Navigating Post-Meme Season Opportunities: Identifying Altcoins with 100x Potential

- 2025 crypto market shifts to fundamentals-driven altcoins post-meme season, prioritizing deflationary tokenomics and real-world utility. - Projects like Layer Brett ($LBRETT) and MAGACOIN leverage capped supply, token burns, and high staking rewards to deliver 100x+ projected returns. - HYPER and MAXI bridge meme traction with scalable DeFi infrastructure, while Fed rate cuts and ETF approvals accelerate institutional altcoin adoption. - Strategic diversification across DeFi, AI, and cross-border payment

The cryptocurrency market in 2025 is at a pivotal juncture. After years of speculative fervor and meme-driven hype, the sector is shifting toward projects with robust fundamentals, deflationary tokenomics, and real-world utility. This transition, often termed "post-meme season," presents a unique window for investors to identify undervalued altcoins poised for exponential growth. By analyzing market cycles, tokenomics, and emerging use cases, we can pinpoint assets with the potential to deliver 100x or more returns in the next bull run.

The Market Cycle: From Bubble to Correction

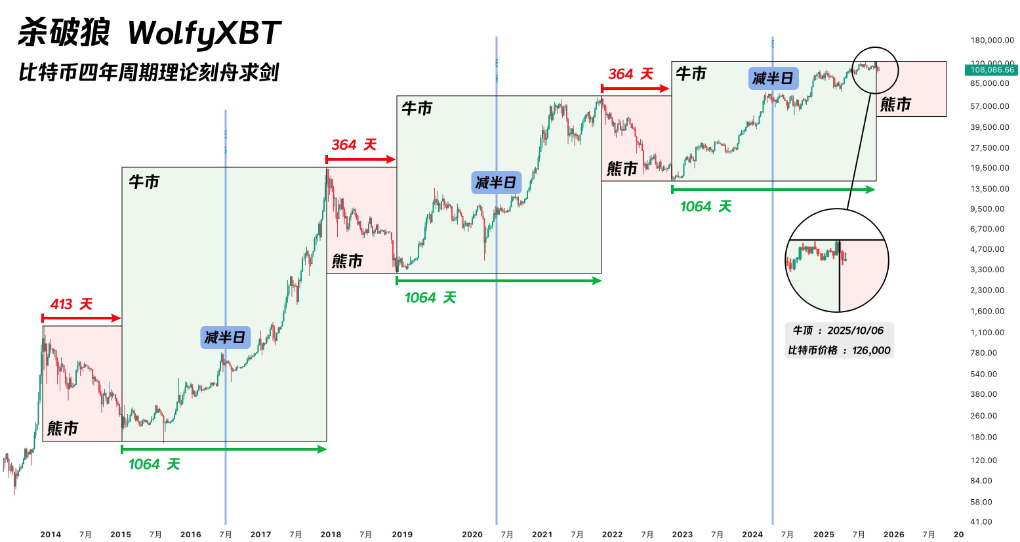

Bitcoin's 2024 halving event marked the beginning of a bull cycle that has now entered its late stages. Historical patterns suggest that the peak of this cycle will occur in Q4 2025, followed by a bearish correction. On-chain metrics like the Puell Multiple and Pi Cycle Indicator confirm that the market is nearing a top, while the Fear and Greed Index signals extreme greed—a classic precursor to market tops.

However, the bear market is not a death knell for crypto. Instead, it often acts as a catalyst for innovation, weeding out speculative projects and rewarding those with sustainable models. For altcoins, this means the post-meme season is the ideal time to focus on projects with strong tokenomics, institutional-grade infrastructure, and clear adoption pathways.

Tokenomics: The New Gold Standard

Tokenomics—the design and mechanics of a cryptocurrency's supply and demand—has become the cornerstone of long-term value creation. Projects with deflationary mechanisms, such as token burns, capped supply, and high staking rewards, are particularly attractive in a maturing market.

