Apple Greenlights First iOS Game with Bitcoin Payment Support

SaruTobi first appeared in 2013 as a lighthearted monkey-flinging arcade game. It was with an experimental Bitcoin payout feature. It didn’t last long on iOS. Later that same year, Apple removed it for breaching its in-app purchase rules. It was particularly due to the prohibition on holding user funds directly on-device.

SaruTobi Returns with Lightning-Powered Payments

Fast-forward over a decade, and SaruTobi is back, this time built around Lightning microtransactions through ZBD integration. That change is central to its compliance. All Bitcoin flows now run through an external, Apple-approved payment provider, meaning the game never acts as a custodian of user funds. Players can spend sats, the smallest Bitcoin unit, with 100 million sats to a BTC to unlock features or retry levels. They can earn sats through in-game activities funded by advertising. Even tiny amounts are viable because Lightning microtransactions settle in milliseconds with minimal fees. For perspective, 920 sats equals about one US dollar, and fees often hover at just 1 sat, far below the 15-30 percent commission Apple typically charges for in-app purchases.

Lightning Tech Fuel Bitcoin Gaming

The comeback wasn’t just a matter of Apple changing its mind. The SaruTobi approval aligns with a wave of regulatory and legal changes. The EU ’s Digital Markets Act now requires platforms to accommodate alternative payments. Court rulings in Epic Games vs Apple have weakened Apple’s in-app purchase exclusivity. In South Korea, “anti-steering” laws have forced similar adjustments. Together, these pressures have led Apple to allow more types of payments. For now, this is handled in a controlled way. Each case is approved individually rather than through an open policy.

ZBD integration ensures that Lightning microtransactions are smooth enough for real-time gameplay. Players spend sats without pausing the game, and rewards can be withdrawn to external Lightning wallets at any time. This spend-earn loop turns micro-rewards into a persistent engagement. Early metrics point to increased session times, and while individual payouts are modest, the novelty of earning Bitcoin in a mainstream iOS title is resonating with players.

More Compliant Bitcoin Gaming on iOS

The SaruTobi approval demonstrates that Bitcoin gaming can work within App Store rules if external payment providers handle the custody and settlement. It also hints at new ways to make money from games. In these models, in-game actions could bring direct financial rewards based on performance, instead of just selling cosmetic items or showing ads. This could lead to things like programmable payments, time-locked rewards, or even in-game DeFi features as Lightning technology develops.

It is not a complete change in policy. But it does create a clear path for other Bitcoin gaming projects to get similar approvals. The economics are compelling. Lightning microtransactions make sub-cent transactions viable at scale, enabling new kinds of player engagement and potentially reshaping revenue strategies.

If Apple continues in this direction, it will face more competitive pressure from Android’s open wallet integrations. Legal support for payment choice is also growing. This could speed up changes to the App Store that are more friendly toward crypto payments. Until then, SaruTobi stands as a proof-of-concept one where regulatory catalysts, Lightning microtransactions, and ZBD integration combined to turn what was once a banned experiment into a fully compliant, revenue-ready iOS game.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Stellar (XLM) Price Prediction: Can Bulls Push Toward $0.30 in December?

21Shares XRP ETF Set to Launch on 1 December as ETF Demand Surges

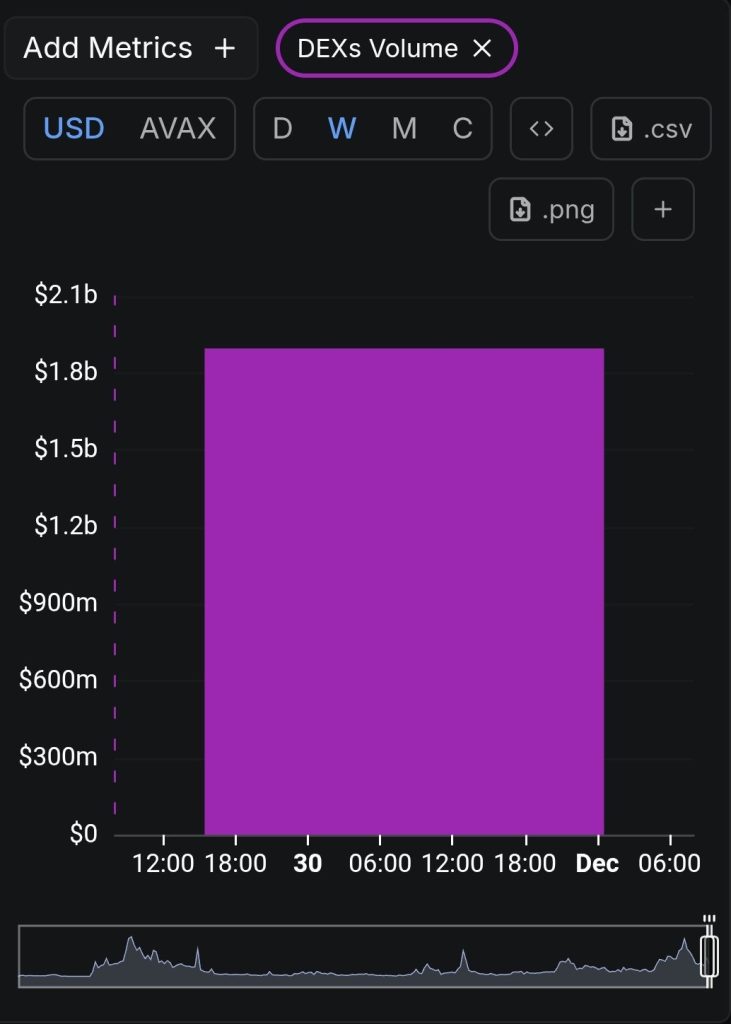

Avalanche (AVAX) Sees DEX Volume Surge as Price Rebounds From Key Support—Is a Major Breakout Near?

CZ Issues Market Warning as Crypto Exits Longest ‘Extreme Fear’ Streak