Ethereum's Volatility Amid FOMC Uncertainty: A Strategic Buying Opportunity?

- Ethereum's 2025 price swings mirrored Fed policy shifts, with hawkish FOMC minutes triggering sell-offs and Powell's dovish Jackson Hole comments spurring a 12% rebound to $4,885. - On-chain resilience emerged as ETH transaction volumes rose 43.83% YoY, driven by Layer 2 solutions and plummeting gas fees post-Dencun/Pectra upgrades. - Institutional adoption accelerated as Ethereum ETFs attracted $27.6B in inflows, outpacing Bitcoin, while 35.5M ETH (29.4% supply) was staked post-Pectra upgrade. - Whale a

Ethereum’s price volatility in 2025 has been inextricably tied to Federal Reserve policy signals, creating a tug-of-war between macroeconomic uncertainty and on-chain resilience. The August FOMC meeting minutes, which emphasized inflation risks and the potential impact of Trump-era tariffs, initially triggered a sell-off, sending ETH into bearish territory [1]. However, the subsequent dovish pivot by Fed Chair Jerome Powell at Jackson Hole—hinting at rate cuts “depending on economic conditions”—sparked a 12% rebound, pushing Ethereum to a new all-time high of $4,885 [5]. This seesaw reflects the crypto market’s sensitivity to central bank messaging, but a deeper look at Ethereum’s fundamentals reveals a story of structural strength.

Macro-Driven Sentiment: The FOMC’s Dual Narrative

The Federal Reserve’s July 2025 meeting minutes exposed internal divisions, with a majority of officials prioritizing inflation risks over employment concerns [1]. This hawkish stance initially pressured Ethereum, as investors braced for higher-for-longer rates and reduced liquidity for speculative assets [4]. Yet Powell’s Jackson Hole speech recalibrated expectations, with his conditional support for rate cuts driving a risk-on rally. By late August, the probability of a September rate cut had climbed to 87%, creating a tailwind for Ethereum as a high-yield, high-volatility asset [3].

The Fed’s balancing act—between inflation persistence and economic slowdown risks—has created a volatile backdrop. However, Ethereum’s price action suggests that market participants are increasingly viewing rate cuts as a near-certainty, with ETF inflows and staking demand acting as amplifiers of bullish sentiment. For instance, Ethereum spot ETFs (ETHA/FETH) attracted $27.6 billion in inflows by August 2025, outpacing Bitcoin’s $548 million [2]. This institutional shift underscores Ethereum’s role as a proxy for macroeconomic optimism.

On-Chain Resilience: A Foundation for Long-Term Growth

While FOMC-driven volatility dominates headlines, Ethereum’s on-chain metrics tell a story of resilience. Daily transaction volumes surged 43.83% year-over-year, averaging 1.74 million transactions per day, driven by Layer 2 solutions like Arbitrum and zkSync, which now handle 60% of the network’s volume [1]. Gas fees, once a barrier to adoption, have plummeted from $18 in 2022 to $3.78, thanks to the Dencun and Pectra upgrades [4]. These improvements have transformed Ethereum into a utility-driven infrastructure layer, attracting both retail and institutional capital.

Validator behavior further reinforces this narrative. The Pectra Upgrade in May 2025 optimized staking efficiency, with 35.5 million ETH (29.4% of the supply) staked, generating annualized yields of 3–14% [1]. This has created a flywheel effect: rising staking demand drives yield generation, which in turn attracts more capital. Notably, 1.2 million ETH (~$6 billion) was moved out of exchanges and into staking protocols during August’s 12% price correction, signaling long-term strategic positioning [2].

Whale activity also highlights Ethereum’s institutional appeal. In Q2 2025, 14.3 million ETH was accumulated, with corporate treasuries like BitMine Immersion Technologies staking 1.5 million ETH ($6.6 billion) as a yield-generating reserve asset [1]. Meanwhile, 97% of ETH holders remained in profit, and sustained exchange outflows—reaching 1.875 million daily transactions—indicated strong usage fundamentals [2].