Take Layer Brett ($LBRETT), an Ethereum Layer 2 (L2) blockchain project. With a fixed supply of 10 billion tokens and 25% allocated to staking rewards, it incentivizes long-term holding. Early stakers have already earned APYs exceeding 20,000%, a testament to its deflationary design.

Similarly, MAGACOIN leverages U.S. election-year narratives and decentralized governance to build a self-sustaining ecosystem. Its zero-tax trading model and real-time token burns create scarcity, while whale inflows totaling $1.4 billion signal institutional confidence. With a capped supply of 100 billion tokens, MAGACOIN's tokenomics are designed to reward early adopters as demand grows.

Emerging Use Cases: Beyond Meme Hype

The most successful altcoins in 2025 are those bridging the gap between meme traction and real-world utility. Bitcoin Hyper (HYPER), for instance, is a Bitcoin Layer 2 solution built on Solana's virtual machine. It combines Bitcoin's value with scalable DeFi infrastructure, offering a staking APY of 205%. This hybrid model attracts both DeFi users and institutional capital, positioning HYPER as a foundational asset for the next wave of blockchain adoption.

Meanwhile, Maxi Doge (MAXI) has evolved from a meme coin to a project with tangible utility. Its dynamic staking APY of 2513% and fixed supply create a deflationary environment, incentivizing long-term holding. MAXI's success demonstrates how meme coins can transition from speculative assets to sustainable projects with real-world use cases.

Institutional Adoption and Macroeconomic Tailwinds

The 2025 altcoin boom is also fueled by macroeconomic factors. Federal Reserve rate cuts and pro-crypto policies under the Trump administration have created a low-interest-rate environment, making speculative investments more attractive. Additionally, the approval of Bitcoin ETFs has broadened the investor base, with institutional capital now flowing into altcoins with strong fundamentals.

Projects like Stellar (XLM) and Pudgy Penguins (PENGU) exemplify this trend. XLM's partnerships with PayPal and Societe Generale validate its role in cross-border payments, while PENGU's transition to an SEC-approved ETF-backed token highlights the convergence of meme culture and institutional-grade investment.

Investment Strategy: Timing the Next Bull Run

For investors seeking exponential growth, the key is to act early and prioritize projects with scalable infrastructure, deflationary mechanics, and institutional backing. Here's a strategic framework:

- Diversify Across Sectors: Allocate capital to DeFi, AI integration, and cross-border payment solutions to mitigate risk.

- Leverage On-Chain Metrics: Monitor transaction volume, active addresses, and TVL to identify projects with strong adoption signals.

Conclusion: The Future of Altcoin Investing

The post-meme season is not the end of speculative gains but the beginning of a new era where fundamentals reign supreme. By analyzing market cycles, tokenomics, and emerging use cases, investors can identify altcoins with 100x potential. Projects like Layer Brett, MAGACOIN, HYPER, and MAXI are not just riding the wave of virality—they are building the infrastructure for the future of decentralized finance.

For those willing to navigate the risks, the path to exponential returns lies in projects that combine innovation with scarcity. As the market matures, the winners will be those who act early, prioritize fundamentals, and embrace the convergence of culture and technology.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Macroeconomic Interpretation: Powell's "Driving in the Fog" and the Financial "Hunger Games"

The article discusses the uncertainty in the global economy under the Federal Reserve's policies, particularly Powell's "hawkish rate cuts" and their impact on the market. It analyzes market distortions driven by liquidity, the capital expenditure risks of the AI investment boom, and the loss of trust caused by policy centralization. Finally, the article provides updates on macroeconomic indicators and market trends. Summary generated by Mars AI. This summary is generated by the Mars AI model, and the accuracy and completeness of its content are still in the process of iterative improvement.

Ethereum : JPMorgan signs a strategic $102M investment

Meta reportedly earned about $16 billion in 2024 from a massive amount of scam ads