Who orchestrated the extreme Hyperliquid XPL market at 5 a.m.?

Hyperliquid XPL experienced extreme market conditions: it surged 200% in 5 minutes before crashing sharply, with two addresses making a combined profit of $27.5 million.

Hyperliquid XPL extreme market: 200% surge in 5 minutes followed by a flash crash, $17.67 million in short positions liquidated, two addresses made a staggering $27.5 million profit.

Written by: KarenZ, Foresight News

Starting at 5:50 AM on August 27, the decentralized derivatives trading platform Hyperliquid witnessed a breathtaking extreme market event: the pre-market token XPL surged nearly 200% in just 5 minutes, then quickly retraced, triggering massive short liquidations and sparking community controversy.

Event Review: A Crazy 5 Minutes, Market Like a Roller Coaster

According to Hyperliquid market data, the price of XPL began to soar rapidly from around $0.6 at 5:50 AM (UTC+8) on August 27, peaking at $1.8 within minutes—a gain close to 200%. However, the frenzy did not last long—within a few minutes after hitting the high, the price fell back to its original level and is currently fluctuating around $0.061.

According to Coinglass data, the amount of XPL/USD short liquidations on Hyperliquid in the past 4 hours reached $17.67 million.

Notably, during the same period, on centralized exchanges like Binance and Bitget that listed XPL pre-market contracts, XPL prices did not show significant fluctuations. This discrepancy has led the community to question potential price manipulation.

The Driving Force: Two Addresses Profited $27.5 Million

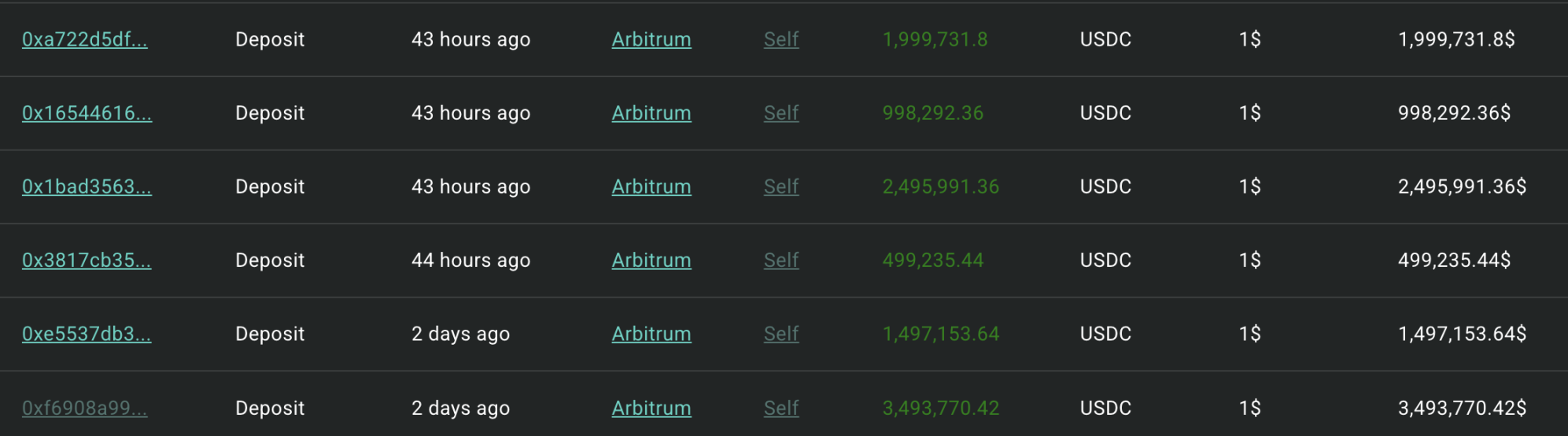

Further on-chain tracking via HypurrScan shows that the address starting with 0xb9c began positioning two days earlier (August 24), depositing a total of 10.98 million USDC into Hyperliquid in 6 transactions, then started building XPL long positions. At 5:35 AM (UTC+8) today, another 4.993 million USDC was deposited into Hyperliquid.

