Dogecoin Price Explosion: Is $1 Back on the Table?

Dogecoin price has once again become the center of market attention after a string of regulatory and corporate developments coincided with a sharp price rebound. From a Trump-linked $50 million acquisition in DOGE mining to Wyoming launching the first state-backed stablecoin, the environment around digital assets is shifting. Add to that the Federal Reserve signaling a softer stance on crypto, and you have the perfect recipe for institutional inflows into meme coins like DOGE.

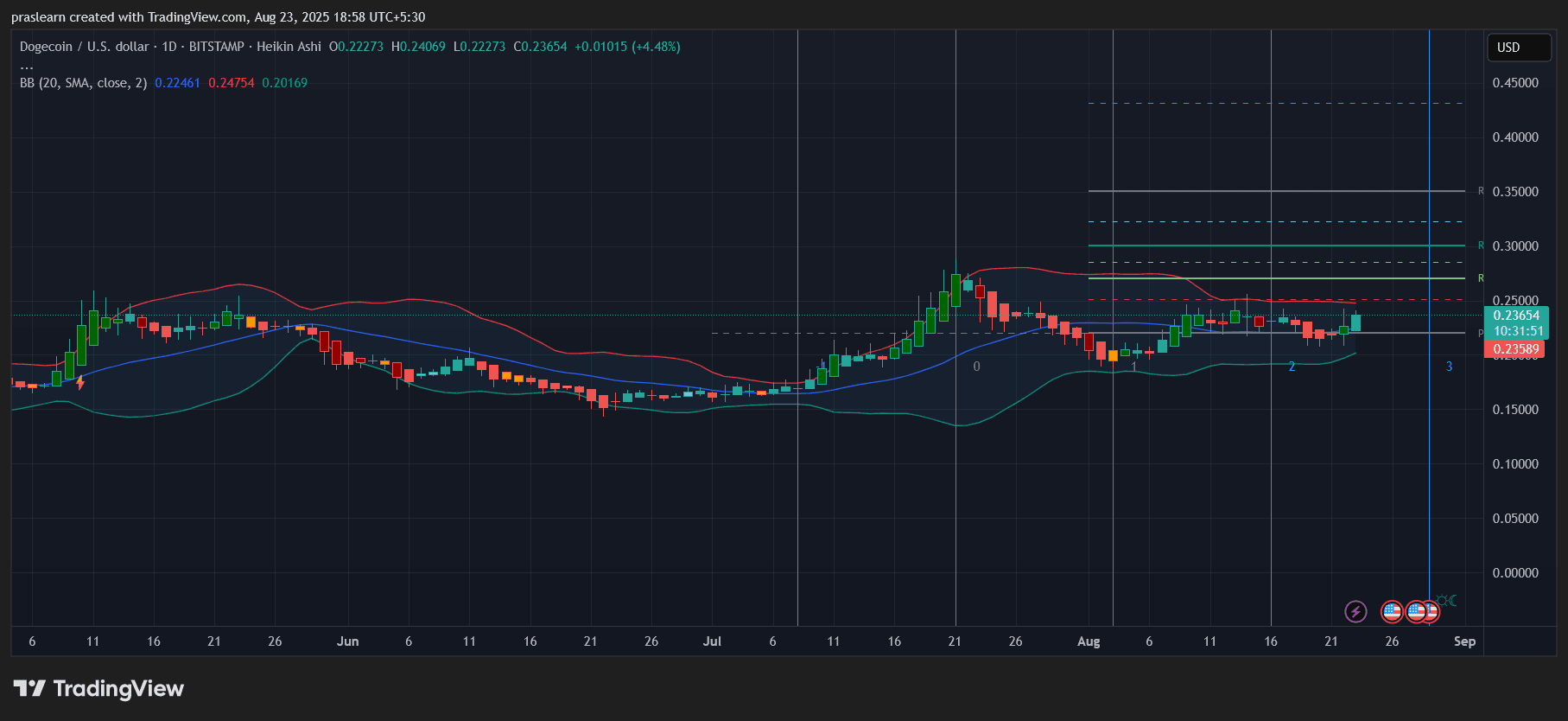

The daily chart now reflects this renewed optimism, with price action pushing past short-term resistance and testing the upper Bollinger Band. The big question: can this wave of institutional confidence sustain a rally toward 30 cents and beyond?

