NFT sales drop 25% to $134m, CryptoPunks plunge 59%

The NFT market has experienced a sharp correction with sales volume dropping by 25.78% to $134 million. This reversal follows the previous week’s recovery.

- NFT sales fall 25% to $134M, but buyers and sellers both rise over 25%

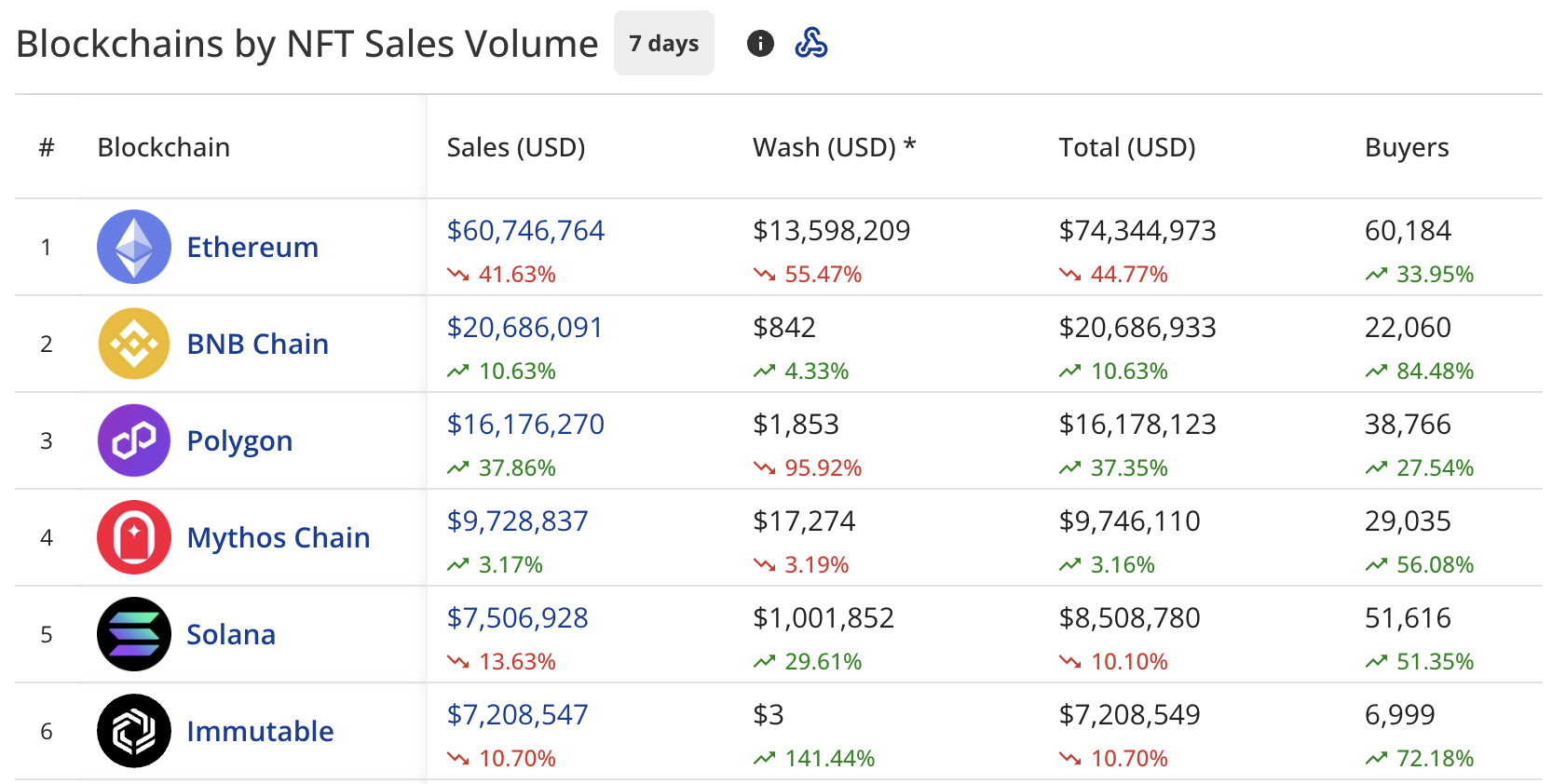

- Polygon and BNB post strong gains while Ethereum sales drop 41%

- Courtyard leads collections with $14.7M sales, CryptoPunks plunge 59%

As per CryptoSlam data, despite the sales decline, market participation has continued to expand. NFT buyers have grown by 25.74% to 450,096, and NFT sellers have risen by 25.91% to 321,107. NFT transactions have increased by 6.26% to 1,652,284.

The market situation is also volatile as the Bitcoin ( BTC ) price has dropped to the $115,000 level. At the same time, Ethereum ( ETH ) has risen to $4,700. The global crypto market cap is now $3.98 trillion, up from last week’s market cap.

Ethereum maintains lead in sales

Ethereum has maintained its leading position with $60.7 million in sales, though declining 41.63% from the previous week. Ethereum’s wash trading has fallen by 55.47% to $13.5 million.

BNB ( BNB ) Chain has held second place with $20.6 million, rising 10.63%. Polygon ( POL ) has climbed back to third position with $16.1 million, surging 37.86%.

Source: Blockchains by NFT Sales Volume (CryptoSlam)

Source: Blockchains by NFT Sales Volume (CryptoSlam)

Mythos Chain remains in fourth with $9.7 million, up 3.17%. Solana ( SOL ) sits in fifth with $7.5 million and dropped 13.63%.

Immutable ( IMX ) holds sixth place with $7.2 million, down 10.70%. Cardano ( ADA ) has entered the top seven with $3.1 million, jumping 48.96%.

NFT buyer count jumps

The buyer count has increased across most blockchains, with Cardano leading at 91.41% growth, followed by BNB Chain at 84.48% and Immutable at 72.18%.

Courtyard on Polygon has reclaimed the top spot in collection rankings with $14.7 million in sales, surging 41.01%. The collection has seen growth in buyers (186.96%) and transactions (45.28%).

SpinNFTBox on BNB Chain holds second place with $10.9 million, rising 39.83%. The collection continues to be dominated by a single seller despite having 1,424 buyers.

CryptoPunks has fallen to third place with $8.7 million, plunging 59.28%. The collection has seen decreases across all metrics, including transactions (56.98%), buyers (52.78%), and sellers (30.23%).

Moonbirds sits in fourth with $7.4 million, up 29.94%. DMarket holds fifth place with $4.6 million, rising 8.70%. Guild of Guardians Heroes rounds out the top six with $4.2 million, growing 18.72%.

Notable high-value sales from this week include:

- CryptoPunks #1082 sold for 80 ETH ($350,969)

- CryptoPunks #2596 sold for 72.99 ETH ($315,628)

- CryptoPunks #5477 sold for 66 ETH ($285,187)

- CryptoPunks #3704 sold for 63 ETH ($271,922)

- CryptoPunks #8864 sold for 56.5 ETH ($269,994)

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Vitalik praised the Ethereum Fusaka upgrade.

Bitwise: Don't worry, the Strategy will never sell its bitcoin holdings

Massive Leverage Triggers Crypto Flash Crash

Fusaka is activated: Ethereum enters a new era