Market cycles often turn on small but symbolic signals. This week, one such signal emerged from Cardano. The formation of a death cross on ADA’s hourly chart has marked a loss of short-term momentum that has unsettled its largest holders, several of whom began liquidating positions after months of cautious accumulation.

While Cardano grapples with weakening sentiment, a very different current is pulling traders elsewhere. Layer Brett ($LBRETT) , a newly launched Ethereum-based meme coin with a utility twist, has ignited a frenzy with 3,000% staking rewards that dwarf traditional offerings.

Cardano’s Death Cross and Whale Exodus

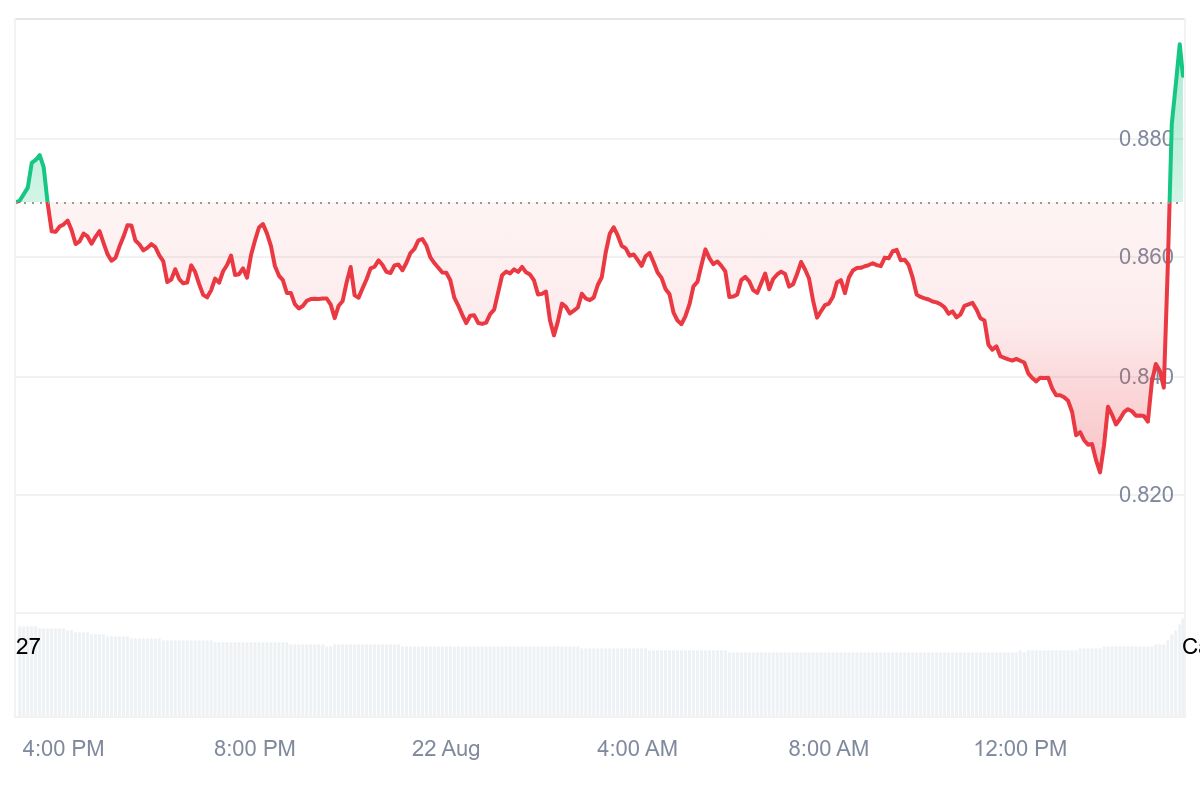

Cardano price analysis. Source: Bitget

Cardano has long styled itself as one of the market’s most resilient altcoins, but the latest technical patterns tell a story of pressure mounting. On the hourly chart, ADA’s short-term moving average crossed below its longer-term average, forming what analysts describe as a death cross. This signal typically reflects waning bullish momentum, and for ADA, it followed a sharp pullback: the token fell from $0.987 to $0.82.

ADA price chart. Source: CoinMarketCap

The timing could not have been worse. Broader macroeconomic currents had already pushed Bitcoin below $112,000, eroding sentiment across the altcoin market. In ADA’s case, the technical breakdown accelerated the sell-off. Weekly losses hovered around 8%, and momentum indicators suggested further weakness if volume failed to return.

Yet, on-chain analysts reported that despite months of accumulation, large holders suddenly offloaded significant ADA reserves. The shift indicates that even institutional-sized traders are choosing to step back from Cardano’s near-term risk profile as many anticipate the coin will remain rangebound for the remainder of the year.

Layer Brett: The Meme Coin With Staggering Utility

Against this backdrop of uncertainty, Layer Bret t has entered the scene with a momentum rarely seen outside peak bull markets. Unlike Cardano’s slow grind through technical hurdles, Layer Brett’s rise has been sharp, fueled by strong investor demand within days. Early investors have watched the token’s price climb from $0.004 to $0.0044, a move that reflects both surging demand and an expanding holder base.

But what has truly set Layer Brett apart is its utility-first approach to meme culture. While many meme coins rely solely on viral branding and community hype, Layer Brett has engineered tangible features designed to sustain long-term engagement. Chief among these is its staking mechanism, which promises an extraordinary 3,000% annual percentage yield in its early phases.

Beyond this, Layer Brett’s positioning on Ethereum’s network gives it technical advantages that resonate with serious traders. It benefits from Ethereum’s security and liquidity while offering the scalability enhancements of its Layer-2 design. This ensures that trading, staking, and future utility integrations can operate at lower costs and higher speeds—an essential upgrade over OG meme tokens like Dogecoin or Shiba Inu.

Conclusion

The divergence between Cardano and Layer Brett captures the essence of today’s crypto market. While ADA wrestles with bearish technicals and a wave of whale exits, Layer Brett has harnessed novelty, utility, and sheer investor appetite to stand out this year.

With its price already advancing, staking rewards drawing in thousands, and strong growth recorded in record time, the project stands as a striking alternative for traders weary of flat performance in traditional altcoins.