KYT Practices in the Cryptocurrency Field

According to Bitrace data, during the period from January 2021 to September 2023, more than 41.52 billions in risky funds have flowed through the Tron network...

According to Bitrace data, during the period from January 2021 to September 2023, more than 41.52 billions of high-risk USDT flowed into certain centralized exchange addresses on the Tron network, and 33.46 billions of high-risk USDT flowed into crypto payment platform addresses. It is evident that USDT is being widely used for online gambling, money laundering, and other illicit activities, and such risky funds entering the market can easily contaminate innocent addresses. Against this backdrop, conducting a fund audit on the recipient address of the counterparty before transferring funds is extremely necessary. This article will explore KYT (Know Your Transaction) practices in the cryptocurrency field and provide practical solutions.

Challenges Faced by KYT

Address Anonymity

The anonymity of cryptocurrency transactions provides users with a higher degree of privacy protection and financial freedom. This technical feature hides the direct link between users’ real identities and their transaction activities. However, like two sides of a coin, this anonymity also brings problems, especially when cryptocurrencies are used for illegal activities, posing challenges for regulation and law enforcement. In addition, the anonymous nature makes it difficult to trace crypto fund transfers; even if an address is identified, it is still challenging to find the entity behind it.

Complex Judgement

Not all addresses associated with risky funds are illegal addresses, and judging address risk from a single dimension is overly arbitrary. Take the Tornado Cash poisoning incident as an example: some anonymous addresses sent 0.1 ETH from sanctioned Tornado Cash wallets to the wallets of well-known crypto individuals, causing the latter to be passively triggered by risk control rules and unable to access certain DeFi protocols.

In this incident, the platform adopted inappropriate KYT rules, leading to operational errors and a poor user experience. Therefore, whether an address is sanctioned or not requires identifying the original intent of mixing fund sources, conducting thorough investigation and reasonable assessment. Clearly, the poisoned addresses in the above case should not be simply regarded as risky addresses.

Different Regulatory Environments Across Countries

For the cryptocurrency industry to achieve true compliance, it is necessary to ensure that all relevant parties participate in regulation and reach consensus. Take the recent arrest in France of Telegram’s Russian founder Pavel Durov as an example: he is facing accusations of terrorism, money laundering, and drug trafficking. France believes that Pavel Durov allowed criminal activities to occur on the application and arrested him; while in countries such as Russia and Ukraine, Telegram is widely used as a communication platform due to its excellent confidentiality. According to "Russia Today," after Durov’s arrest, Russian State Duma (lower house of parliament) Vice Chairman Davankov immediately protested and called on the French government to release Durov.

It is clear that compliance and regulation are crucial in any market. Although cryptocurrencies can easily achieve cross-border circulation, actions that use cryptocurrencies for crime require sanctions from the real world. In reality, there are significant differences in regulatory environments across countries, and different regional attitudes toward cryptocurrencies often make it difficult for relevant parties to cooperate and may cause friction. The varying definitions of compliance create regulatory barriers.

Bitrace’s KYT Practices

Address Label Database

Based on machine learning and pattern recognition algorithm modeling, Bitrace has accumulated a database of over 400 million address labels, including entity labels (DeFi platforms, mining pools, digital asset exchanges, etc.) and risk behavior labels (fraud, terrorism, drugs, illegal online gambling, money laundering, gray and black industries). In addition, the address label database also sources data from partners and clients seeking assistance. Such risky addresses and related intelligence are re-verified by the technical team and included in the database after confirmation.

The rich address label database makes it possible to trace the entities behind anonymous addresses and helps screen the fund risks of counterparties. For example, in scams such as using bad checks to defraud USDT or depositing ETH in fake Binance mining pools to receive BNB, Bitrace found that the perpetrator addresses had interacted with risky addresses related to gray and black market transactions even before committing fraud. In Detrust’s newly launched risk quick-check tool, these are shown as high-risk fraud addresses. It is evident that quickly checking the counterparty’s risk address before a transaction can effectively avoid fraud.

