Capturing Altcoin Alpha Before ETF Hype Peaks: Why ADA, AVAX, and MAGACOIN FINANCE Are Strategic Bets

- 2025 crypto market faces inflection point with ETF approval potential, spotlighting ADA, AVAX, and MAGACOIN FINANCE as strategic pre-ETF plays. - ADA gains regulatory momentum via 83% Grayscale ETF approval odds and $1.2B institutional custody growth, signaling mainstream legitimacy. - AVAX strengthens institutional appeal through $250M real-world asset deals and 42.7% fee cuts, targeting $33–$37 price range by year-end. - MAGACOIN FINANCE combines meme virality with 12% burn rate and dual audits, projec

The cryptocurrency market in 2025 is at a pivotal inflection point, driven by the convergence of institutional adoption and regulatory clarity. As the industry edges closer to the approval of spot ETFs—a catalyst long anticipated to unlock mainstream capital—investors must identify assets with structural advantages in positioning. Cardano (ADA), Avalanche (AVAX), and MAGACOIN FINANCE stand out as strategic bets, each leveraging distinct institutional tailwinds and technological innovation to capture alpha before the next speculative wave.

ADA: A Layer-1 Play with Regulatory Momentum

Cardano’s institutional adoption has accelerated dramatically in Q3 2025, with custodial holdings surging to $1.2 billion, a 300% year-over-year increase [1]. This growth is underpinned by an 83% probability of Grayscale’s ADA ETF approval by December 2025, according to market analysts [1]. Such regulatory validation would not only legitimize ADA as a mainstream asset but also amplify liquidity for the broader altcoin market. Technically, ADA’s price action above $1.25 has signaled a structural shift, with projections of double-digit gains in 2025 [1]. Historical backtesting from 2022 to 2025 reveals that ADA’s price breaking through resistance levels has historically led to positive returns, with a notable hit rate and average gain over 30 days . The key question is whether ADA can sustain this momentum as institutional inflows outpace retail outflows—a dynamic that will define its role in the ETF-driven bull run.

AVAX: Utility-Driven Institutional Adoption

Avalanche’s institutional appeal lies in its dual focus on real-world utility and cost efficiency. The platform’s recent $250 million real-world asset tokenization deal with SkyBridge Capital has positioned it as a preferred infrastructure for institutional-grade DeFi solutions [2]. Complementing this is the Octane upgrade, which reduced transaction fees by 42.7%, driving a 493% quarter-on-quarter surge in daily transactions [2]. AVAX’s integration with Visa for stablecoin settlements further cements its role as a scalable payments layer. Analysts project price targets of $33–$37 by year-end and $185–$222 by 2030, assuming continued institutional traction [2]. The critical risk, however, is whether AVAX can maintain its first-mover advantage in a crowded Layer-1 space.

MAGACOIN FINANCE: A High-Volatility Meme-DeFi Hybrid

MAGACOIN FINANCE represents a unique intersection of meme culture and institutional-grade security. With $1.4 billion in whale inflows and a 12% transaction burn rate, the project’s deflationary model is designed to create scarcity amid rising demand [3]. Dual audits from CertiK and HashEx have addressed early-stage security concerns, while its capped supply and growing community of 12,000 wallets suggest strong retail and institutional overlap [3]. Analysts project 35x–50x returns by Q4 2025, driven by its liquidity and cultural virality [3]. Yet, MAGACOIN’s success hinges on its ability to avoid the volatility pitfalls of traditional meme coins—a challenge that could either validate its DeFi credentials or expose its speculative nature.

Strategic Implications for ETF Positioning

This window offers a rare opportunity to acquire undervalued assets before liquidity surges. ADA’s regulatory tailwinds, AVAX’s utility-driven adoption, and MAGACOIN’s meme-DeFi hybrid model each present distinct risk-reward profiles. Investors should prioritize assets with:

1. Regulatory alignment (e.g., ADA’s ETF probability),

2. Scalable utility (e.g., AVAX’s tokenization deals), and

3. Structural scarcity (e.g., MAGACOIN’s burn rate).

However, the path to ETF approval remains uncertain, and market sentiment can shift rapidly. Diversification across these three projects—while hedging against sector-specific risks—could optimize exposure to the 2025 bull cycle.

Source:[1] Cardano (ADA) Momentum Highlights Market Rotation as MAGACOIN FINANCE Records Consecutive Sellouts [2] MAGACOIN FINANCE Named the Best Crypto Project to Watch After Avalanche Slips [3] MAGACOIN FINANCE Ranked Alongside Solana and Avalanche for 2025 Growth Forecast

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Privacy’s HTTPS Moment: From Defensive Tool to Default Infrastructure

Summarizing the "holistic reconstruction of the privacy paradigm" from dozens of speeches and discussions at the Devconnect ARG 2025 "Ethereum Privacy Stack" event.

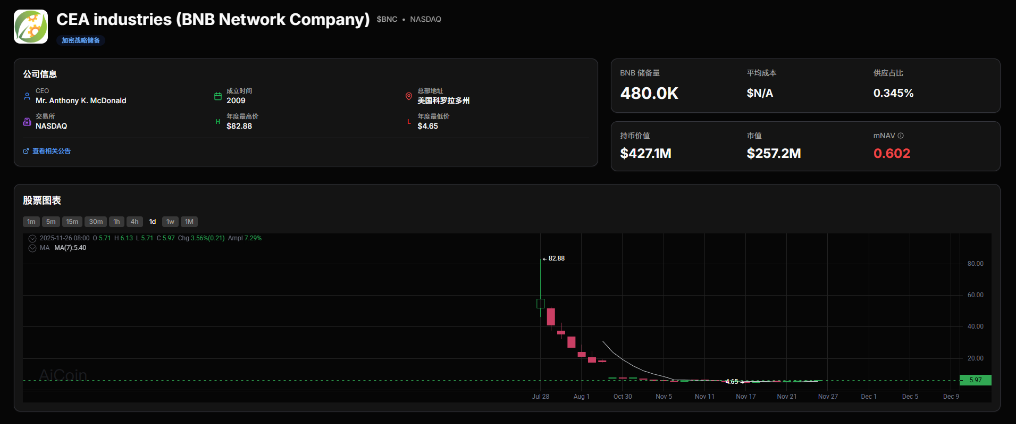

Shareholder Revolt: YZi Labs Forces BNC Boardroom Showdown

Halving Is No Longer the Main Theme: ETF Is Rewriting the Bitcoin Bull Market Cycle

The Crypto Market Amid Liquidity Drought: The Dual Test of ETFs and Leverage