Strategic Buying Opportunity? Weighing the Risks and Rewards

Ethereum’s volatility amid FOMC uncertainty presents a paradox: while macroeconomic headwinds could delay rate cuts, the network’s on-chain resilience suggests a strong foundation for long-term growth. Critics point to bearish indicators like a 15% MVRV ratio and 15% leveraged volume, historically correlating with 10–25% price corrections [2]. However, these metrics must be contextualized against Ethereum’s structural advantages.

For instance, the SEC’s 2025 reclassification of Ethereum as a utility token unlocked $43.7 billion in staked assets via protocols like Lido and EigenLayer [1]. This regulatory clarity has accelerated institutional adoption, with Ethereum ETFs now holding 4.1 million ETH in assets under management [1]. Additionally, the network’s dominance in DeFi (62% of TVL) and smart contract innovation positions it as a critical infrastructure layer for both digital and traditional capital markets [4].

Conclusion: Navigating the Volatility

Ethereum’s price swings in 2025 reflect the broader tension between macroeconomic uncertainty and on-chain strength. While FOMC policy signals will continue to drive short-term volatility, the network’s fundamentals—driven by institutional adoption, technological upgrades, and yield generation—suggest a compelling long-term case. For investors, the key lies in balancing macro-driven caution with a recognition of Ethereum’s evolving role as a utility asset.

Source:

[1] Coindesk, Hawkish FOMC Minutes Knocks Legs Out of Crypto Bounce

[2] AInvest, Ethereum's Onchain Activity as a Leading Indicator of Institutional Adoption

[3] CNBC, Ether Notches First New Record Since 2021 After Powell

[4] AInvest, Ethereum's Institutional Edge: Defying the Crypto Selloff in Q3 2025

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Galaxy Research Report: What Is Driving the Surge in Zcash, the Doomsday Vehicle?

Regardless of whether ZEC's strong price momentum can be sustained, this market rotation has already succeeded in forcing the market to reassess the value of privacy.

Soros predicts an AI bubble: We live in a self-fulfilling market

When the market starts to "speak": an earnings report experiment and a trillion-dollar AI prophecy.

Soros predicts an AI bubble: We live in a self-fulfilling market

The article uses Brian Armstrong's behavior during the Coinbase earnings call to vividly illustrate George Soros' "reflexivity theory," which posits that market prices can influence the actual value of assets. The article further explores how financial markets actively shape reality, using examples such as the corporate conglomerate boom, the 2008 financial crisis, and the current artificial intelligence bubble to explain the workings of feedback loops and their potential risks. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively improved.

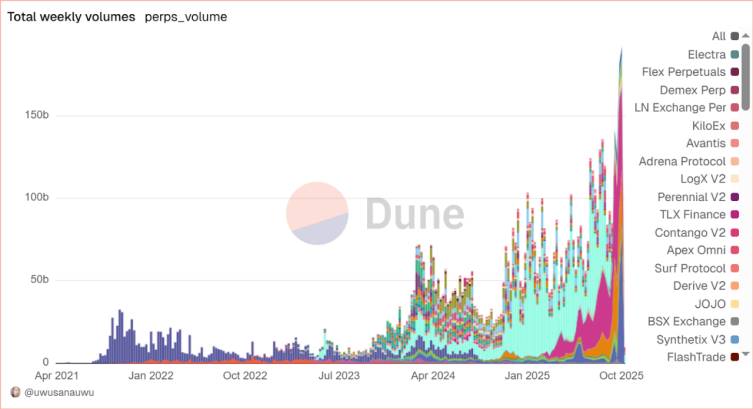

In-depth Research Report on Perp DEX: Comprehensive Upgrade from Technological Breakthroughs to Ecosystem Competition

The Perp DEX sector has successfully passed the technology validation period and entered a new phase of ecosystem and model competition.