What Crypto Whales Are Buying After Powell’s Jackson Hole Speech

Crypto whales are moving selectively after Powell’s Jackson Hole speech, with Cardano, Chainlink, and Morpho seeing fresh accumulation. The buying suggests whales are eyeing key breakouts, even as retail interest spreads across the market.

While the broader crypto market has bounced, Bitcoin up 2.2%, Ethereum surging 10.1%, and XRP gaining 6.5%, whales are not chasing every rally. Instead, large holders are moving selectively, concentrating their bets on tokens where they see the strongest risk-reward.

This divergence explains why some assets remain range-bound despite the broader recovery, while others are attracting heavy inflows. Tracking what coins crypto whales are buying after Powell’s Jackson Hole speech offers a clearer picture of where big money expects momentum to build next. Read on as we have identified three such coins.

Cardano (ADA)

Cardano has quickly joined the list of altcoins crypto whales are buying as optimism builds around potential September rate cuts following Powell’s Jackson Hole speech. While ADA’s rally has been steadier, suggesting it may still have room to catch up.

On-chain data shows renewed whale interest. Wallets holding between 10 million and 100 million ADA lifted their balances from 12.97 billion to 13.08 billion ADA in just 24 hours. That’s an addition of 110 million ADA, worth roughly $102 million at the current price of $0.93.

Cardano as one of the Coins Crypto Whales are Buying:

Santiment

Cardano as one of the Coins Crypto Whales are Buying:

Santiment

Meanwhile, mega whales holding more than 1 billion ADA had already moved earlier in August, raising their stash from 1.82 billion to 1.88 billion ADA; an increase of about 60 million ADA, valued at almost $55.8 million.

This scale of accumulation highlights conviction among large holders that ADA could benefit strongly if the Fed confirms easing in September.

