Justin Sun Wins Best Blockchain Innovator at UK Hackathon

- Justin Sun awarded Best Blockchain Innovator at UK AI Hackathon.

- TRON DAO sponsored event, highlighting AI and blockchain.

- No immediate impact on TRX token’s market performance.

Justin Sun, TRON founder, honored as Best Blockchain Innovator at the UK AI Agent Hackathon hosted by Imperial College London, where TRON DAO generously sponsored $10,000 in innovation bounties.

The recognition underscores TRON’s role in pioneering blockchain and AI synergy, potentially boosting developer interest and impacting TRON ecosystem and asset engagement.

Justin Sun, founder of TRON , received the Best Blockchain Innovator accolade at the UK AI Hackathon conducted by Imperial College London. The event was significantly supported by TRON DAO , who contributed $10,000 in bounties for innovation.

Justin Sun, known for his pioneering work in stablecoin and DeFi innovation, spoke on the future of blockchain and AI synergy. TRON DAO offered further insights through Sam Elfarra, their Community Spokesperson.

TRON (TRX) token and its related DeFi protocols may not see short-term market changes. However, there could be increased interest from developers and students due to the platform’s exposure during the hackathon.

The hackathon’s focus on AI and blockchain aligns with TRON DAO’s strategy to engage more developers. TRON’s participation aims to improve infrastructure and attract institutional interest in blockchain innovations.

Market response to hackathon awards typically influences developer and institutional engagement. However, TRON’s recent event lacks immediate quantifiable financial impact. Historical trends indicate potential uplift in developer activity within the TRON ecosystem.

Data from similar events suggest early-stage innovations post-hackathon. This can help increase long-term investment and cross-industry applications. TRON’s engagement with academia solidifies its position for future growth in AI-related blockchain developments.

“We are committed to driving the intersection of blockchain and AI, ensuring that TRON continues to lead in delivering real-world applications and innovations.” – Justin Sun, Founder, TRON

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

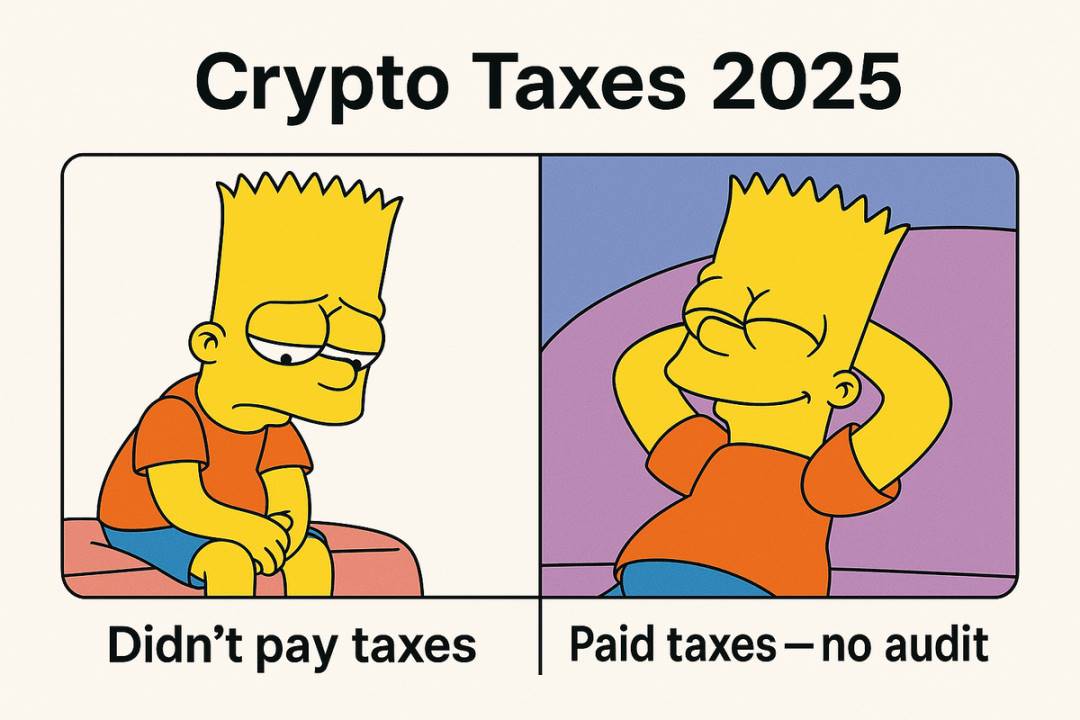

Are taxes eating up more than half your profits? 3 legal profit-preserving strategies for crypto whales

Wealthy investors almost never sell cryptocurrencies directly.

Goldman Sachs' $470M Bitcoin Play: A Signal for Institutional Onboarding and Long-Term Value Capture

- Goldman Sachs allocates $470M in direct Bitcoin holdings and $1.5B in Bitcoin ETFs, signaling institutional acceptance of crypto as a macro-hedge. - The dual strategy balances unmediated price exposure with regulated ETFs like IBIT/FBTC, aligning with evolving U.S. and EU regulatory frameworks. - Rising institutional adoption by firms like BlackRock and JPMorgan validates Bitcoin's role in diversifying portfolios amid inflation and geopolitical risks. - Retail investors are urged to re-evaluate crypto al

The Fragile Pillars of Central Bank Independence: Assessing the Risks to U.S. Monetary Policy and Global Markets

- Trump's unprecedented attempt to remove Fed Governor Lisa Cook, lacking legal basis, triggers market volatility and questions the Fed's independence. - Historical parallels to Nixon's 1971 pressure on the Fed highlight risks of inflation and dollar instability from political interference. - Legal challenges over Cook's removal could set a precedent, threatening the Fed's apolitical role and global financial stability. - Investors now prioritize inflation hedges (gold, TIPS) and value stocks as central ba

Bitcoin Market Volatility and Institutional Activity: Decoding Whale Movements as Leading Indicators

- 2025 Q2 saw dormant Bitcoin whale accounts (10,000+ BTC) reactivating, shifting $642M to Ethereum through leveraged positions and large ETH purchases. - Ethereum whales (10,000–100,000 ETH) accumulated 200,000 ETH ($515M), reflecting institutional adoption driven by deflationary supply, 3.8% staking yields, and Dencun/Pectra upgrades. - SEC's utility token reclassification and 29% ETH staking rate boosted Ethereum's appeal, while investors adopted 60–70% Bitcoin/30–40% Ethereum portfolios to balance stab