and diversified holdings (e.g., 74.3% stake in WhiteFiber , valued at $468.4 million).

Investor Perception and Strategic Risk-Taking

Legal regimes amplify or mitigate behavioral biases. In the EU, where disclosures are standardized and probabilistically framed, investors may make more rational decisions. Conversely, in the U.S., where disclosures are often voluntary and inconsistently structured, behavioral biases like herding and overconfidence can dominate. A 2024 study of Saudi investors, for example, found that herding behavior and blue-chip bias significantly skewed risk perception, with investors favoring large-cap stocks despite higher volatility.

For XRPi (a hypothetical or real-world token, depending on context), this means that regulatory clarity in the EU could attract institutional investors seeking transparency, while U.S. investors might be more prone to speculative trading based on incomplete disclosures.

Actionable Insights for Portfolio Resilience

- Dynamic Rebalancing Based on Legal Regimes:

- Bear markets: Increase exposure to assets in jurisdictions with strong disclosure laws (e.g., EU-listed crypto firms) where risk is better quantified.

Bull markets: Reduce exposure to volatile assets in low-transparency regimes (e.g., U.S. crypto firms with minimal ESG disclosures).

Behavioral Framing of Disclosures:

- Prioritize companies that explicitly state probabilities of risks (e.g., “a 5% chance of regulatory delay” vs. vague warnings).

Use scenario analysis to test how different legal regimes affect a company's risk profile. For example, a U.S. crypto firm with a dual EU listing may face higher compliance costs but offer more transparent disclosures.

Hybrid Portfolio Construction:

- Combine high-conviction, volatile assets (e.g., crypto) with low-volatility, high-disclosure assets (e.g., EU-listed renewables) to balance behavioral biases.

Allocate a portion of the portfolio to regulatory arbitrage opportunities, such as investing in companies that benefit from EU sustainability mandates.

Financial Literacy and Regulatory Advocacy:

- Advocate for probabilistic framing in corporate disclosures, as mandated by the CSRD.

- Educate investors on recognizing the reflection effect, using tools like behavioral nudges in investment platforms.

Conclusion: Navigating the Legal-Behavioral Nexus

The intersection of legal regimes and behavioral finance is a double-edged sword. While stringent disclosure laws like the CSRD can reduce irrational decision-making, they also create compliance burdens for companies. Conversely, lax regimes exacerbate behavioral biases, leading to market inefficiencies. For investors, the key lies in leveraging regulatory transparency to counteract cognitive distortions. By integrating behavioral insights with jurisdictional analysis, portfolios can become more resilient to both market volatility and psychological pitfalls.

As the global regulatory landscape evolves—whether through the EU's Omnibus package or potential U.S. federal mandates—investors must stay agile. The future of risk management lies not just in understanding what companies disclose, but in decoding how they disclose it, and why it matters to the human mind.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

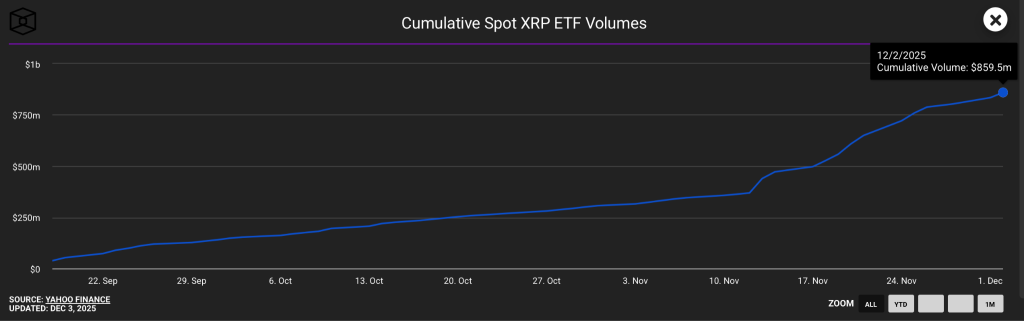

XRP ETF Flows Hit Record High—What It Means for XRP Price

Ethereum Hits New All-Time High for TPS Ahead of Fusaka Upgrade

Pi Network News: Expert Says ‘Sleeping Giant’ Fails to Wake As Stalled Protocol 23 Raises Doubts