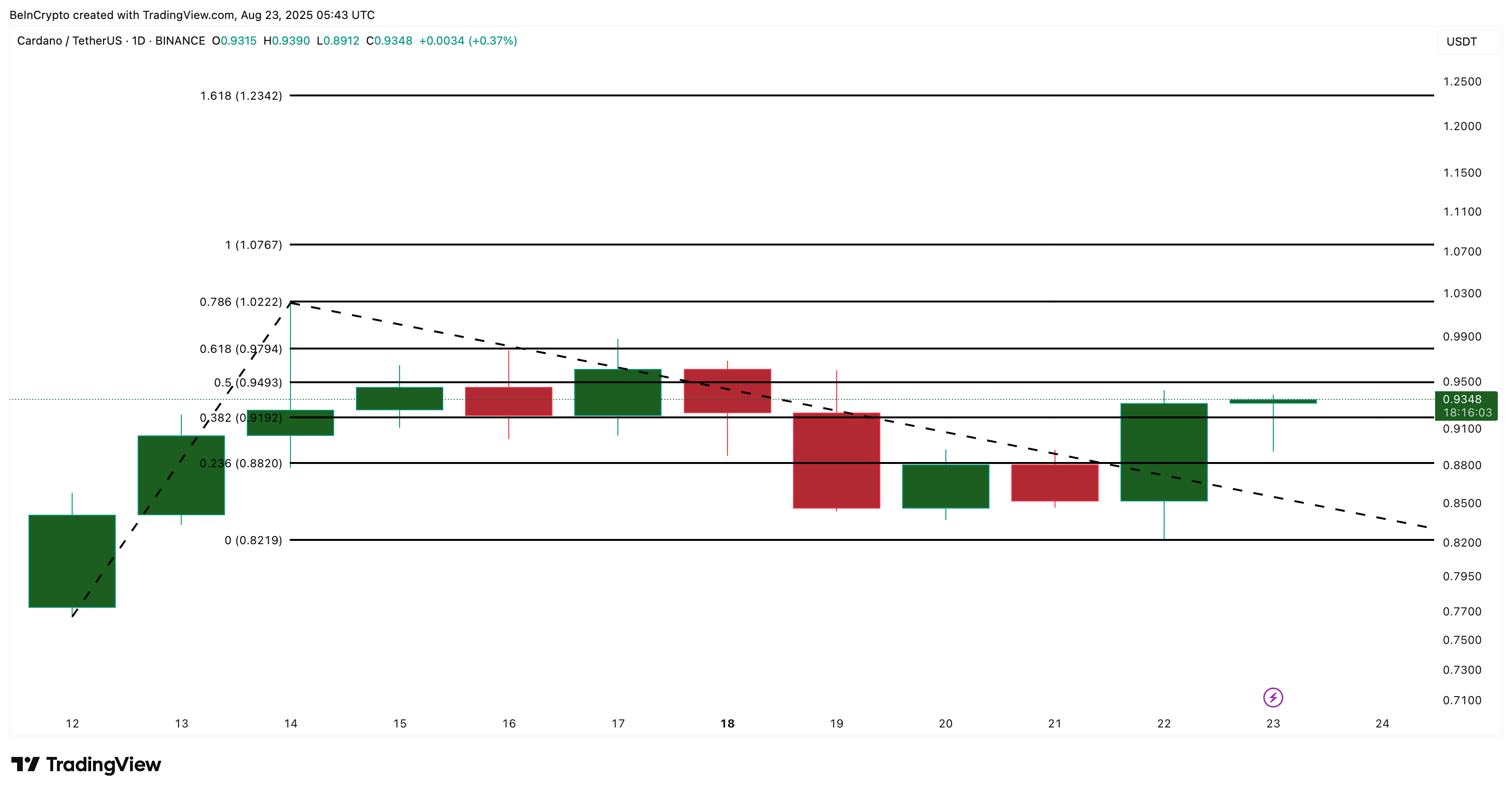

Cardano price analysis:

TradingView

Cardano price analysis:

TradingView

From a price perspective, ADA is trading near $0.93, up more than 8% in the past 24 hours, though still slightly down –2% over the week. Immediate resistance sits at $0.94 and $0.97, with a breakout potentially opening the door to the $1 psychological level.

Above that, limited resistance could carry ADA toward $1.23. However, a breakdown below $0.82 would invalidate the bullish setup in the short term, potentially shaking even the confidence reflected in whale buying.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Chainlink (LINK)

Chainlink is another name among the coins crypto whales are buying, supported by broad investor participation. Over the last 24 hours, whales added about 64,674 LINK (almost $1.69 million) to bring their stash up to 5.64 million LINK.

LINK Whales adding to their stash:

Nansen

LINK Whales adding to their stash:

Nansen

Exchange balances have dropped by 0.6%, signaling retail accumulation alongside whale activity, while smart money and top addresses have also increased their exposure. Balances dropped by about 1.59 million LINK, equal to roughly $41.6 million at the current price of $26.13.

