Headline:

- U.S. core PCE inflation rose to 2.9% in July, aligning with forecasts and marking the Fed's first major data test since Powell hinted at rate cuts. - Markets now price an 87% chance of a 25-basis-point cut at the September meeting, with 86% odds of at least a 50-basis-point cut by year-end. - A $103.6B trade deficit and crypto market declines highlight inflation's broader impact, while Trump's proposed tariffs could complicate the Fed's easing strategy.

The U.S. core Personal Consumption Expenditures (PCE) inflation, the Federal Reserve's preferred gauge of inflation, edged up to 2.9% in July from 2.8% in June, matching economists' forecasts. The monthly increase in core PCE prices also came in at 0.3%, in line with expectations, reflecting continued inflationary pressures despite earlier optimism about cooling prices [1]. This marks the first major data test for the Fed since Chair Jerome Powell hinted at the resumption of rate cuts during his remarks at the Jackson Hole symposium. The PCE report, released in conjunction with the personal income and outlays data, showed that personal income rose 0.4% in July, and personal consumption expenditures increased 0.5%, both aligning with projections [1].

The release of the core PCE data has had immediate implications for the market’s expectations regarding the Federal Reserve’s monetary policy trajectory. Following the report, traders priced in an 87% probability of a 25-basis-point rate cut at the September 17 meeting, up from 83% before the data was released. Furthermore, the odds of at least a 50-basis-point cut over the remaining three meetings of the year now stand at 86%, up from 84% previously [1]. These updated expectations reflect a market that is still betting on a gradual easing of monetary policy, despite the persistent inflation reading.

The core PCE data were largely anticipated based on earlier indicators, particularly the July Consumer Price Index (CPI) and Producer Price Index (PPI), which had already signaled the direction of the final PCE figures [1]. The relatively low suspense around the release suggests that the data did not disrupt existing market expectations. However, the upcoming August jobs report and the next round of inflation data in early September will serve as more critical benchmarks ahead of the September policy meeting, where the Fed is widely expected to initiate its rate-cut cycle.

The impact of inflationary pressures is also being felt in other sectors of the economy. The U.S. goods trade deficit surged to $103.6 billion in July, exceeding the estimated $87.7 billion, driven by a 7.1% increase in imports [1]. Meanwhile, the cryptocurrency market has been particularly sensitive to inflation developments, with the CoinDesk 20 Index declining 3.6% in 24 hours amid risk-averse sentiment ahead of the PCE release. Analysts suggest that a hotter-than-expected inflation reading could lead the Fed to adopt a "one-and-done" stance, limiting further cuts to a single 25-basis-point reduction this year [3].

Despite the challenges posed by inflation, consumer spending remains resilient, with a revised 0.4% growth in personal consumption for June, up from 0.3% initially reported [1]. This indicates that households continue to absorb cost-of-living pressures, at least for now. However, economists warn that the full impact of President Trump’s proposed tariff increases on consumer prices is yet to be felt, which could complicate the Fed’s rate-cut strategy further.

Source: [1] PCE Inflation Data Passes First Test Of Fed Rate-Cut Shift [2] (not included) [3] Crypto Markets Today: SOL Futures Are More Popular Than Ever

