Tilray Brands' Strategic Gambit: Can a Reverse Stock Split and Nasdaq Compliance Spark a Sustainable Rebound?

- Tilray Brands delays reverse stock split to stabilize its $1.17 Nasdaq-listed shares amid U.S. cannabis rescheduling speculation and European expansion. - Strategic cost-cutting and debt reduction ($76M net debt cut) support a diversified revenue model, with beverages now driving 70% of total income. - Analysts remain divided: "Hold" consensus reflects cautious optimism about regulatory tailwinds versus near-term profitability risks and $1.27 average price target. - Long-term success hinges on balancing

In the ever-shifting landscape of cannabis and wellness, Tilray Brands has embarked on a high-stakes maneuver to secure its future. The company's recent shareholder-approved reverse stock split and Nasdaq compliance efforts are more than just technical adjustments—they are a calculated attempt to reposition itself as a resilient player in a sector still grappling with regulatory uncertainty and market volatility. But does this strategy offer a genuine path to long-term value creation, or is it a temporary fix for deeper structural challenges?

The Nasdaq Compliance Tightrope

Tilray's decision to pause the implementation of its reverse stock split—despite shareholder approval—reveals a nuanced understanding of market dynamics. The company's stock, currently trading at $1.17 (as of August 21, 2025), has shown signs of stabilization, buoyed by speculation around U.S. cannabis rescheduling and its expanding European footprint. By delaying the split, Tilray is buying time to assess whether its current valuation can withstand the split's dilutive effects or if a more favorable window exists. This pause is not a sign of hesitation but a strategic recalibration, allowing the company to align its capital structure with both Nasdaq's $1 minimum bid price requirement and investor sentiment.

The reverse stock split, if executed, would reduce the number of shares outstanding by up to 90%, potentially boosting the per-share price and making the stock more attractive to institutional investors. This move also aligns with Tilray's broader goal of reducing operational costs—annual savings of $1 million from streamlined shareholder meetings are a tangible benefit. However, the success of this strategy hinges on one critical factor: whether the company's intrinsic value can justify the higher share price post-split.

Financial Fortitude and Strategic Diversification

Tilray's balance sheet provides a foundation for optimism. As of Q3 2025, the company reduced net debt by $76 million, bringing its net debt-to-EBITDA ratio to under 1.0x, a significant improvement from previous years. With $250 million in cash and marketable securities, Tilray has the liquidity to pursue acquisitions, reduce debt further, or invest in high-margin ventures. This financial flexibility is a stark contrast to its peers, many of whom remain burdened by high leverage.

The company's diversification into wellness and beverages has also proven resilient. While cannabis revenue dipped slightly in Q3 2025, the wellness segment grew by 5%, driven by Manitoba Harvest's tariff-exempt status in the U.S. and expanding international demand. Meanwhile, the beverage segment—bolstered by acquisitions of Anheuser-Busch and Molson Coors brands—contributed 70% of total revenue, a testament to Tilray's pivot away from cannabis-centric risk.

The Analyst Divide: Caution vs. Cautious Optimism

Analyst ratings for Tilray remain split, reflecting the company's precarious position. A “Hold” consensus prevails, with Jefferies standing out as a bullish outlier, raising its price target to $2.00 on the back of potential U.S. cannabis reclassification. Piper Sandler and others maintain a “Neutral” stance, citing near-term profitability challenges. The average price target of $1.27 implies a modest 13% upside, but the Street-high target of $3 underscores the speculative nature of the stock.

The key question for investors is whether Tilray's strategic initiatives—such as Project 420, which aims to save $33 million through SKU rationalization and supply chain optimization—can translate into consistent profitability. The company's fiscal 2026 EBITDA guidance of $62–72 million suggests a path to breakeven, but losses are expected to persist into 2027.

The Long Game: Regulatory Tailwinds and Global Expansion

Tilray's most compelling catalyst lies in the evolving regulatory environment. The U.S. federal review of cannabis rescheduling, if successful, could unlock new markets and reduce tax burdens. Tilray's European expansion—particularly its partnership with Italian pharma firm Molteni to distribute cannabis extracts—positions it to capitalize on the continent's growing medical cannabis demand. These moves are not just about compliance; they're about building a diversified revenue base insulated from U.S. regulatory delays.

However, the company must navigate a delicate balancing act. Overreliance on the reverse stock split as a short-term fix could alienate retail investors, while underinvestment in R&D or AI-driven automation risks falling behind competitors. Tilray's emphasis on innovation—whether in horticulture or digital platforms—will be critical to sustaining its premium brand positioning.

Investment Thesis: A Calculated Bet

For investors with a medium-term horizon, Tilray presents a high-risk, high-reward opportunity. The company's Nasdaq compliance efforts and financial discipline are positives, but the stock remains vulnerable to regulatory headwinds and market sentiment swings. A “Hold” rating is prudent for now, with a closer eye on the timing of the reverse stock split and the pace of international expansion.