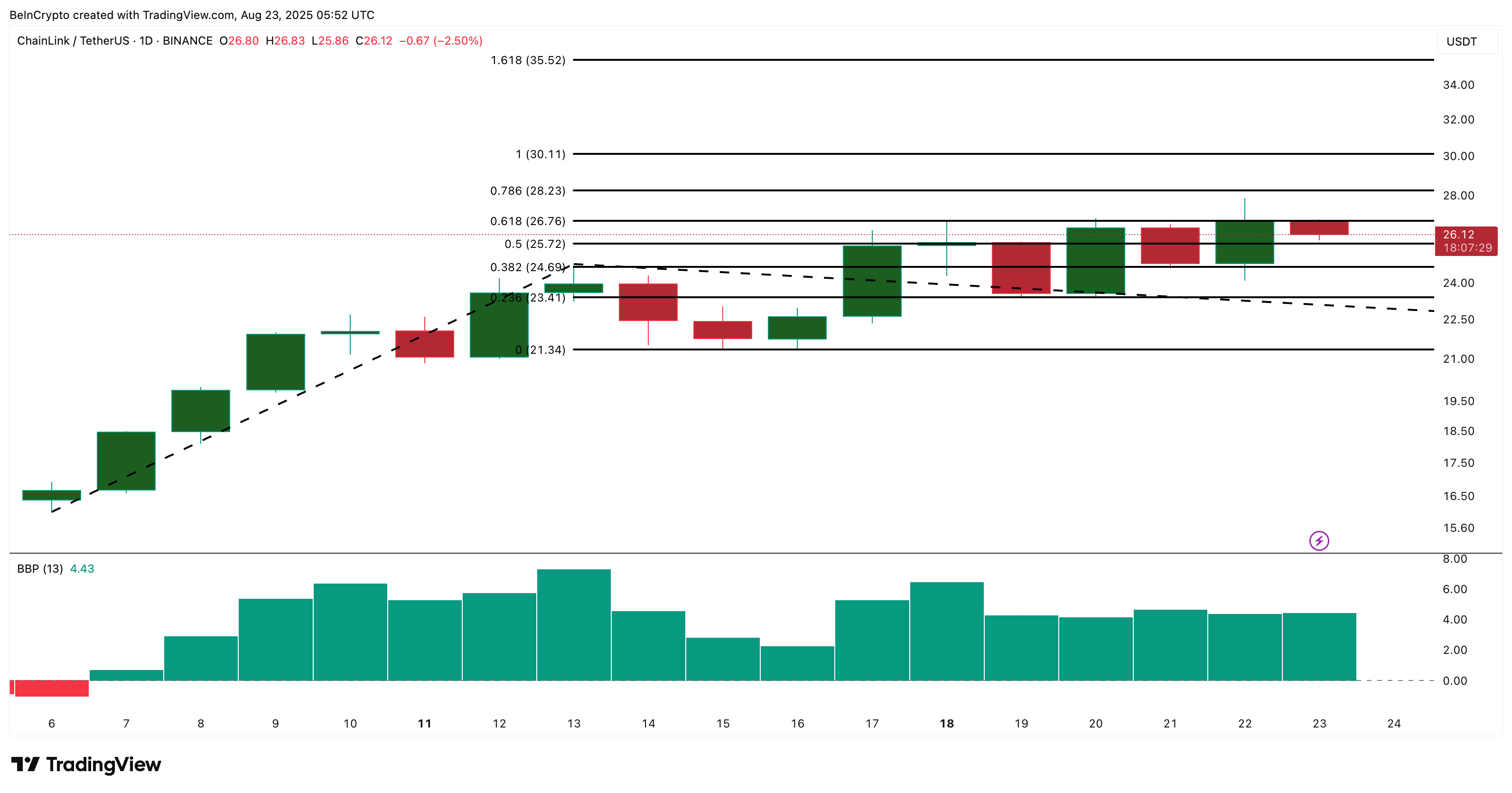

LINK price analysis:

TradingView

LINK price analysis:

TradingView

Price-wise, LINK has rallied nearly 70% in the past three months and remains in an uptrend. The token is currently testing the 0.618 Fibonacci retracement at $26.76, widely considered a strong resistance. If that level breaks, LINK could climb to $30, with whales likely eyeing an extension target at $35.52.

Importantly, the bull-bear power indicator has stayed green for 17 straight sessions, confirming consistent bullish momentum not often seen in recent rallies.

With Powell’s signal of easier liquidity conditions, whales may be betting on LINK as a leading oracle play with solid technical backing.

Bull Power Indicator measures the strength of buyers by comparing the day’s highest price with a moving average, showing how much bulls can push above the average trend.

Morpho (MORPHO)

Morpho, a DeFi protocol enabling lending and borrowing through efficient vaults, is also drawing whale attention.

In the past 24 hours, whale wallets boosted their holdings by 1.32%, bringing their total to 3.74 million MORPHO, now valued near $9.9 million at the current price of $2.64.

Morpho is one of the coins crypto whales are buying:

Nansen

Morpho is one of the coins crypto whales are buying:

Nansen

At the same time, exchange reserves fell by 1.35% ( currently at 21.32 million MORPHO), reflecting parallel retail buying.

Morpho has outperformed the broader market with 9.4% daily gains and nearly 77% growth in the past three months.

