Decoding Ripple's Price Volatility: Behavioral Economics and the Reflection Effect in Crypto Markets

- Ripple's XRP faced a decade-long SEC regulatory battle, driving price swings between $0.50 and $1.50 as investors exhibited risk-seeking behavior during losses and risk-averse moves post-2025 resolution. - The 2025 SEC reclassification of XRP as a commodity stabilized volatility to 3.95%, shifting institutional perception from speculative asset to utility tool for cross-border payments. - Strategic buyers capitalized on fear-driven dips below $3.09, leveraging XRP's 0.0004% fees and ISO compliance to dri

The cryptocurrency market is a theater of paradoxes. Investors oscillate between euphoria and panic, often reacting to news not with logic but with visceral emotion. For XRP , the token at the heart of Ripple's blockchain, this dynamic has been amplified by a decade-long regulatory saga. Yet, beneath the noise lies a pattern: investor behavior during XRP's volatility can be decoded through the lens of behavioral economics, particularly the reflection effect. This cognitive bias—where individuals become risk-seeking in the domain of losses and risk-averse in the domain of gains—offers a framework to understand how market sentiment shapes price action and, crucially, how to spot strategic buying opportunities.

The Reflection Effect and XRP's Regulatory Rollercoaster

The reflection effect, first identified by Daniel Kahneman and Amos Tversky, explains how people's risk preferences invert depending on whether they perceive outcomes as gains or losses. In crypto markets, this manifests starkly. During the SEC's prolonged legal battle with Ripple (2023–2025), XRP's price swung wildly between $0.50 and $1.50. Investors, facing perceived losses due to regulatory uncertainty, often took irrational risks—selling at troughs or buying on margin during dips—hoping to avoid further pain. This risk-seeking behavior fueled hyper-volatility, as seen in the 18% 24-hour surge in July 2024 when Ripple secured a partial summary judgment.

The August 2025 resolution—where the SEC reclassified XRP as a commodity in secondary markets—shifted the narrative. Suddenly, the “loss” of regulatory uncertainty became a “gain,” triggering risk-averse behavior. Institutional investors, now confident in XRP's legal standing, began treating it as a utility asset rather than a speculative gamble. By Q1 2025, XRP's 30-day volatility had stabilized at 3.95%, a 60% drop from 2023 levels. This transition from risk-seeking to risk-averse behavior mirrors the reflection effect's core tenet: once a perceived loss is mitigated, investors prioritize preservation over speculation.

Strategic Buying Opportunities: When Fear Becomes Folly

The reflection effect's implications for XRP are profound. During periods of regulatory ambiguity, fear-driven selling often creates mispricings. For instance, in August 2025, a 470 million XRP whale dump pushed the price toward the $2.96 support level. While this triggered panic, the move presented a buying opportunity for those who recognized the underlying strength of Ripple's ecosystem. The token's $3.09 support level held firm, and on-chain data revealed whale accumulation near $3.20–$3.30, signaling confidence in its fundamentals.

Investors who understood the reflection effect could have capitalized on these dips. By Q3 2025, XRP's market cap surged to $180 billion, driven by institutional adoption and macroeconomic tailwinds. The token's 0.0004% transaction fee and ISO 20022 compliance made it a preferred tool for cross-border payments, with Ripple's ODL service processing $1.3 trillion in Q2 2025 alone. These fundamentals, often overlooked during panic-driven selloffs, became the bedrock of XRP's post-2025 recovery.

The Road Ahead: ETFs, Macroeconomics, and Behavioral Biases

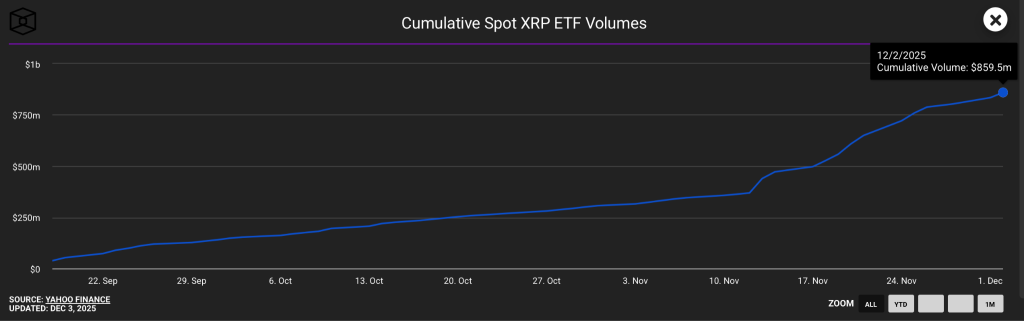

The reflection effect also explains why XRP's price remains sensitive to macroeconomic cues. For example, the Federal Reserve's September 2025 rate decision—a 25-basis-point cut paired with hawkish commentary—triggered a 10% single-day drop. Investors, perceiving the Fed's caution as a potential loss to liquidity, sold off XRP despite its growing utility. Yet, this volatility creates asymmetric opportunities. If the ProShares Ultra XRP ETF (UXRP) is approved by October 2025, it could unlock $5–$8 billion in institutional capital, pushing XRP toward $3.65–$5.80.

Conclusion: Navigating the Behavioral Labyrinth

XRP's journey from regulatory uncertainty to institutional adoption underscores the power of behavioral economics in crypto markets. The reflection effect reveals how fear and greed distort price action, creating cycles of overreaction and undervaluation. For investors, the key lies in distinguishing between emotional noise and structural fundamentals. As XRP stabilizes post-2025, strategic buyers should focus on:

1. Key support levels ($2.96–$3.09) during regulatory or macroeconomic shocks.

2. Institutional inflows, such as the $1.1 billion in XRP purchases in 2025.

3. ETF approvals, which could catalyze a shift from speculative to fundamentals-driven demand.

In a market where sentiment often trumps substance, understanding the reflection effect is not just an academic exercise—it's a survival tool. For XRP, the next chapter may hinge on whether investors can outthink their biases and recognize opportunity in chaos.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP ETF Flows Hit Record High—What It Means for XRP Price

Ethereum Hits New All-Time High for TPS Ahead of Fusaka Upgrade

Pi Network News: Expert Says ‘Sleeping Giant’ Fails to Wake As Stalled Protocol 23 Raises Doubts