Ethereum and Bitcoin ETF outflows on August 29, 2025, reflect institutional profit-taking: Ethereum spot ETFs saw $165M in redemptions and Bitcoin ETFs $127M as ETH traded near $4,340 and BTC above $108,000, signaling caution after sustained gains.

-

Ethereum ETFs recorded $165M in outflows on Aug 29, 2025, and total net assets of $28.58B.

-

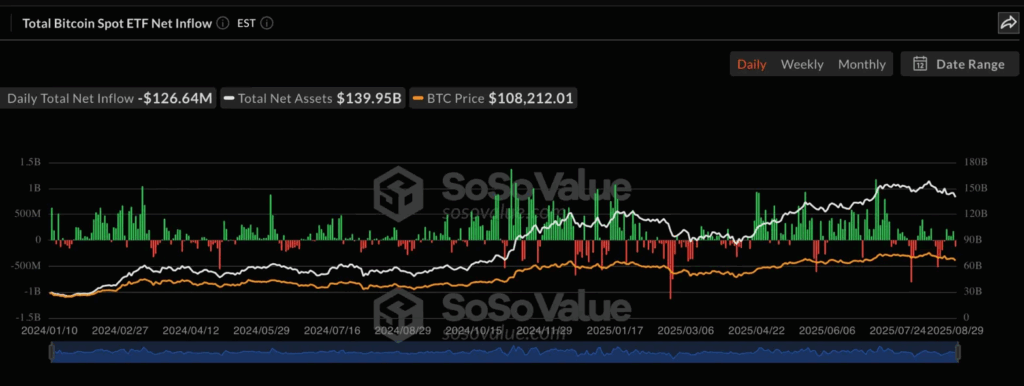

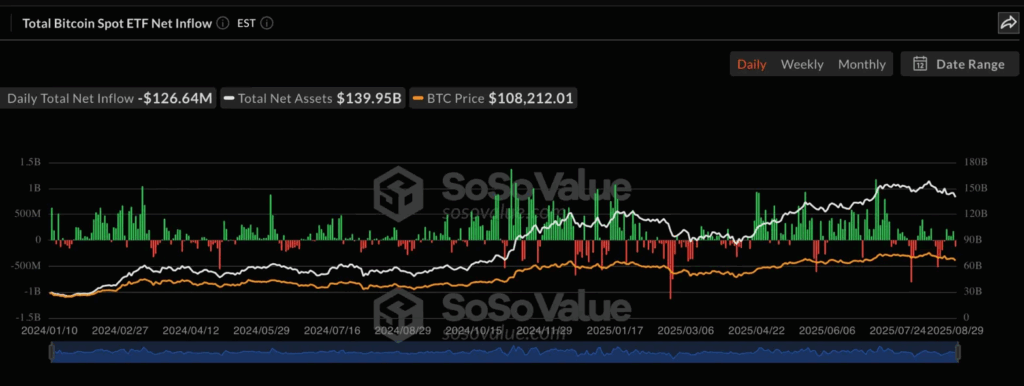

Bitcoin ETFs posted $127M in redemptions as BTC traded above $108K; both markets show institution-led profit-taking.

-

Daily ETF redemptions exceeded $1B in August for both assets, reversing mid-2025 inflow-driven rallies.

Ethereum ETF outflows and Bitcoin ETF withdrawals signal institutional profit-taking; view asset totals, daily redemptions, and market impact. Read the latest data and implications.

Ethereum and Bitcoin ETFs see heavy outflows as investors take profits with ETH near $4K and BTC above $108K amid volatility.

- Ethereum ETFs faced $165M outflows while Bitcoin ETFs lost $127M, showing big investors are cashing out after major gains.

- ETH inflows in mid-2025 fueled a price surge to $4K but August redemptions over $1B revealed sharp institutional withdrawals.

- Bitcoin ETFs rose from $42K to $108K since launch yet heavy outflows above $1B now signal strong profit-taking by institutions.

Ethereum and Bitcoin ETFs are showing new signals after recording massive outflows in late August 2025. Ethereum spot ETFs lost $165 million on August 29, with all nine products posting redemptions.

Bitcoin ETFs followed with $127 million in outflows, marking the first loss after four days of inflows. This shift highlights rising investor caution as institutional players lock in profits at critical price levels.

Ethereum ETFs reported net assets of $28.58 billion, according to Sosovalue. ETH traded at $4,340.78 during the same session. The latest figures underline the close link between institutional flows and price trends. The timeline tracked since July 2024 shows repeated shifts between inflows and redemptions.

Source: Wu Blockchain

What caused the Ethereum and Bitcoin ETF outflows?

ETF outflows were driven primarily by institutional profit-taking after rapid mid-2025 gains. Large redemptions on August 29 reflect portfolio rebalancing as ETH traded near $4,340 and BTC hovered above $108,000. Market participants cite rotation into cash and risk management ahead of macro events.

How large were the ETF outflows and what do they indicate?

Ethereum spot ETFs recorded $165 million in redemptions on August 29 across nine products, while Bitcoin ETFs saw $127 million pulled. These flows follow earlier inflows that helped ETH rise from about $2,500 to above $4,000 and BTC from roughly $42,000 to six-figure territory. The pattern indicates short-term profit taking by institutional investors and increased sensitivity to volatility.

Frequently Asked Questions

How do ETF flows affect ETH and BTC prices?

ETF flows change supply-demand dynamics: sustained inflows can push prices higher by increasing institutional demand, while large redemptions can add selling pressure and trigger short-term pullbacks. The August 2025 outflows demonstrate this linkage.

Are the outflows a sign of long-term institutional withdrawal?

Not necessarily. Historical data since ETF launches in 2024 show cycles of inflows and redemptions. Large outflows often reflect short-term profit-taking rather than wholesale exit from cryptocurrencies.

Key Takeaways

- Institutional profit-taking: Outflows of $165M (ETH) and $127M (BTC) on Aug 29 signal portfolio rebalancing.

- Flow–price link: ETF inflows earlier in 2025 helped drive ETH and BTC rallies; redemptions now coincide with short-term pullbacks.

- Monitor daily flows: Investors should track daily ETF flows and macro events to gauge possible continuation or reversal of trends.

Conclusion

Ethereum and Bitcoin ETF outflows in late August 2025 reflect institutional profit-taking amid elevated prices and volatility. With ETH near $4,340 and BTC above $108,000, daily redemptions exceeding $1 billion at times underscore the market’s sensitivity to large institutional moves. Monitor ETF flows, macro indicators, and official data sources for the next directional clues. COINOTAG will continue tracking these shifts and updating asset-flow analysis.

Source: Sosovalue