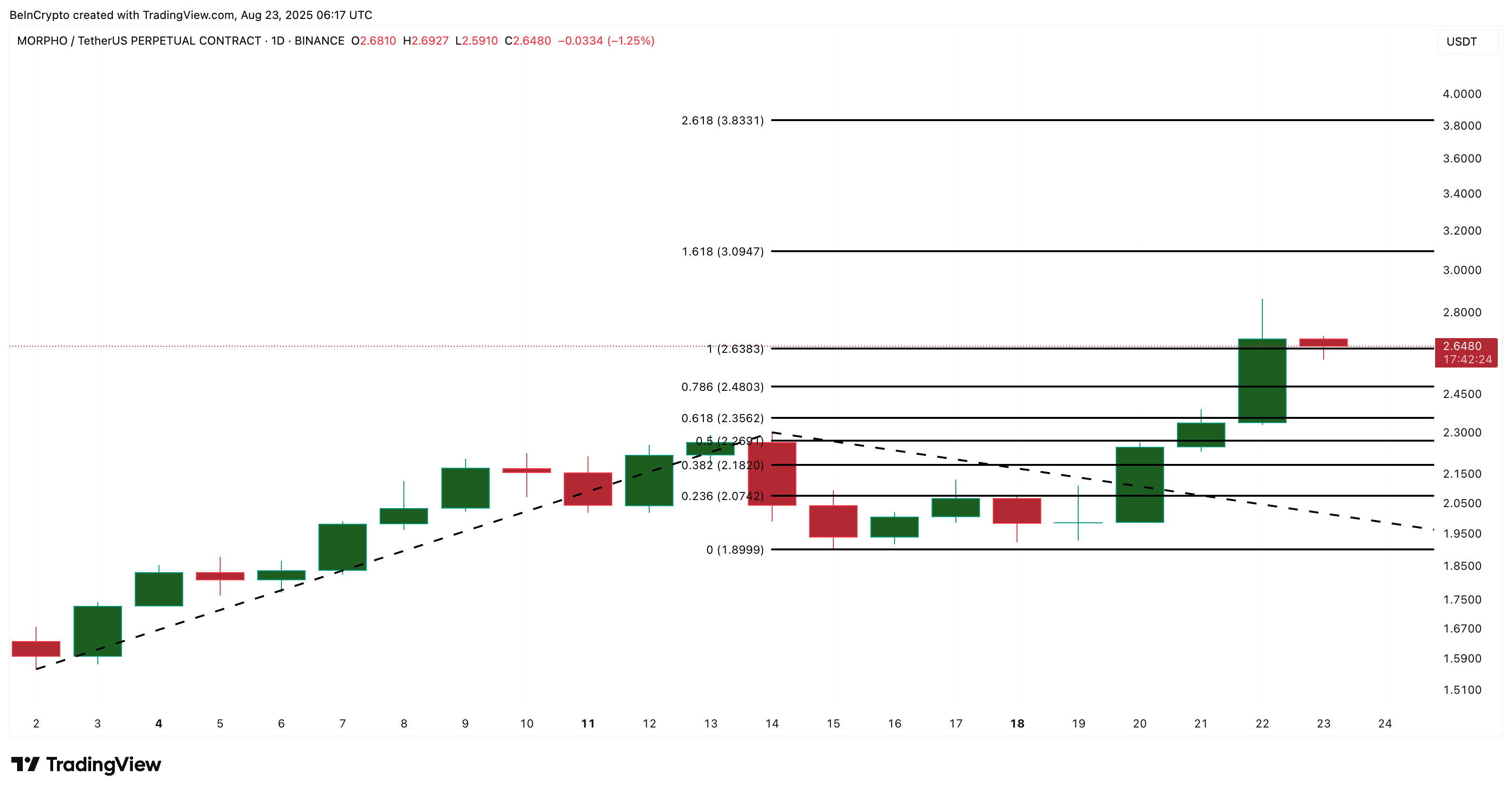

On the chart, it recently broke above a critical resistance at $2.63 and is now targeting $3.09, with potential upside to $3.80 if momentum sustains.

MORPHO price analysis:

TradingView

MORPHO price analysis:

TradingView

Longer term, Fibonacci extensions suggest $4.57, which would mark a new all-time high. Invalidation lies below $2.18, where the bullish setup would turn bearish.

With Powell hinting at rate cuts and DeFi primed to benefit from renewed liquidity, whales appear to be positioning Morpho as one of the breakout coins to watch.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

What kind of judicial game is hidden behind CZ's pardon?

Under market selling pressure, which funds are buying BTC and ETH against the trend?

Messari Report: Filecoin 2025 Q3 Status Survey

Revealing key data such as network utilization and storage volume, showcasing its ecosystem and economic dynamics.

"Whales" Accelerate Bitcoin Sell-Off, But Is It Really a Panic Signal?

Some "whale" wallets are showing regular selling patterns, which may be related to profit-taking rather than panic signals, but the market's ability to absorb these sales has weakened.