Canary Capital Files for Trump Coin ETF, Triggering SEC Scrutiny and Volatility Concerns

Contents

Toggle- Quick breakdown:

- Eric Balchunas doubts ETF going through

Quick breakdown:

- Canary Capital has filed to launch a Trump Coin exchange-traded fund (ETF) in the US, aiming to provide direct exposure to the political memecoin linked to President Donald Trump.

- The filing represents a bold move into politically themed crypto assets but faces challenges from SEC regulations requiring futures products be traded for at least six months.

- The ETF could set a regulatory precedent, though analysts warn of high volatility and regulatory risks.

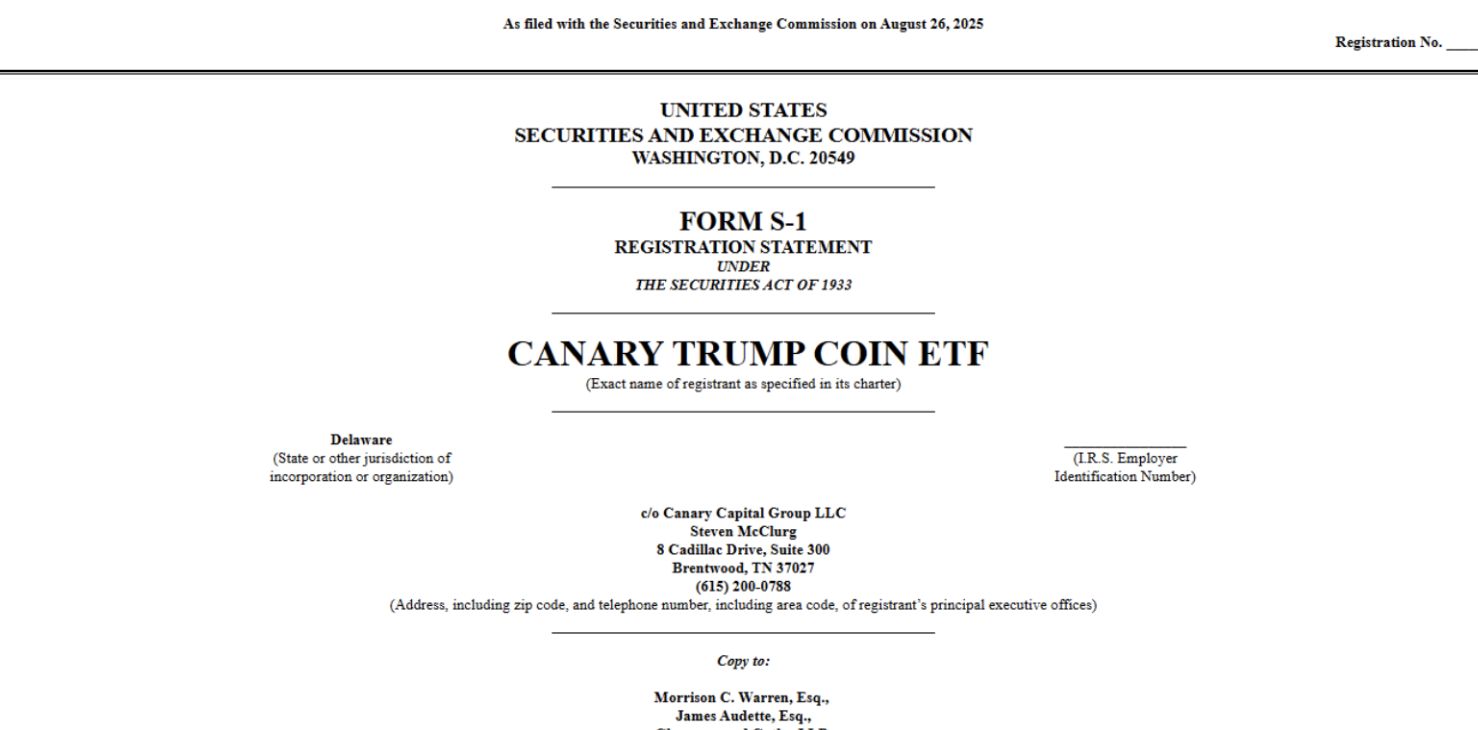

Canary Capital has submitted a landmark filing to the US Securities and Exchange Commission (SEC) to launch the first-ever exchange-traded fund (ETF) based on the Trump Coin (TRUMP), a politically-charged memecoin linked directly to former President Donald Trump. The proposed ETF aims to offer investors direct exposure to TRUMP through traditional brokerage accounts, eliminating the need for self-custody of the digital asset, under the ticker MRCA.

Source:

SEC

Source:

SEC

Trump Coin, launched in January 2025 on the Solana blockchain, quickly gained prominence as both a political statement and a digital collector’s item. While the token briefly reached a market value exceeding $27 billion, it has since plummeted nearly 70% from its January peak, exhibiting extreme volatility tied to political events and online sentiment.

Canary’s filing under the Securities Act of 1933 differs from similar pending ETFs filed under the Investment Company Act of 1940 in that it allows for the direct holding of the coin, rather than shares in an offshore entity.

Eric Balchunas doubts ETF going through

Bloomberg ETF analyst Eric Balchunas has cast doubt on SEC approval, citing regulatory requirements that a futures product linked to the asset must trade for at least six months—something TRUMP currently lacks.

Industry voices warn about the speculative nature of such funds, with risks amplified given the memecoin’s political branding and slim fundamental utility. Canary’s filing itself describes TRUMP shares as “speculative securities” unsuitable for risk-averse investors.

If approved, the SEC’s verdict on Canary’s Trump Coin ETF could set an important precedent for politically themed digital assets entering mainstream financial products. This will mark a critical test for how regulators handle the intersection of crypto, politics, and speculative investment instruments.

Meanwhile, Canary Capital has filed a Delaware trust to potentially launch an exchange-traded fund (ETF) for the official Trump memecoin, aiming for an SEC filing under the ’33 Act. This move establishes the legal framework for the fund.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Cobie: Long-term trading

Crypto Twitter doesn't want to hear "get rich in ten years" stories. But that might actually be the only truly viable way.

The central bank sets a major tone on stablecoins for the first time—where will the market go from here?

This statement will not directly affect the Hong Kong stablecoin market, but it will have an indirect impact, as mainland institutions will enter the Hong Kong stablecoin market more cautiously and low-key.

Charlie Munger's Final Years: Bold Investments at 99, Supporting Young Neighbors to Build a Real Estate Empire

A few days before his death, Munger asked his family to leave the hospital room so he could make one last call to Buffett. The two legendary partners then bid their final farewell.

Stacks Nakamoto Upgrade

STX has never missed out on market speculation surrounding the BTC ecosystem, but previous hype was more like "castles in the air" without a solid foundation. After the Nakamoto upgrade, Stacks will provide the market with higher expectations through improved performance and sBTC.