Navigating the $4.5B September Token Unlock Wave: Opportunities and Risks in a Matured Crypto Market

- Over $4.5B in crypto tokens across 93 projects unlock in September 2025, led by SUI ($153M) and FTN ($90M), testing market resilience. - Cliff unlocks (e.g., SUI) risk acute price drops due to sudden supply shocks, while linear unlocks (e.g., FTN) distribute pressure over time. - Matured markets show improved strategies: 90% linear vesting in 2025 vs. 30% in 2020, with institutions using hedging to mitigate volatility. - Opportunities arise for tokens with strong fundamentals and low unlock percentages,

The cryptocurrency market is entering a pivotal period in September 2025, as over $4.5 billion in tokens across 93 projects transition from locked to tradable status. This unlock wave, dominated by Sui (SUI) with a $153 million cliff-style release and Fasttoken (FTN) with a $90 million unlock, represents a critical test of market resilience and investor strategy [1]. While historical data shows that large unlocks often trigger short-term volatility—Arbitrum’s 3.2% supply release in 2024 caused a 29% price drop [3]—the broader market’s maturation suggests new opportunities for strategic positioning.

The Dual Nature of Unlock Risk: Cliff vs. Linear Vesting

The September unlocks are split between cliff and linear vesting schedules, each with distinct implications. Cliff unlocks, like SUI’s 44 million token release on September 1, pose acute risks due to their sudden supply shock. Historical analysis reveals that such events often lead to immediate price declines, as seen with Aptos’ 2.59% supply unlock in June 2024, which triggered a 10% drop within a week [2]. In contrast, linear unlocks, such as FTN’s staggered 2.08% release on September 18, distribute pressure over time, reducing the likelihood of abrupt price dislocations [4].

Projects with hybrid vesting models—combining cliffs with gradual releases—offer a middle ground. For example, SUI’s cliff is followed by multi-year linear vesting, which could stabilize its price post-unlock if market fundamentals remain strong [4]. Investors must weigh these structures against a project’s governance model and utility. Tokens tied to ecosystem growth (e.g., liquidity provision) often outperform those with speculative allocations [2].

Market Maturity: Beyond “Unlock Anxiety”

The crypto market’s evolution is evident in how investors now approach token unlocks. In 2020, 30% of projects used linear vesting; by 2025, this figure has risen to 90% [4]. This shift reflects a broader focus on long-term value alignment rather than short-term panic. Institutional players, for instance, employ derivatives hedging and OTC sales to manage large token allocations without destabilizing markets [5]. For example, venture capital firms often stagger distributions over months, minimizing liquidity fragmentation [5].

Retail investors can mirror this sophistication by prioritizing projects with transparent tokenomics and robust governance. SUI’s community-driven governance model, for instance, has historically mitigated post-unlock volatility [4]. Similarly, Aptos’ multi-year vesting schedule for core contributors ensures sustained stakeholder alignment [6].

Strategic Positioning: Opportunities in the Unlock Wave

While risks abound, the September unlocks also present opportunities for savvy investors. Tokens with strong fundamentals and low unlock percentages (e.g., FTN’s 2.08% release) may see positive price action if market absorption is efficient. Historical data shows that ecosystem-focused unlocks—such as Celestia’s TIA token, which allocated 80% of its supply to validators—can even drive price appreciation [3].

