Google Cloud is developing a Python-based layer 1 blockchain for institutions

Key Takeaways

- Google Cloud strategy head calls its new universal ledger a layer 1 blockchain.

- The platform has already attracted major institutional interest, with CME Group, one of the world's largest commodities exchanges, selecting GCUL to explore tokenization and payment solutions.

Share this article

Google Cloud is developing a layer 1 blockchain platform called Google Cloud Universal Ledger (GCUL), designed for financial institutions and featuring Python-based smart contracts, Rich Widmann, Global Head of Strategy for web3 at Google Cloud, shared in a LinkedIn post .

Google Cloud Universal Ledger was first unveiled in March through a joint announcement with CME Group outlining plans to pilot tokenization and wholesale payments on the new distributed ledger.

The companies did not explicitly call GCUL a layer 1 blockchain upon announcing the initiative.

CME Group said it had completed the first phase of integration and testing, calling the technology a step toward low-cost, 24/7 settlement for collateral, margin, and fees. Direct testing with market participants is scheduled to begin later this year, with new services targeted for 2026.

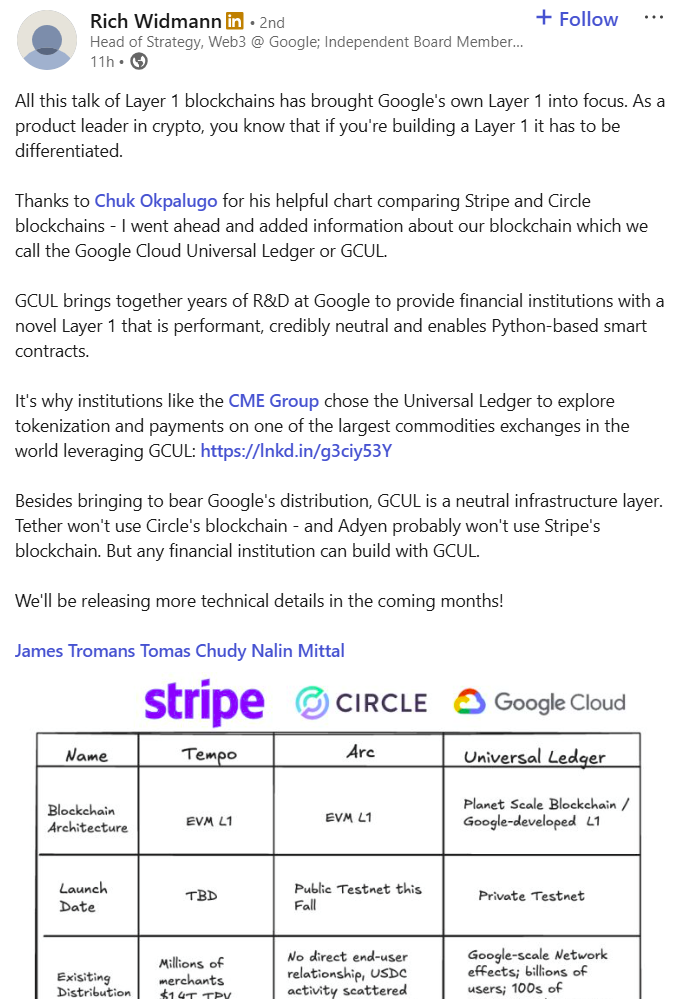

In his latest post, Widmann placed GCUL alongside layer 1 solutions developed by Circle and Stripe in a comparative chart originally shared by Chuk Okpalugo, Head of Product at Paxos. He said that Google-developed layer 1 aims to differentiate itself as a neutral infrastructure.

“Tether won’t use Circle’s blockchain – and Adyen probably won’t use Stripe’s blockchain. But any financial institution can build with GCUL,” he stated, adding that more specs on the system are slated for release in the coming months.

Following its successful IPO, Circle announced the upcoming launch of its layer 1 blockchain, Arc , set to deploy on the public testnet this fall with features tailored for stablecoin payments, FX, and capital markets.

Stripe is also developing a new layer 1 blockchain called Tempo , focusing on high-performance payment solutions, which is compatible with Ethereum’s coding language.

The project, still in stealth mode, involves a partnership with Paradigm and is part of Stripe’s ongoing expansion in the crypto realm.

Share this article

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitget donates HK$12 million to support fire rescue and reconstruction efforts in Tai Po, Hong Kong

Bitget Spot Margin Announcement on Suspension of ELX/USDT Margin Trading Services

Enjoy perks for new grid traders and receive dual rewards totaling 150 USDT

Bitget Spot Margin Announcement on Suspension of BEAM/USDT, ZEREBRO/USDT, AVAIL/USDT, HIPPO/USDT, ORBS/USDT Margin Trading Services