Dogecoin Price Prediction: Why the News Matters for DOGE Price?

The $50 million acquisition of Dogehash by Thumzup , a Trump-affiliated entity, is more than just a headline. It signals confidence in Dogecoin infrastructure from politically connected, deep-pocketed backers. This isn’t speculative retail enthusiasm — it’s a show of long-term commitment to DOGE mining .

Wyoming’s state-backed stablecoin, the Frontier Stable Token, adds legitimacy to U.S. digital assets and indirectly strengthens DOGE’s narrative as a parallel, community-driven coin. At the same time, Fed Vice Chair Michelle Bowman’s comments warning banks against delaying digital asset adoption signal that regulatory headwinds are easing. Together, these catalysts explain why institutional flows picked up sharply this week.

Chart Analysis: Dogecoin Daily Trend

DOGE/USD Daily Chart- TradingView

DOGE/USD Daily Chart- TradingView

On the daily chart, DOGE price is trading at $0.236, up 4.5% on the session. The move took price back above the 20-day simple moving average and toward the midpoint of the Bollinger Band range.

Key observations from the chart:

- Strong support sits around $0.21, where DOGE consolidated with heavy volume earlier this week.

- The first resistance zone is near $0.25, coinciding with the upper Bollinger Band. A breakout here could quickly open up the $0.28–$0.30 range.

- A sustained close above $0.30 would target $0.35 and potentially $0.42 based on Fibonacci extensions.

Momentum has turned positive, but volumes will need to remain high for follow-through. The chart shows higher lows forming, which strengthens the bullish case.

Institutional Flows vs Retail Speculation

DOGE’s latest rally has been driven less by retail euphoria and more by institutional positioning. Large trading volumes between $0.21–$0.22 suggest accumulation. If institutions continue to see DOGE as an on-ramp into broader crypto narratives, price stability above $0.25 could invite further flows.

The difference this time is that DOGE price isn’t just riding Elon Musk’s tweets or meme hype — it’s riding real structural shifts in U.S. digital asset adoption.

Dogecoin Price Prediction: Near-Term and 30-Day Outlook

- Bullish scenario: A break above $0.25 could ignite momentum toward $0.30 in the coming week. If volume supports the move, $0.35–$0.42 becomes a realistic 30-day target.

- Neutral scenario: DOGE price consolidates between $0.21 and $0.25, with sideways movement as traders digest the news.

- Bearish scenario: A breakdown below $0.21 would re-expose $0.18 as support, invalidating the bullish thesis.

Given the combination of chart strength and regulatory tailwinds, the probability currently leans bullish.

Final Takeaway

Dogecoin price recent surge isn’t just another meme rally — it’s the result of institutional adoption signals and regulatory momentum in the U.S. With $50 million pouring into DOGE mining, a state-backed stablecoin in Wyoming, and the Fed softening its tone, the backdrop for DOGE is stronger than it has been in months.

As long as DOGE holds above $0.21, the path toward $0.30 looks increasingly viable. A decisive breakout there could set the stage for a much larger rally into the 35–40 cent range in the coming month.

$Dogecoin, $DOGE

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BTC Signs Potential Mid-Cycle Bottom As Fear Grips the Market

The "Black Tuesday" for US stock retail investors: Meme stocks and the crypto market plunge together under the double blow of earnings reports and short sellers

Overnight, the US stock market experienced its worst trading day since April, with the retail-heavy stock index plunging 3.6% and the Nasdaq dropping more than 2%. Poor earnings from Palantir and bearish bets by Michael Burry triggered a sell-off, while increased volatility in the cryptocurrency market added to retail investor pressure. Market sentiment remains tense, and further declines may follow. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved by the Mars AI model.

Crypto Market Macro Report: US Government Shutdown Leads to Liquidity Contraction, Crypto Market Faces Structural Turning Point

In November 2025, the crypto market experienced a structural turning point. The U.S. government shutdown led to a contraction in liquidity, pulling about 20 billions USD out of the market and intensifying capital shortages in the venture capital sector. The macro environment remains pessimistic.

Market volatility intensifies: Why does Bitcoin still have a chance to reach $200,000 in Q4?

Institutional funds continue to buy despite volatility, targeting a price level of $200,000.