Bitcoin reclaims $116K, Ether, XRP push higher after Fed's Powell hints at possible rate cuts

Key Takeaways

- Bitcoin surged above $116,000 following Federal Reserve Chair Powell's signal of possible rate cuts.

- Powell emphasized a data-driven approach to monetary policy, citing resilience in the economy and ongoing inflation concerns.

Bitcoin climbed over 3% on Friday to trade above $116,000 as optimism in crypto markets picked up after Federal Reserve Chair Jerome Powell gave a cautious signal that the central bank could move toward lowering interest rates.

Speaking at the Fed’s Jackson Hole event, Powell noted that inflation is still “somewhat elevated” but has eased substantially from post-pandemic highs.

The Fed is facing a delicate balance, he said, with upside pressures on inflation and downside pressures on employment. He added that the current policy rate is closer to neutral and the labor market is stable, giving the Fed room to proceed cautiously.

“The baseline outlook and the shifting balance of risks may warrant adjusting our policy stance,” Powell said.

“Monetary policy is not on a preset course. FOMC members will make these decisions based solely on their assessment of the data and its implications for the economic outlook and the balance of risks,” Powell stressed.

According to the central bank leader, tariffs could push inflation higher, but the base case is that price increases will be short-lived. The Fed remains vigilant against stagflation and is committed to its 2% inflation target.

Powell’s remarks quickly lifted crypto and stock markets as investors read the speech as more dovish than expected.

Bitcoin hit $116,000 after retreating below $112,000 earlier this week in anticipation of Powell’s hawkish stance, while other major crypto assets also moved higher following the speech.

Ethereum jumped 7% to $4,600. XRP, Solana, and Chainlink each gained over 6%, while Dogecoin and Cardano rose around 8% on the speech.

The total crypto market capitalization surpassed $4 trillion, rising by 2% in a day.

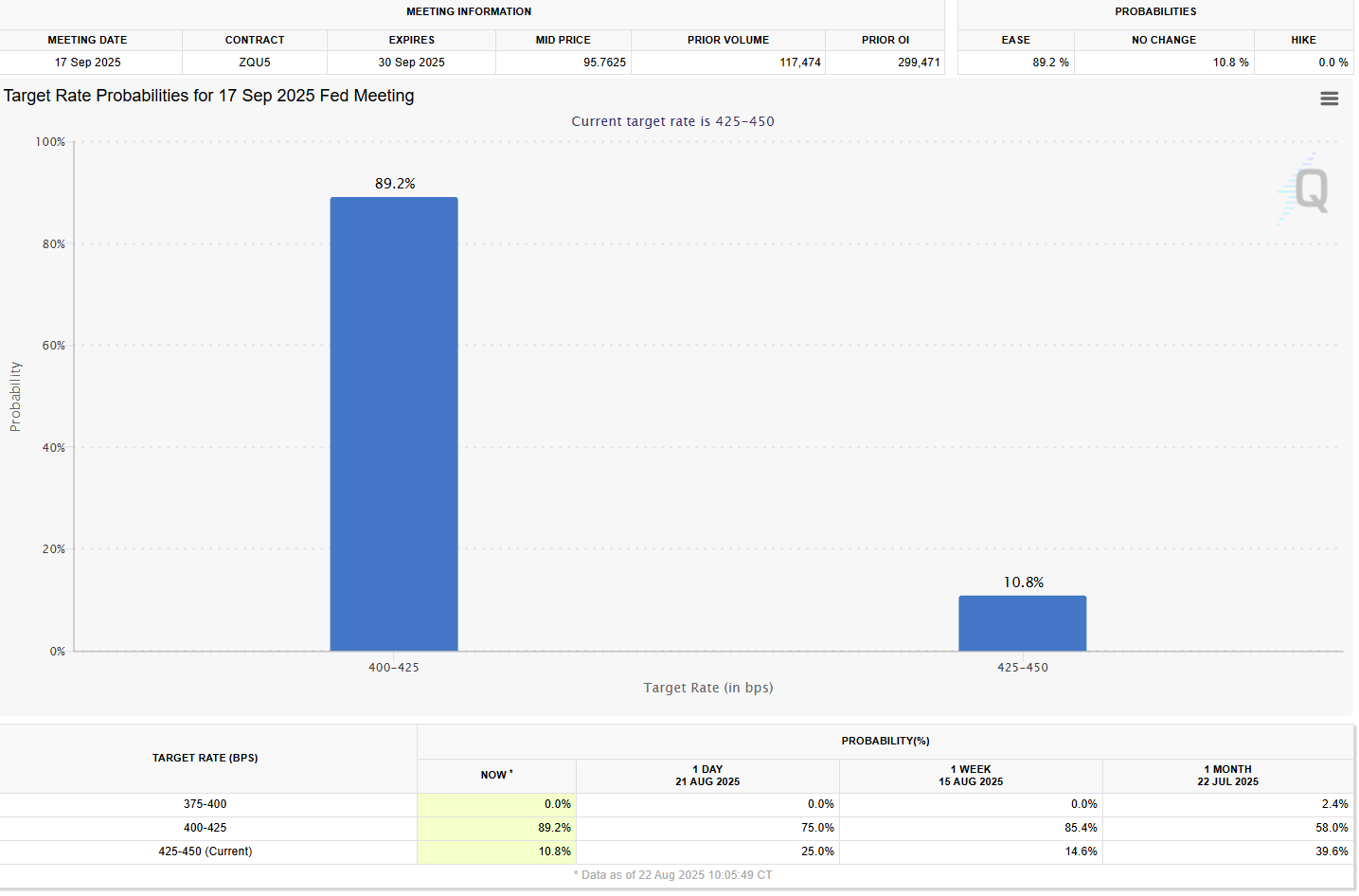

Traders are now overwhelmingly betting the Fed will deliver a quarter-point rate cut in September, with odds lifting to nearly 90% from just 75% in the previous session, according to FedWatch Tool data .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitget donates HK$12 million to support fire rescue and reconstruction efforts in Tai Po, Hong Kong

Bitget Spot Margin Announcement on Suspension of ELX/USDT Margin Trading Services

Enjoy perks for new grid traders and receive dual rewards totaling 150 USDT

Bitget Spot Margin Announcement on Suspension of BEAM/USDT, ZEREBRO/USDT, AVAIL/USDT, HIPPO/USDT, ORBS/USDT Margin Trading Services