Hillenbrand's Strategic Discipline: A Blueprint for Dividend Stability in Industrial Manufacturing

- Hillenbrand, Inc. maintains a 4.11% dividend yield in industrials, double the sector average, via disciplined cash flow management and 15.65% payout ratio. - Despite 49% stock price drop and 2024 net loss, $191M operating cash flow and $799M liquidity sustain dividends amid debt reduction priorities. - 2025 guidance projects 25.51% payout ratio, relying on earnings recovery, while 14-year dividend growth streak and institutional backing reinforce long-term stability. - Strategic focus on cash generation

In the volatile world of industrial manufacturing, where margins can be razor-thin and demand cycles unpredictable, Hillenbrand , Inc. (NYSE: HI) has carved out a reputation for strategic discipline. For income-focused investors, the company's dividend policy is a case study in balancing prudence with growth. Over the past three years, Hillenbrand has maintained a consistent quarterly dividend, even as it navigated a challenging macroeconomic environment. Its latest payout of $0.225 per share, announced in May 2025, underscores a commitment to shareholder returns that has made it a standout in the Industrials sector.

The Numbers Behind the Stability

Hillenbrand's dividend yield of 4.11% as of June 2025 is more than double the sector average of 1.44%. This premium is not accidental. The company's payout ratio—calculated as 33.49% of trailing twelve months' earnings per share—suggests a sustainable approach. While this metric appears modest, it masks a more nuanced reality: Hillenbrand's 2023 payout ratio based on earnings was a staggering 176.47%, a relic of non-cash charges and restructuring costs. However, when viewed through the lens of cash flow, the payout ratio drops to 15.65%, revealing a company that prioritizes liquidity and operational cash generation.

The 49% decline in Hillenbrand's stock price since June 2024 has amplified its yield, but the company's ability to maintain dividends despite a reported net loss of $213 million in 2024 (GAAP) speaks to its financial resilience. This is not a company relying on accounting gimmicks; it is one that has generated $191 million in operating cash flow in 2024 and holds $799 million in liquidity, including $199 million in cash on hand.

Strategic Priorities: Debt, Cash, and Shareholder Returns

Hillenbrand's management has been clear: debt reduction is its top priority. Yet, even as it works to delever its balance sheet (with a net debt-to-EBITDA ratio of 3.3x), the company has returned $63 million to shareholders in 2024 through dividends. This balance between fiscal conservatism and shareholder rewards is rare in capital-intensive industries.

The company's guidance for 2025—adjusted EPS of $2.80 to $3.15—suggests continued prudence. While revenue is expected to decline mid-single digits, Hillenbrand's focus on cost discipline and operational efficiency has insulated its cash flow. For example, its Q4 2024 operating cash flow of $167 million, achieved amid a net loss, highlights its ability to generate returns even in downturns.

Risks and Rewards for Income Investors

Hillenbrand's dividend is not without risks. The company's forward-looking payout ratios (25.51% in 2025 and 23.28% in 2026) are optimistic, assuming earnings recover. If demand in its Advanced Process Solutions segment fails to rebound, the 1.1% annualized dividend growth rate could stall. Additionally, the stock's 97% surge in yield over the past year is partly a function of its price collapse—a reminder that high yields can be a double-edged sword.

However, for investors with a long-term horizon, Hillenbrand's 14-year streak of dividend increases and its institutional backing (notably, GAMMA Investing's 3905% stake increase in Q1 2025) provide reassurance. The company's strategic focus on innovation and cost control—such as its $167 million in Q4 2024 cash flow—positions it to navigate cyclical headwinds.

A Model for the Sector

Hillenbrand's approach offers a blueprint for industrial manufacturers seeking to balance growth and stability. By prioritizing cash flow over short-term earnings, maintaining a conservative payout ratio, and aligning with institutional investors, it has created a dividend policy that is both attractive and resilient. For income-focused investors, the key takeaway is clear: Hillenbrand's strategic discipline is not a one-time feat but a repeatable formula.

