Date: Sat, Aug 30, 2025 | 05:30 AM GMT

The cryptocurrency market has once again entered choppy waters as Ethereum (ETH) slipped to $4,350 from its recent high of $4,954, marking a 7% weekly decline. The pullback has pressured major memecoins , including Solana-based Bonk (BONK).

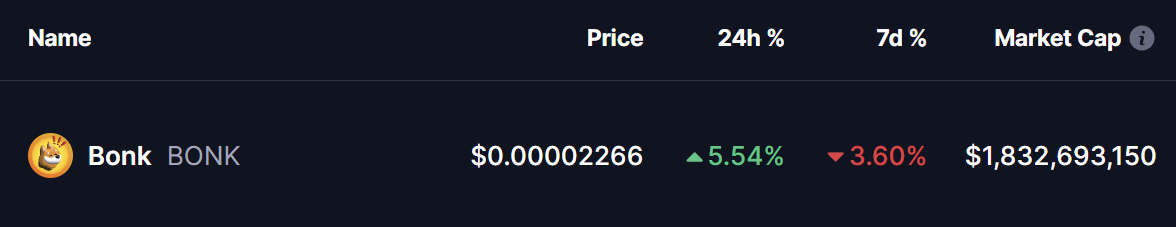

However, BONK showed relative strength today with a 5% intraday jump, trimming its weekly losses to just 3%. More importantly, the price chart is signaling a harmonic pattern setup that could pave the way for a potential bounceback.

Source: Coinmarketcap

Source: Coinmarketcap

Harmonic Pattern Taking Shape

On the daily chart, BONK appears to be forming a Bearish ABCD harmonic pattern. Despite its bearish name, this pattern often involves a strong bullish CD-leg rally before the token approaches its Potential Reversal Zone (PRZ).

The structure kicked off with a rally from Point A near $0.00001142 up to Point B, followed by a retracement to Point C around $0.00001956, where buyers stepped in near the 200-day moving average (MA). Since then, BONK has shown resilience, climbing back to around $0.00002260, suggesting the CD leg may now be in motion.

Bonk (BONK) Daily Chart/Coinsprobe (Source: Tradingview)

Bonk (BONK) Daily Chart/Coinsprobe (Source: Tradingview)

Critically, BONK is approaching its 50-day MA resistance at $0.00002717. A decisive breakout above this zone could validate the harmonic setup and trigger fresh momentum buying.

What’s Next for BONK?

If bulls manage to push BONK above the 50-day MA, the token could rally toward the 1.38 Fibonacci PRZ at $0.00004890, implying a potential upside of over 116% from current levels.

On the flip side, if BONK loses ground and closes below the 200-day MA support near $0.00001842, the harmonic structure could be invalidated, opening the door to further downside pressure.