Bitcoin's Role as a Macro Hedge Amid Trump-Fed Tensions: Strategic Portfolio Reallocation in a Post-Rate-Hike World

- The Fed's 2022-2024 rate hikes and Trump's pro-crypto agenda create macroeconomic tensions, positioning Bitcoin as a strategic hedge against policy uncertainty. - Bitcoin's 2023-2025 rebound to $124,000 reflects regulatory clarity (ETF approvals), fixed supply advantages, and Trump's "Strategic Bitcoin Reserve" policy promises. - Trump's 2025 CBDC ban and Fed policy divergence highlight Bitcoin's dual role: hedging dollar devaluation (-0.29 correlation) while benefiting from low-rate liquidity (+0.49 wit

The Federal Reserve's aggressive rate-hiking cycle from 2022 to 2024, coupled with the re-election of Donald Trump in 2024 and his pro-crypto agenda, has created a unique macroeconomic landscape. Investors now face a critical question: How can Bitcoin , once a volatile speculative asset, be leveraged as a strategic hedge in a world where central bank policy and political leadership are in tension? The answer lies in understanding Bitcoin's evolving role as a macroeconomic counterbalance—and how to position portfolios accordingly.

The Fed's Tightening Cycle and Bitcoin's Resilience

Bitcoin's performance during the Fed's rate hikes underscores its sensitivity to liquidity and investor sentiment. In 2022, as the Fed raised rates to combat inflation, Bitcoin plummeted from $64,000 to near $20,000. This was not an isolated event; high-risk assets across the board—tech stocks, venture capital, and even gold—saw sharp corrections. The Fed's tightening choked liquidity, forcing investors to flee speculative assets.

However, Bitcoin's recovery in 2023–2025 reveals a critical shift. As the Fed paused hikes and signaled cuts in 2024, Bitcoin surged past $124,000 by August 2025. This rebound was fueled by three factors:

1. Regulatory Clarity: The approval of spot Bitcoin ETFs in 2024 normalized institutional access, reducing volatility.

2. Macroeconomic Diversification: Bitcoin's fixed supply and low post-halving inflation rate (0.83%) positioned it as a superior hedge against fiat devaluation.

3. Political Tailwinds: Trump's pro-crypto promises, including replacing SEC Chair Gary Gensler and creating a “Strategic Bitcoin Reserve,” boosted investor confidence.

Trump-Fed Tensions and the New Macro Paradigm

The 2024 election of Trump, who has consistently criticized the Fed's inflationary policies, introduced a new layer of complexity. His administration's executive order in January 2025—banning a U.S. CBDC and promoting open blockchain networks—signaled a regulatory shift favoring Bitcoin. This contrasts with the Fed's traditional focus on monetary stability, creating a tug-of-war between political and central bank priorities.

For investors, this tension presents an opportunity. Bitcoin's negative correlation with the U.S. dollar (-0.29) and its positive alignment with high-yield bonds (+0.49) make it a versatile hedge. In a world where Trump's policies may prioritize growth over inflation control, Bitcoin's role as a store of value becomes even more compelling.

Strategic Portfolio Reallocation: Balancing Risk and Reward

Bitcoin's evolving correlation with traditional assets—from a +0.91 peak with the S&P 500 in 2023 to near-zero by 2025—highlights its potential for diversification. Here's how to integrate it strategically:

- Hedge Against Dollar Devaluation: Allocate 5–10% of a portfolio to Bitcoin to offset potential devaluation risks, especially if Trump's administration pursues expansionary fiscal policies.

- Leverage ETFs for Institutional Exposure: Spot Bitcoin ETFs (e.g., BlackRock's IBIT) offer a low-cost, regulated way to gain exposure without holding crypto directly.

- Diversify Across Macroeconomic Scenarios: Bitcoin's dual role—as a hedge against inflation (via fixed supply) and a beneficiary of low rates (via increased liquidity) makes it a unique asset in both tightening and easing cycles.

