ILV Surges 28.57% in 24 Hours Amid Volatile Market Conditions

- ILV surged 28.57% in 24 hours to $14.89 on Aug 29, 2025, reversing a 714.29% 7-day drop. - Traders analyze the rebound amid extreme volatility, with analysts warning of persistent swings due to historical patterns. - Technical indicators show accelerated short-term momentum but bearish long-term trends, with key resistance levels unheld. - A backtesting strategy targeting 15%+ daily gains could have triggered positions, though sustainability remains uncertain.

On AUG 29 2025, ILV rose by 28.57% within 24 hours to reach $14.89, following a dramatic 714.29% drop over the past seven days. Over the last month, the asset rebounded with a 783.41% increase, but it has faced a severe decline of 6286.7% over the past year. These figures highlight the extreme volatility inherent in the asset’s price movement.

The recent 24-hour surge has drawn attention from traders and analysts, who are examining the underlying factors. While no specific news event has been directly linked to the movement, the sharp rebound suggests increased market interest or speculative activity. Analysts project that the volatility may persist, driven by the asset’s historical pattern and current sentiment.

text2img

Technical indicators point to continued uncertainty. Short-term momentum appears to have accelerated, as evidenced by the recent one-day surge, but longer-term trends remain deeply bearish. The 50-day moving average has not crossed above the 200-day line, indicating that the broader trend remains downward. The asset’s price has also failed to hold key resistance levels established in recent months.

text2visual

The price has bounced off a historically significant support level, raising questions about the strength of the rebound. If the current rally is confirmed as a short-term reversal rather than a sustained trend, traders may look for confirmation through additional follow-through buying. However, given the asset’s history, further corrections cannot be ruled out.

Backtest Hypothesis

Given the volatile nature of the asset and the sharp one-day rebound, a backtesting approach could offer insight into the effectiveness of a strategy that targets large daily price swings. A potential model would involve opening positions whenever the daily close rises by 15% or more relative to the prior day’s close. The exit would occur after a fixed holding period—such as five trading days—to capture the momentum. Alternatively, exit rules such as stop-loss or take-profit thresholds could be integrated to manage risk and optimize returns. If the price surge on AUG 29 meets the entry criteria, this strategy could have triggered a position. The performance of such a strategy would depend on the frequency and sustainability of large price jumps, as well as the behavior of the asset following the initial momentum.

backtest_stock_component

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Tesla engaged in deceptive marketing for Autopilot and Full Self-Driving, judge rules

IBIT-Linked Structured Notes: Wall Street’s $530M Bet on Bitcoin Integration

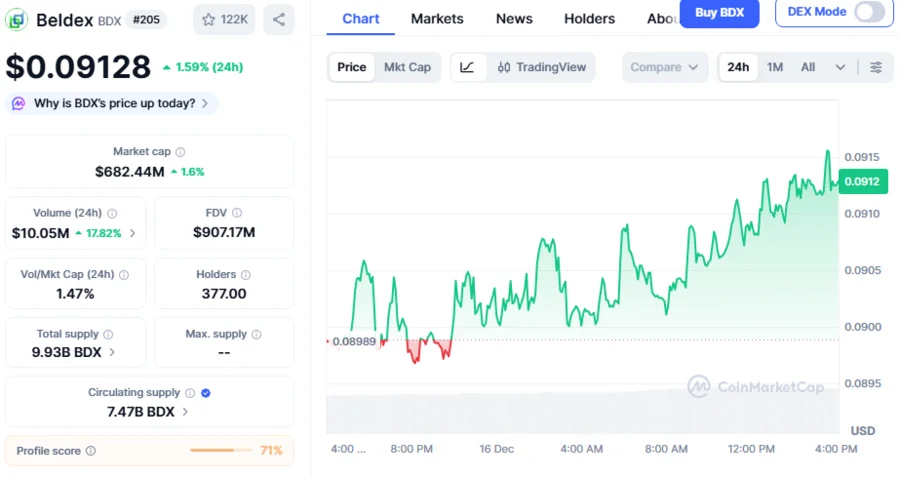

Beldex Price: BDX Token Gains Momentum with Stargate Integration via LayerZero’s OFT Standard

Altcoin Season Index Plummets: A Stark 4-Point Drop to 18 Signals Bitcoin’s Grip