If Tilray can execute its strategic initiatives while maintaining its Nasdaq listing, it could emerge as a leader in the post-legalization era. But patience is key. The path to sustainable growth is not a sprint—it's a marathon, and the finish line remains out of sight.

In the end, Tilray's story is one of resilience. Whether it can transform its structural moves into shareholder value will depend not just on its ability to meet Nasdaq's rules, but on its capacity to redefine what it means to be a global leader in cannabis, wellness, and beyond.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Story of Brother Machi's "Going to Zero": Just Be Happy

New Bitcoin highs could take 2 to 6 months but data says it’s worth the wait: Analysis

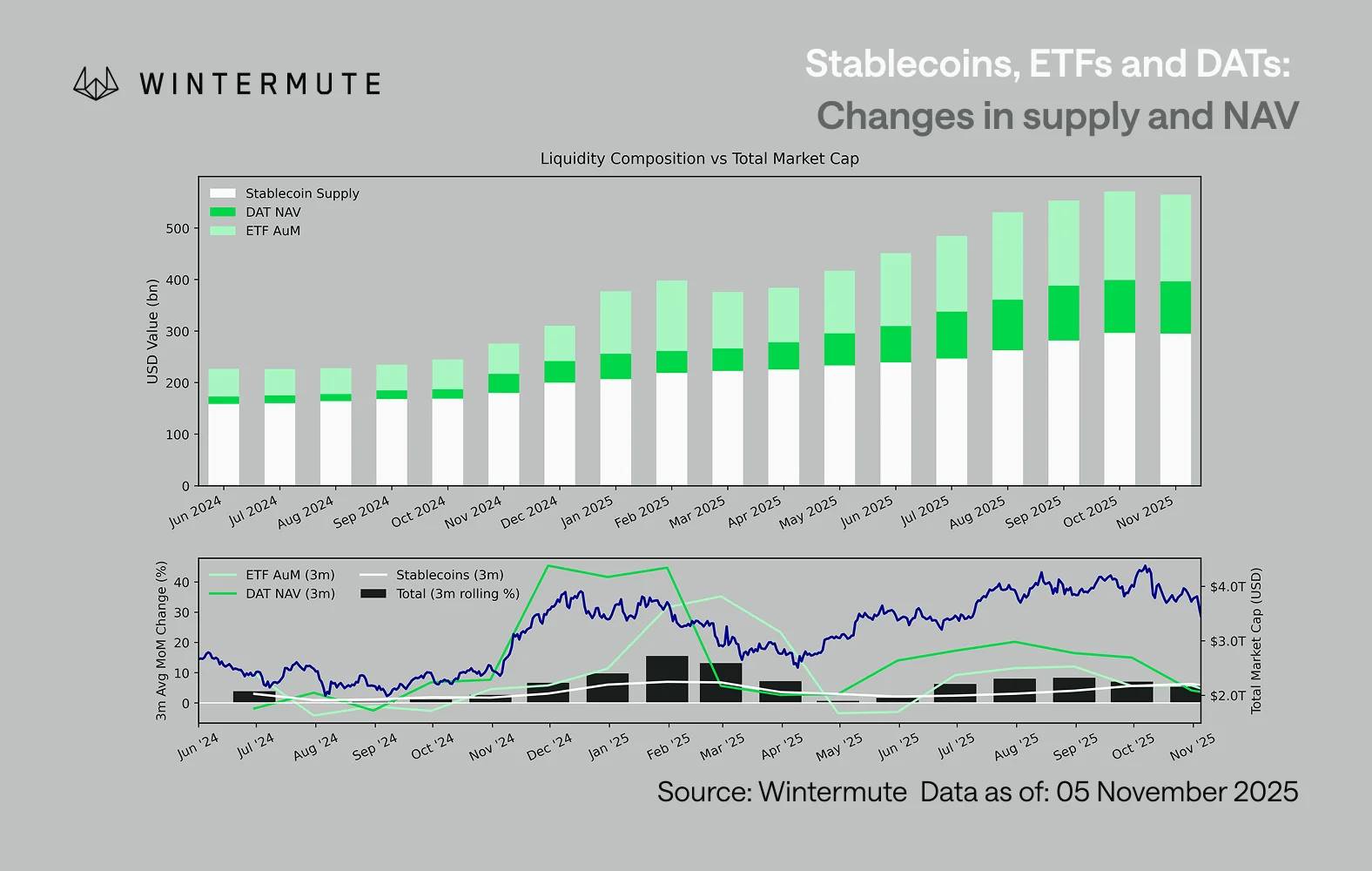

Wintermute: Liquidity, the Lifeline of the Crypto Industry, Is in Crisis

Liquidity determines every cryptocurrency cycle.

Ray Dalio's latest post: This time is different, the Federal Reserve is fueling a bubble

Because the fiscal side of government policy is now highly stimulative, quantitative easing will effectively monetize government debt, rather than simply reinjecting liquidity into the private system.