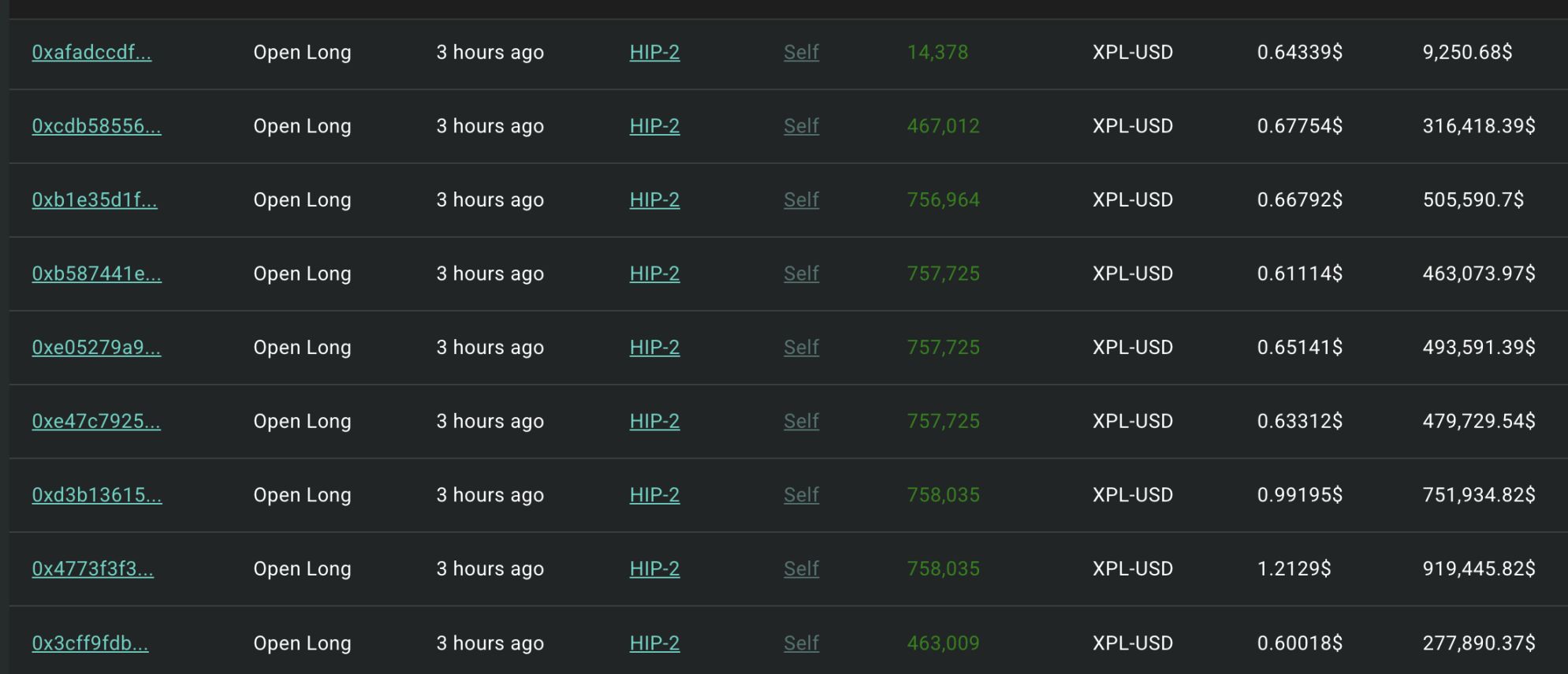

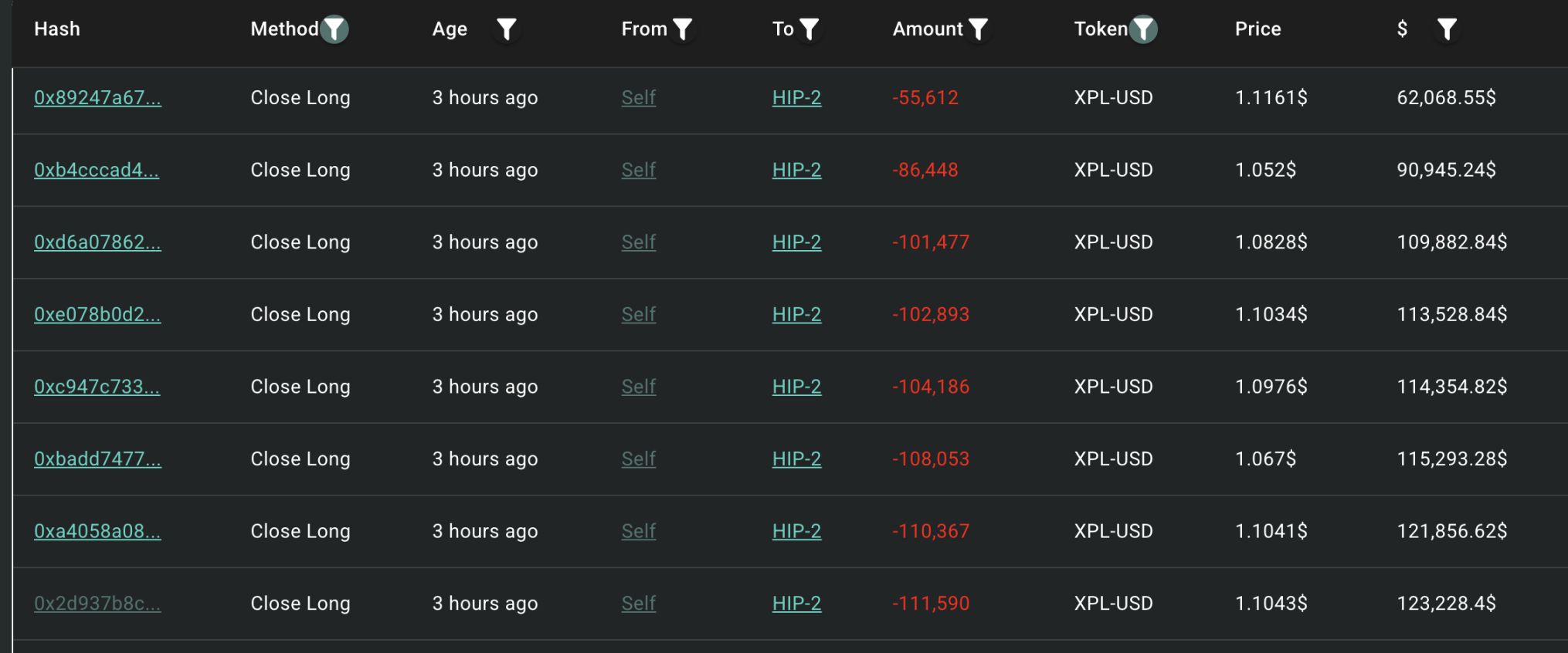

Subsequently, the 0xb9c address began placing multiple long orders on XPL at 5:36 AM (UTC+8) on August 27 (with most single orders ranging from tens of thousands to hundreds of thousands of dollars), and started closing long positions at 5:53 AM (UTC+8). When XPL dropped to around $0.6, the address went long on XPL again. Currently, the XPL contract position of the 0xb9c address on Hyperliquid is valued at $8.28 million.

Around 08:10 AM (UTC+8), the 0xb9c address "withdrew" nearly 600,000 USDC in two transactions, with no further actions afterward.

According to analysis by @ai_9684xtpa, this address swept the entire order book, squeezing out all shorts (mainly 1x hedging positions), and made $16 million in just one minute.

According to another analysis by Ember, the XPL liquidation manipulator on Hyperliquid likely used two wallets to first build long positions, then pump the price to trigger automatic liquidations and thus earned up to $27.5 million in profit. Among them, the 0xb9c address pumped XPL price, causing a chain of liquidations, and eventually triggered auto-liquidations between $1.1 and $1.2. The address with DeBank username "silentraven" (starting with 0xe417) built a long position of 21.1 million XPL at an average price of $0.56 with $9.5 million on Hyperliquid over the past 3 days. After the liquidation was triggered, the position was auto-liquidated at an average price of about $1.15, resulting in a profit of $12.5 million.

Some community members also pointed fingers at Justin Sun. @ai_9684xtpa stated, "Rumors about Justin Sun's involvement stem from tracing the source of funds upward, as this address transferred ETH to an address associated with Justin Sun five years ago, but there is no direct evidence proving it is Justin Sun."

Exposed Core Issues: Structural Risks of DeFi Perpetual Contracts

This incident revealed several key risks of DeFi perpetual contract platforms:

- Single Oracle Dependency, Price Manipulation "Easy as Pie": Hyperliquid perpetual contract oracle prices do not rely on any external data, and funding rates are determined based on the moving average of Hyperp's mark price. As a pre-issued token, XPL relies solely on a single price oracle, making its price easily manipulated. Whales can quickly pump the price with large long positions, easily breaching liquidation thresholds.