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

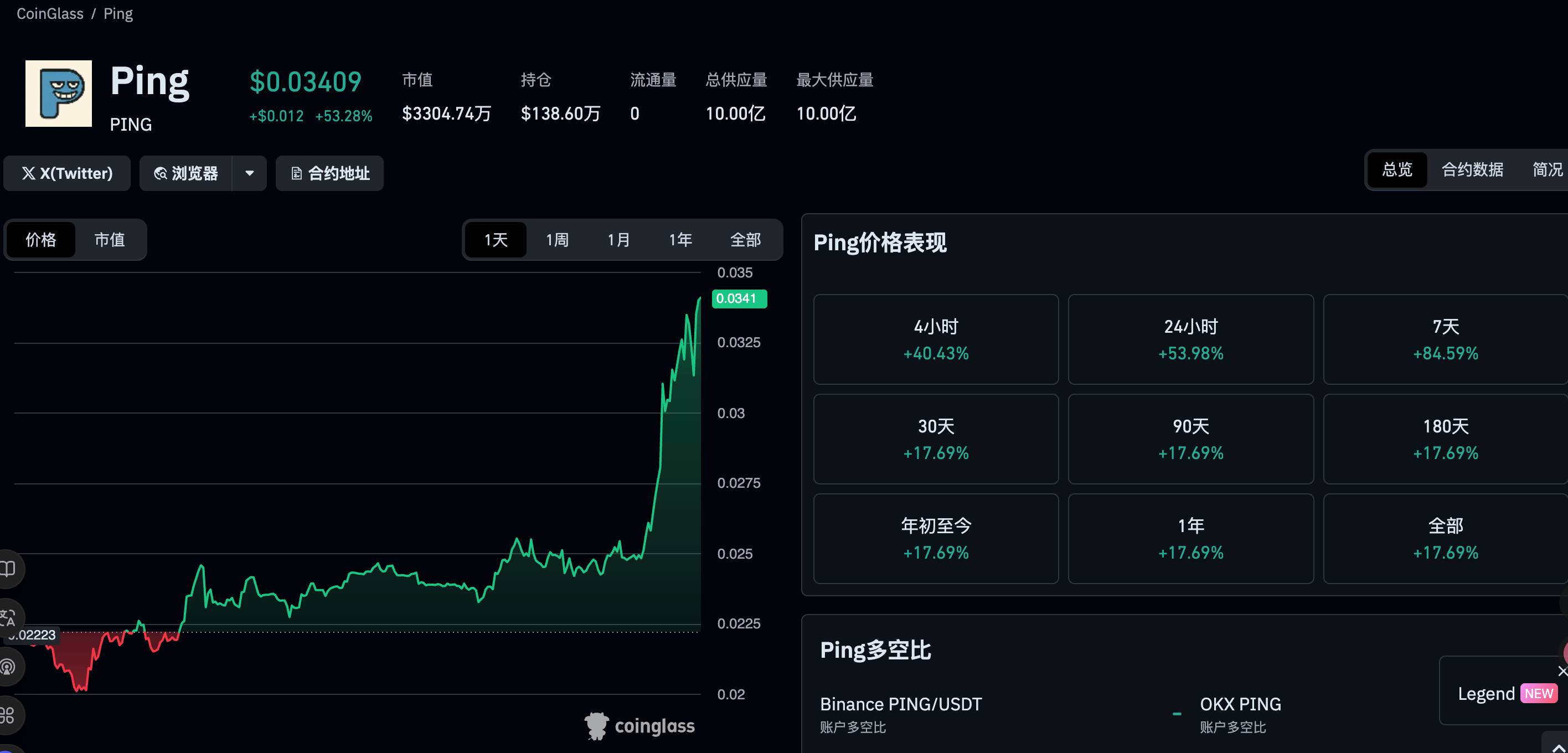

$PING rebounds 50%, a quick look at the $PING-based launchpad project c402.market

c402.market's mechanism design is more inclined to incentivize token creators, rather than just benefiting minters and traders.

Crypto Capitalism, Crypto in the AI Era

A one-person media company, ushering in the era of everyone as a Founder.

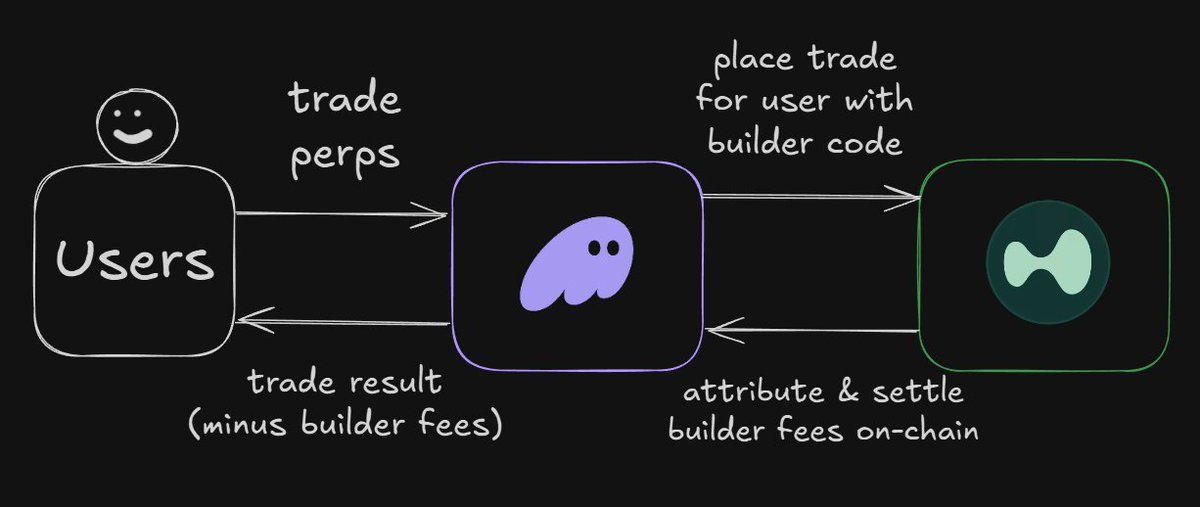

Interpretation of the ERC-8021 Proposal: Will Ethereum Replicate Hyperliquid’s Developer Wealth Creation Myth?

The platform serves as a foundation, enabling thousands of applications to be built and profit.

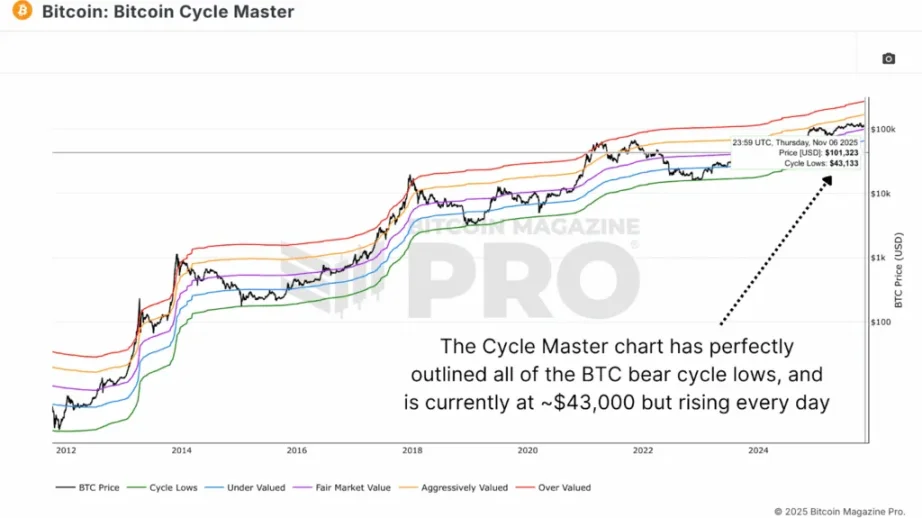

Data shows that the bear market bottom will form in the $55,000–$70,000 range.

If the price falls back to the $55,000-$70,000 range, it would be a normal cyclical movement rather than a signal of systemic collapse.