Investment Advice: Hillenbrand's 4.11% yield and low payout ratio (based on cash flow) make it a compelling option for income portfolios. However, investors should monitor its 2025 guidance and cash flow trends. Those comfortable with moderate volatility and a focus on long-term stability may find Hillenbrand's dividend a reliable anchor in an otherwise turbulent sector.

In an era where many industrial stocks struggle to maintain payouts, Hillenbrand's strategic rigor is a rare and valuable asset. For income investors, the question is not whether the company can sustain its dividend, but whether they can afford to ignore it.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Leading DEXs on Base and OP will merge and expand deployment to Arc and Ethereum

Uniswap's new proposal reduces LP earnings, while Aero integrates LPs into the entire protocol's cash flow.

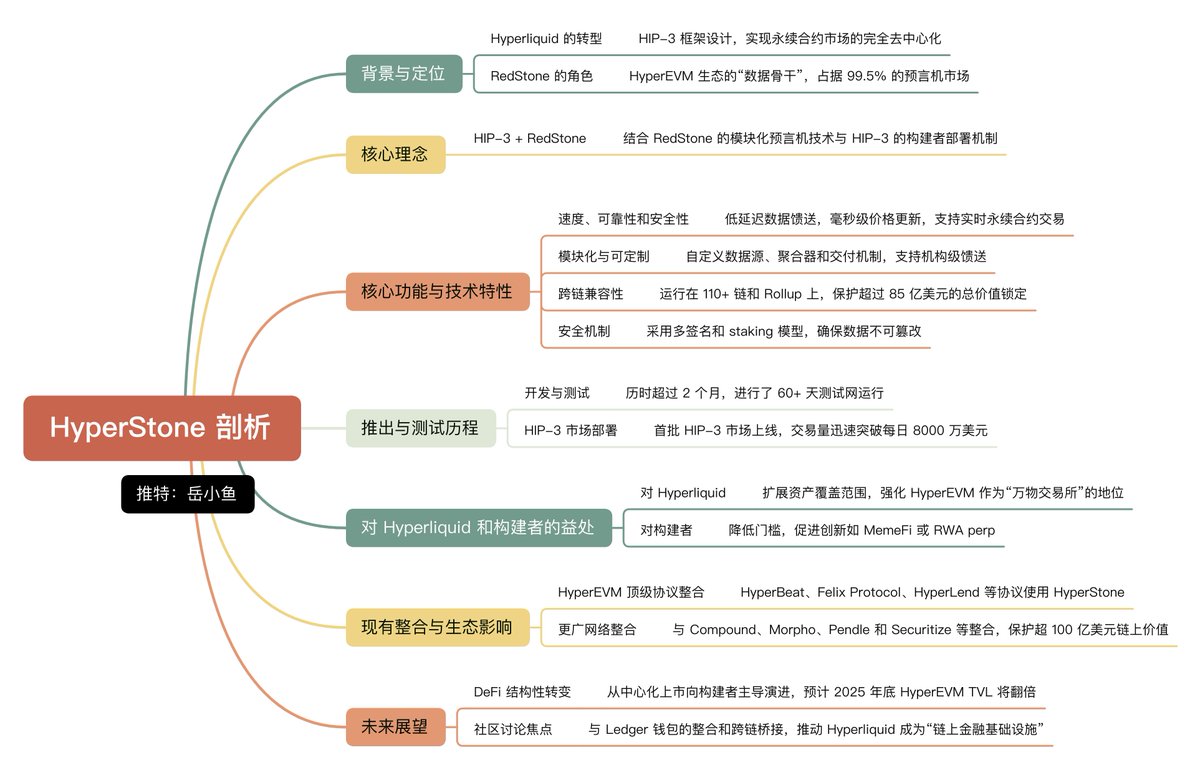

The Future of Hyperliquid: HIP-3 and HyperStone

The future of Hyperliquid lies in HIP-3, and the foundation of HIP-3 is HyperStone.

A New Era of Token Financing: A Milestone for Compliant Fundraising in the United States

Asset issuance in the crypto industry is entering a new era of compliance.

Circle, the First Stablecoin Stock, Releases Q3 Financial Report: What Are the Highlights?

By the end of the third quarter, the circulating supply of USDC reached $73.7 billion, representing a year-on-year increase of 108%.