MBOX +83.47% in 24 Hours Amid Major Market Shifts

- MBOX surged 83.47% in 24 hours on Aug 28, 2025, but remains down 6832.72% annually amid volatile short-term swings. - A technical development triggered sudden buying activity, though weekly declines contrast with the month's 1504.76% rise. - Divergent moving averages and overbought RSI signal heightened volatility, with traders monitoring key support levels for trend confirmation. - A backtesting strategy using MA crossovers and RSI thresholds aims to capture momentum while mitigating overbought correcti

On AUG 28 2025, MBOX surged by 83.47% within 24 hours to trade at $0.06. Despite the recent daily gain, the token has seen a 427.89% decline over seven days, a 1504.76% increase over one month, and a staggering 6832.72% drop over one year. This sharp intraday rally reflects a sudden influx of investor activity following a technical development.

MBOX’s short-term performance has been volatile, with the price swinging between large gains and losses over the past week and month. Analysts project continued uncertainty in the near term as market participants react to evolving conditions. The sudden rise on AUG 28 may be attributed to an unspecified development that triggered a buying spree among traders. However, the broader trend over the past month remains bullish despite the weekly decline.

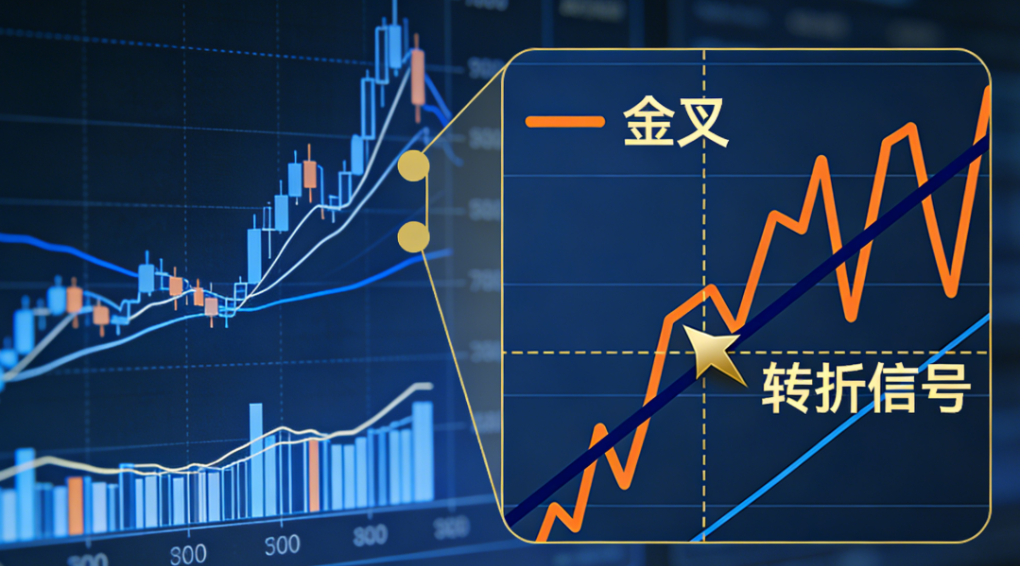

Technical indicators suggest that the MBOX price movement is being driven by both momentum and reversal signals. The 50-day and 200-day moving averages have diverged significantly, reflecting the recent sharp gains. Short-term oscillators like the RSI have shown signs of overbought conditions, while Bollinger Bands have expanded, indicating heightened volatility. Traders are closely monitoring whether the price can consolidate above key moving averages to confirm the sustainability of the upward trend.

The current technical landscape points to a potential continuation pattern if the market can hold key support levels established in the recent correction. However, given the magnitude of the prior declines, caution remains warranted. The interplay between moving averages and volume patterns may provide further insights into the direction of the next major price movement.

Backtest Hypothesis

A proposed backtesting strategy seeks to model the behavior of MBOX using a combination of moving averages and RSI to determine potential entry and exit points. The approach involves entering long positions when the 50-day moving average crosses above the 200-day line and the RSI remains above 50. Exit signals are generated when the RSI drops below 30 or the 50-day line crosses back below the 200-day line. This strategy aims to capture sustained upward momentum while avoiding overbought conditions that may lead to short-term corrections.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Price Prediction 2026, 2027 – 2030: How High Will BTC Price Go?

XRP News Today: Ripple Moves 65M XRP as Market Remains Under Pressure

A rare "golden cross" appears, signaling a technical turning point for the US dollar