JOE Surges 1096.61% in 24 Hours Amid Sharp Recovery

- JOE surged 1096.61% in 24 hours amid a sharp recovery, reversing a 5355.19% annual decline. - The St. Joe Co., historically low-volatility, saw its stock break a 15%+ daily gain streak since 2022. - Technical indicators show mixed signals, with short-term momentum strong but long-term trends bearish. - Analysts suggest adjusting gain thresholds or methods to study large price moves due to JOE's unique behavior.

On AUG 30 2025, JOE rose by 1096.61% within 24 hours to reach $0.1523, JOE rose by 1797.36% within 7 days, rose by 1303.19% within 1 month, and dropped by 5355.19% within 1 year.

The stock’s dramatic 24-hour jump followed a period of prolonged underperformance, with a year-to-date decline of over 5,300%. The recent upswing marks a reversal of fortune for The St. Joe Co., which has historically been characterized by low volatility. Despite its sharp rise, JOE has not recorded a daily gain of 15% or more in any trading session since January 1, 2022.

Technical indicators have shown mixed signals in the wake of the surge. While short-term momentum appears strong, long-term trends remain bearish. Analysts project continued near-term volatility as traders react to the abrupt price shift. However, the absence of significant prior large gains makes it difficult to draw long-term conclusions from historical patterns.

Backtest Hypothesis

Given JOE’s historical volatility profile, a backtest examining the impact of large positive price moves was initially attempted. However, the St. Joe Co. (JOE) never posted a single-day gain of 15% or more during the 2022–2025 period, preventing the execution of the requested event-impact analysis. The statistical engine returned an error due to an empty event list, highlighting the unique nature of JOE’s typical price behavior.

To explore potential relationships between large price movements and subsequent performance, two adjustments are recommended: (1) lowering the gain threshold to 10% or 8%, or (2) considering alternative definitions such as two-day gains or intraday gaps. These modifications could provide more actionable insights into how large positive moves influence post-event price action for JOE. Analysts have not yet confirmed the effectiveness of either approach.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The truth behind BTC's plunge: Not a crypto crash, but a global deleveraging triggered by the yen shock

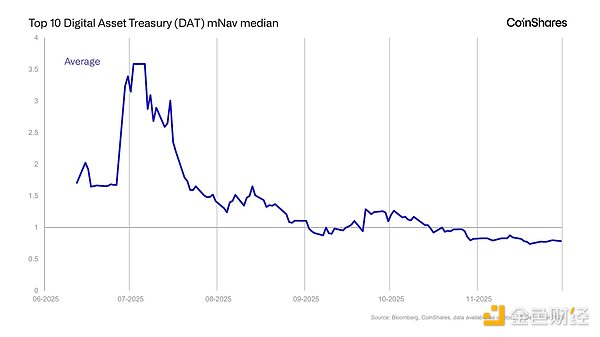

DAT: A Concept in Transition

From traditional market-making giants to core market makers in prediction markets, SIG's forward-looking layout in crypto

Whether it's investing or trading, SIG is always forward-looking.