Date: Sat, Aug 23, 2025 | 03:24 PM GMT

The cryptocurrency market turned bullish after Jerome Powell hinted at potential rate cuts in September during today’s Jackson Hole event. Following the remarks, Ethereum (ETH) surged to a new all-time high of $4,878, fueling strong momentum across altcoins , including Avalanche (AVAX).

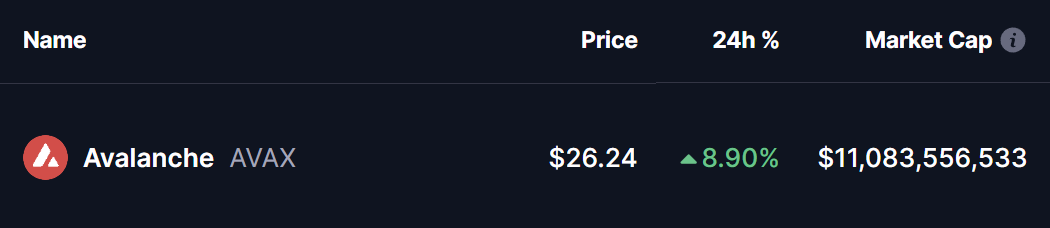

Over the past 24 hours, AVAX has gained 8%, and its price action is now showing a bullish technical setup that closely mirrors Arbitrum (ARB)’s recent breakout structure.

Source: Coinmarketcap

Source: Coinmarketcap

AVAX Mirrors ARB’s Breakout Structure

ARB’s price action offers an important roadmap. Back in June, ARB broke out of a classic falling wedge pattern—a well-known bullish reversal formation. After the breakout, it consolidated just under a key resistance zone (highlighted in red). Once that resistance gave way, ARB surged nearly 19%, heading toward major resistance targets at $0.9541 and $1.2383.

ARB and AVAX Fractal Chart/Coinsprobe (Source: Tradingview)

ARB and AVAX Fractal Chart/Coinsprobe (Source: Tradingview)

Now, AVAX appears to be tracing the same path.

After breaking out of its own falling wedge, AVAX is currently testing a critical resistance zone between $25.65 and $27.38, also marked in red on the chart. This area is crucial because a clean breakout above it could replicate ARB’s momentum-driven move.

What’s Next for AVAX?

If AVAX successfully clears $27.38, it could trigger a strong rally, with the next upside targets at $45.08 and $55.80. From current prices, that represents a potential 114% rally—a move that would firmly confirm the bullish fractal setup.

However, caution is warranted. In a bearish case, failure to hold above the 100-day and 200-day moving average support around $21.50 could invalidate the bullish structure and expose AVAX to downside pressure.