- Yeezy Money (YZY) hit $3B market cap before crashing over 60% in hours.

- Top wallets hold nearly 90% of the supply, sparking rug-pull fears.

- Insider trades flipped $450K into $1.5M within launch day.

Kanye West’s bold entry into the world of digital assets has taken a dramatic turn.

His Solana-based crypto, Yeezy Money (YZY), launched with fanfare and hype that briefly pushed its market capitalisation to $3 billion.

However, within hours, the YZY coin’s value collapsed, leaving investors staring at losses of more than 60%.

The launch of Yeezy Money was marked by a mix of celebrity power, technical intrigue, and immediate controversy.

Kanye West, who has rebranded himself as Ye, used his official account to promote the token with a short clip claiming “The official Yeezy token just dropped.”

But what followed was one of the most volatile trading debuts in recent memory.

From $3 billion peak to freefall

Moments after launch, the YZY token surged to more than $3 billion in market capitalisation.

At one point, it was trading above $3 per token, sparking a frenzy across Solana-based exchanges.

The hype attracted big names in the crypto space. Arthur Hayes, co-founder of BitMEX , publicly admitted buying into YZY, at first joking that he hoped West would not “rug” him.

Hours later, as prices tumbled, Hayes conceded that he had made a mistake, writing that he should not have traded “shitters” like YZY.

Oopsie … fam next time pls don’t let me trade shitters like $YZY . Should have just kept two-steppin. pic.twitter.com/6oiKLNv9Mo

— Arthur Hayes (@CryptoHayes) August 21, 2025

Other traders, including leverage specialist James Wynn, also took positions, highlighting how even seasoned market participants can get swept up in celebrity-driven frenzies.

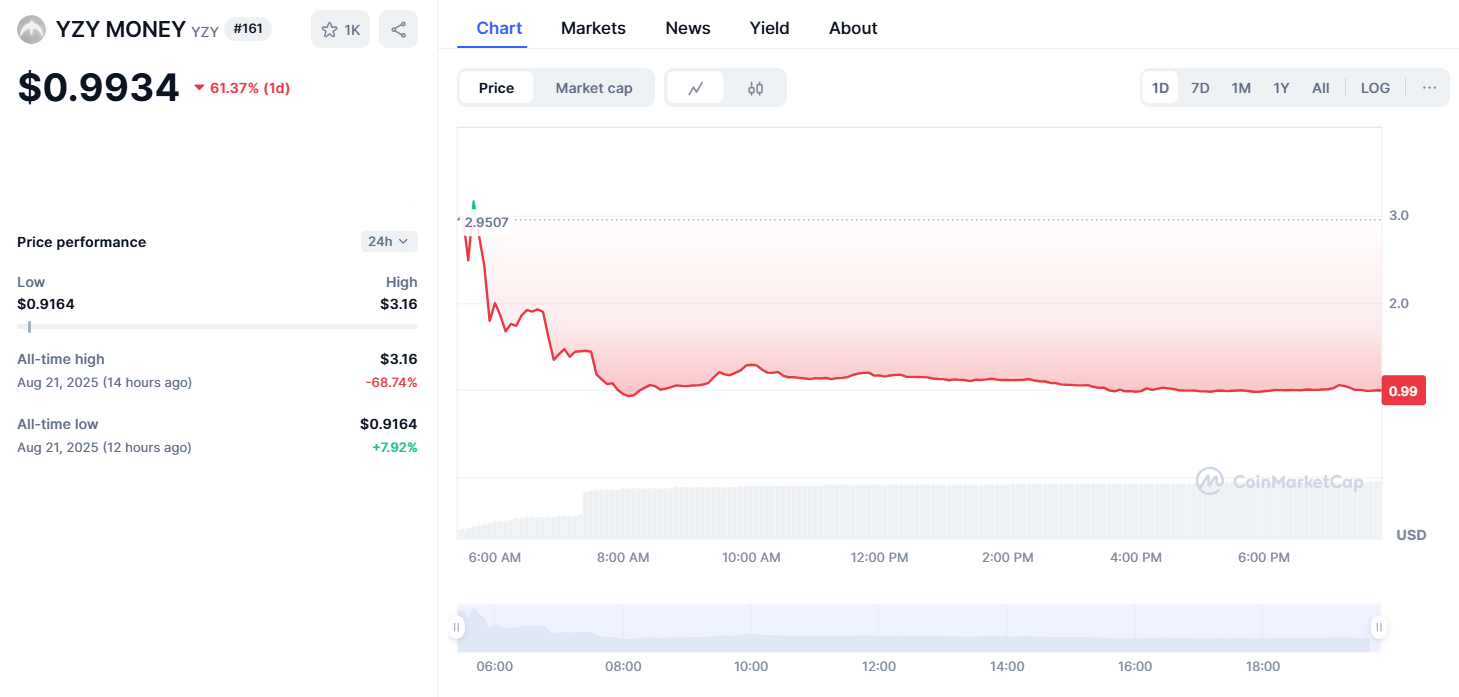

The YZY token rally was very short-lived. Within three hours, the token shed more than 65% of its value, tumbling below $1.20.

By Thursday evening, the coin had fallen even further. CoinMarketCap showed it trading around $0.99, down 61% in a single day.

The crash left its market capitalisation hovering near $298 million, a fraction of the peak it had touched just hours earlier.

The heavy trading volume told its own story. In the first 24 hours, YZY recorded nearly $1 billion in trades, with volume surging by more than 37,000%.

For many traders, the swings underscored the risks of a token built more on celebrity hype than demonstrable utility.

Insider wallets raise alarms

On-chain analysis quickly highlighted troubling patterns. On-chain data reveals that the top six wallets controlled close to 90% of the total supply.

In fact, one multisignature wallet alone accounted for 87% before distribution. Such concentration has left critics warning of a textbook “rug pull” scenario.

LookOnChain, a blockchain analytics firm, flagged several wallets that appeared to have privileged access to the token before the public.

One insider spent about $450,000 in USDC to secure 1.29 million YZY at a low entry price, only to flip the holdings for more than $1.5 million within hours.

An insider spent 450K $USDC to buy 1.89M $YZY at $0.24 via 2 wallets, then sold 1.59M $YZY for 3.37M $USDC at $2.12.

He still holds 303,425 $YZY ($510K), with a profit of over $3.4M (+760%).

To ensure he got in first, one wallet even paid 129 $SOL ($24K) in priority fees.… pic.twitter.com/HaUeEjcmSC

— Lookonchain (@lookonchain) August 21, 2025

For retail traders who entered later, the story was very different, with some losing hundreds of thousands of dollars after buying into the wrong contracts or chasing inflated prices.

Kanye’s shifting stance on crypto

The YZY launch has drawn attention because of Kanye West’s previous comments on digital currencies.

Earlier this year, Kanye dismissed memecoins as scams that exploit fans through hype.

He even claimed that he turned down a $2 million offer to promote a fake cryptocurrency, warning at the time that such schemes “scam the public out of tens of millions of dollars.”

Kanye’s decision to front Yeezy Money, therefore, came as a surprise.

The official website pitched it as the foundation of a new financial ecosystem, complete with Ye Pay, a payment processor meant to undercut traditional card networks, and the YZY Card, a tool for spending in both crypto and fiat.

The platform claimed to be “a new economy, built on chain,” though many observers noted that no working products accompanied the promises.

Despite the turbulence, Yeezy Money has carved out a cultural moment.

Like Donald Trump’s NFT collections or Iggy Azalea’s token launches, West’s venture into crypto underscores the growing crossover between pop culture and digital finance.

Solana itself even saw a boost, rising more than 2% as investors chased the hype.