The Road Ahead: Navigating Uncertainty

While Bitcoin's 375.5% return from 2023 to 2025 is impressive, its hedging efficacy remains context-dependent. For instance, its response to inflation surprises varies by index (positive for CPI, negative for Core PCE). Investors must also consider the risk of regulatory shifts—should the Fed or Congress impose stricter controls, Bitcoin's volatility could resurge.

However, the broader trend is clear: Bitcoin is no longer a speculative fad. With 180+ companies holding it as a strategic reserve and central banks in the U.S. and Bhutan treating it as a reserve asset, its macroeconomic utility is here to stay.

Conclusion: A New Era of Macro Hedging

In a post-rate-hike world marked by Trump-Fed tensions, Bitcoin offers a unique toolkit for investors. Its ability to decouple from traditional assets, hedge against dollar depreciation, and benefit from both inflationary and deflationary environments makes it a cornerstone of strategic reallocation. For those willing to navigate its complexities, Bitcoin is not just a digital asset—it's a macroeconomic linchpin.

As the Fed's next move looms and Trump's policies take shape, the time to act is now. The question isn't whether Bitcoin belongs in a portfolio—it's how much of it to own.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Stellar (XLM) Price Prediction: Can Bulls Push Toward $0.30 in December?

21Shares XRP ETF Set to Launch on 1 December as ETF Demand Surges

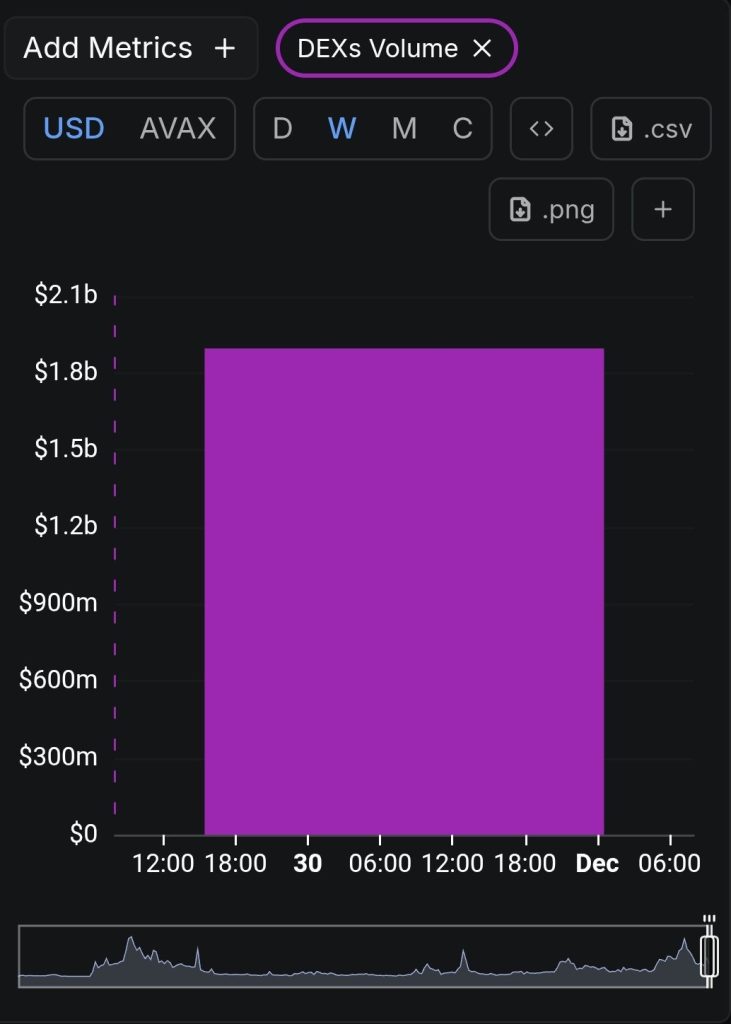

Avalanche (AVAX) Sees DEX Volume Surge as Price Rebounds From Key Support—Is a Major Breakout Near?

CZ Issues Market Warning as Crypto Exits Longest ‘Extreme Fear’ Streak