- Lack of Position Concentration Control: Whales Can "Control the Market": Most DeFi contract platforms currently do not set position limits for individual users, allowing whales to influence market prices and liquidation mechanisms through large positions.

Many users believe that "1x leverage hedging" carries extremely low risk and is a stable operation, thus letting their guard down against extreme market conditions. However, in the highly volatile crypto market, even seemingly "safe" strategies can be "vulnerable" in the face of price manipulation or black swan events. The mass liquidation of 1x leverage hedging positions in this incident is a typical example.

@Cbb0fe stated, "In this XPL liquidation event, I hedged 10% of my XPL token assets on the HyperliquidX platform, using 1x leverage short and providing a large amount of collateral for protection, but still suffered a loss of $2.5 million. The user said, 'I will never touch such isolated markets again.'"

Takeaways

This "five-minute storm" is not only a typical case of market manipulation but also exposes the weak links in risk control, oracle mechanisms, and position management in DeFi derivatives protocols. If not improved, similar issues are highly likely to occur in other DeFi perpetual contract or crypto synthetic asset platforms.

For traders, it is important to recognize: in the crypto market lacking clear regulation and robust risk control, even seemingly stable hedging strategies can be "wiped out in an instant" in the face of whale manipulation and extreme volatility. The "tuition" of the crypto market is often expensive—respecting risk and making rational decisions are the keys to long-term survival.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Privacy’s HTTPS Moment: From Defensive Tool to Default Infrastructure

A summary of the "Holistic Reconstruction of Privacy Paradigms" based on dozens of speeches and discussions from the "Ethereum Privacy Stack" event at Devconnect ARG 2025.

Donating 256 ETH, Vitalik Bets on Private Communication: Why Session and SimpleX?

What differentiates these privacy-focused chat tools, and what technological direction is Vitalik betting on this time?

Ethereum Raises Its Gas Limit to 60M for the First Time in 4 Years

DeFi: Chainlink paves the way for full adoption by 2030