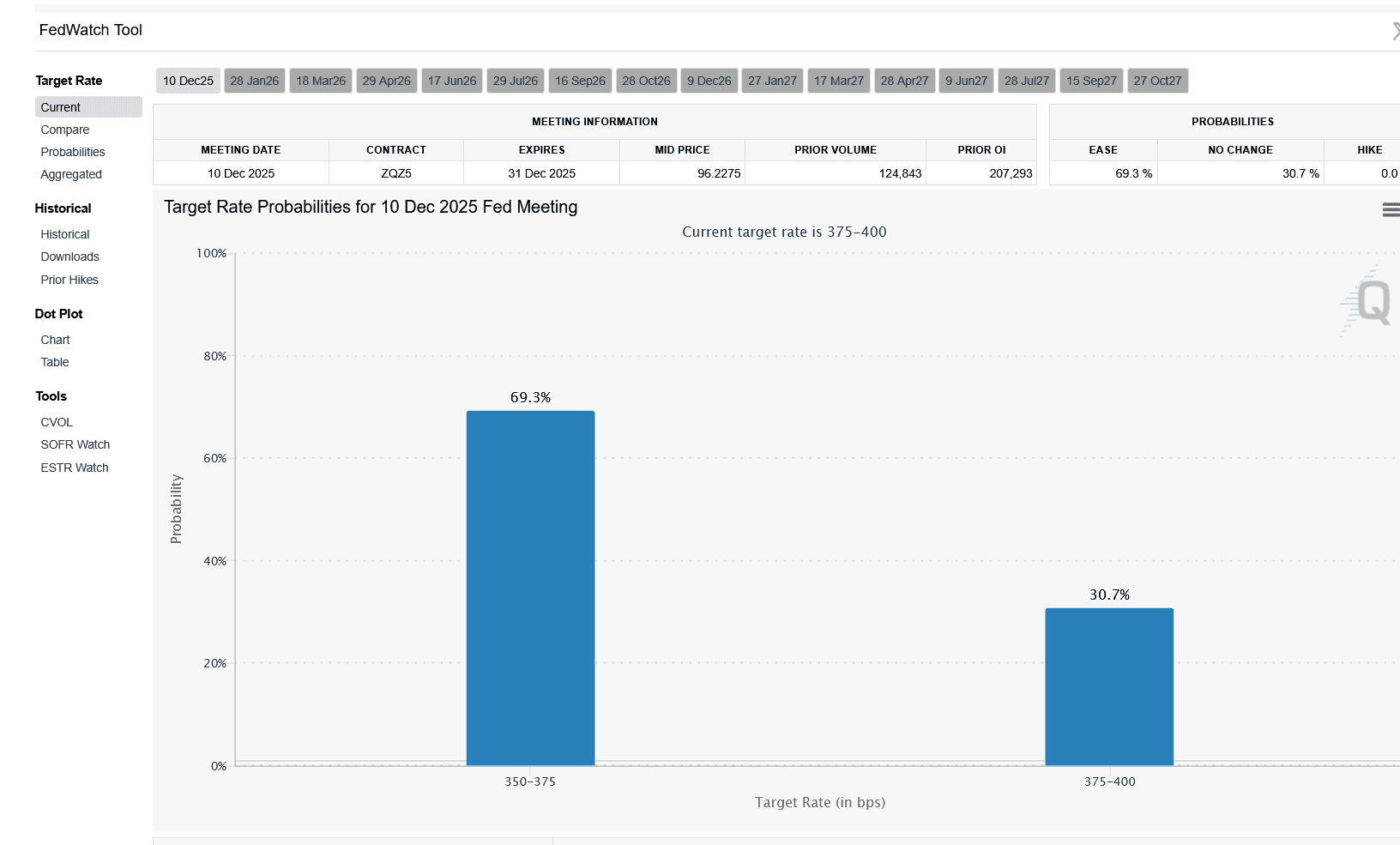

Moreover, macroeconomic factors like the Federal Reserve’s mid-September FOMC decision add layers of complexity. A dovish outcome could bolster risk-on sentiment, offsetting some unlock-driven volatility [2]. Investors should also monitor liquidity metrics: tokens with high trading volumes (e.g., SUI’s $12.24 billion market cap) are better equipped to absorb large unlocks than smaller-cap assets [4].

Conclusion: Balancing Caution and Confidence

The September 2025 unlock wave is a double-edged sword. While SUI’s cliff unlock and TRUMP’s 6.83% supply shock pose clear risks [1], the market’s maturation offers tools to mitigate these challenges. Investors who combine technical analysis of vesting schedules with macroeconomic insights—such as hedging strategies and selective buying—can navigate this period profitably. As the industry moves toward structured tokenomics, the ability to differentiate between speculative noise and sustainable value will define long-term success.

Source:

[1] Crypto market to unlock $4.5B in tokens in September

[2] Token Unlock Events and Strategic Entry Points in ...

[3] How Have Token Unlocks Impacted Crypto Prices?

[4] Strategic Opportunities in Post-Unlock Token Markets

[5] Token Unlock Strategies Used by Top Crypto VCs

[6] Aptos Tokenomics and Unlock Schedule

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Fed Uncertainty Slams Dogecoin Price

Bitcoin Price Below 100K: Is This the Start of a Deeper Crash?

Ripple’s $1.25B Deal Brings XRP Trading to Big Investors

Introducing FlipAI Agents: Data Science in Your Pocket