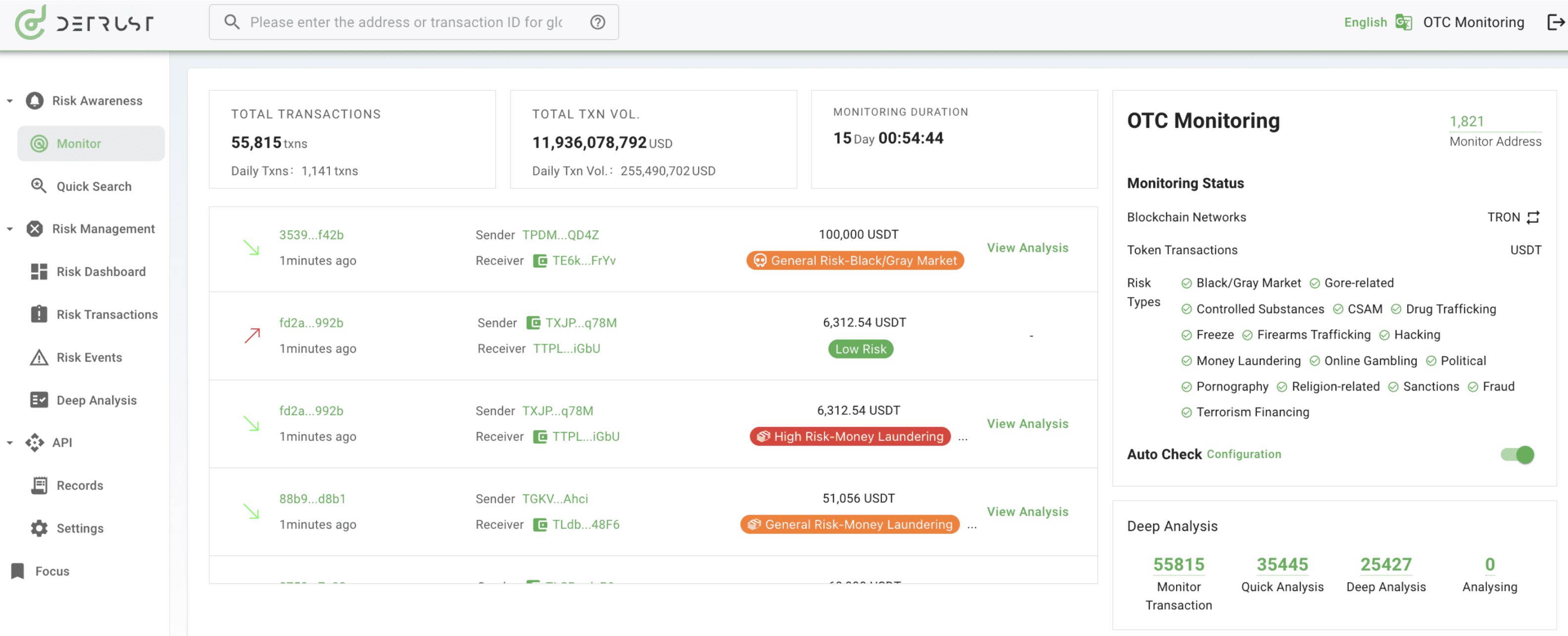

Detrust

Based on Bitrace’s leading criminal risk label database, address profiling, and criminal fund monitoring and early warning capabilities, Detrust provides relevant data for crypto enterprises. By analyzing counterparty behavior, it helps companies identify crypto transactions involved in illegal activities, and monitors anomalies by comparing current transactions with their historical behavior.

The Monitor function supports real-time automatic detection of each transaction. Through pattern analysis, behavioral deviation analysis, and cluster analysis, it provides immediate alerts and assistance when users receive risky funds, helping to reduce the risk of association with criminal funds and business compliance risks.

Custom Risk Control Strategies

The product allows users to customize risk control strategies and adopt different approaches to specific types of risk events, rather than being limited to the platform’s default rules. For example, rules can be triggered only under certain risk ratios, risk categories, risk sources, or regional policies, providing users with greater flexibility to adapt to local compliance regimes.

Conclusion

Cryptocurrencies, especially stablecoins represented by USDT, are widely used by many crypto enterprises for daily fund transfers. These companies often need a comprehensive KYT mechanism to achieve compliant risk control and protect user fund security. In the future, as global regulatory environments become increasingly stringent, KYT practices will shift from compliance requirements to industry standards, helping to build a safer, more transparent, and efficient trading environment and promoting the healthy development of the blockchain industry.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Interview with VanEck Investment Manager: From an Institutional Perspective, Should You Buy BTC Now?

The support levels near $78,000 and $70,000 present a good entry opportunity.

Macroeconomic Report: How Trump, the Federal Reserve, and Trade Sparked the Biggest Market Volatility in History

The deliberate devaluation of the US dollar, combined with extreme cross-border imbalances and excessive valuations, is brewing a volatility event.

Vitalik donated 256 ETH to two chat apps you've never heard of—what exactly is he betting on?

He made it clear: neither of these two applications is perfect, and there is still a long way to go to achieve true user experience and security.

Prediction Market Supercycle