BTCS rolls out Ethereum ‘bividend’ as NAV discount lingers

The company will pay a $0.05 dividend and a $0.35 ETH loyalty payout in ether

Ether treasury company BTCS is leaning into its “Ethereum-first” identity with a one-time blockchain dividend: a $0.05 per-share payout in ETH, plus an optional cash alternative for investors who don’t opt in.

The company also unveiled a $0.35 per-share loyalty payment — payable only in ETH — for holders who move shares to book entry with its transfer agent and keep them there through Jan. 26, 2026. Instead of your shares being held at your broker, they’re recorded in your name on the company’s official shareholder register.

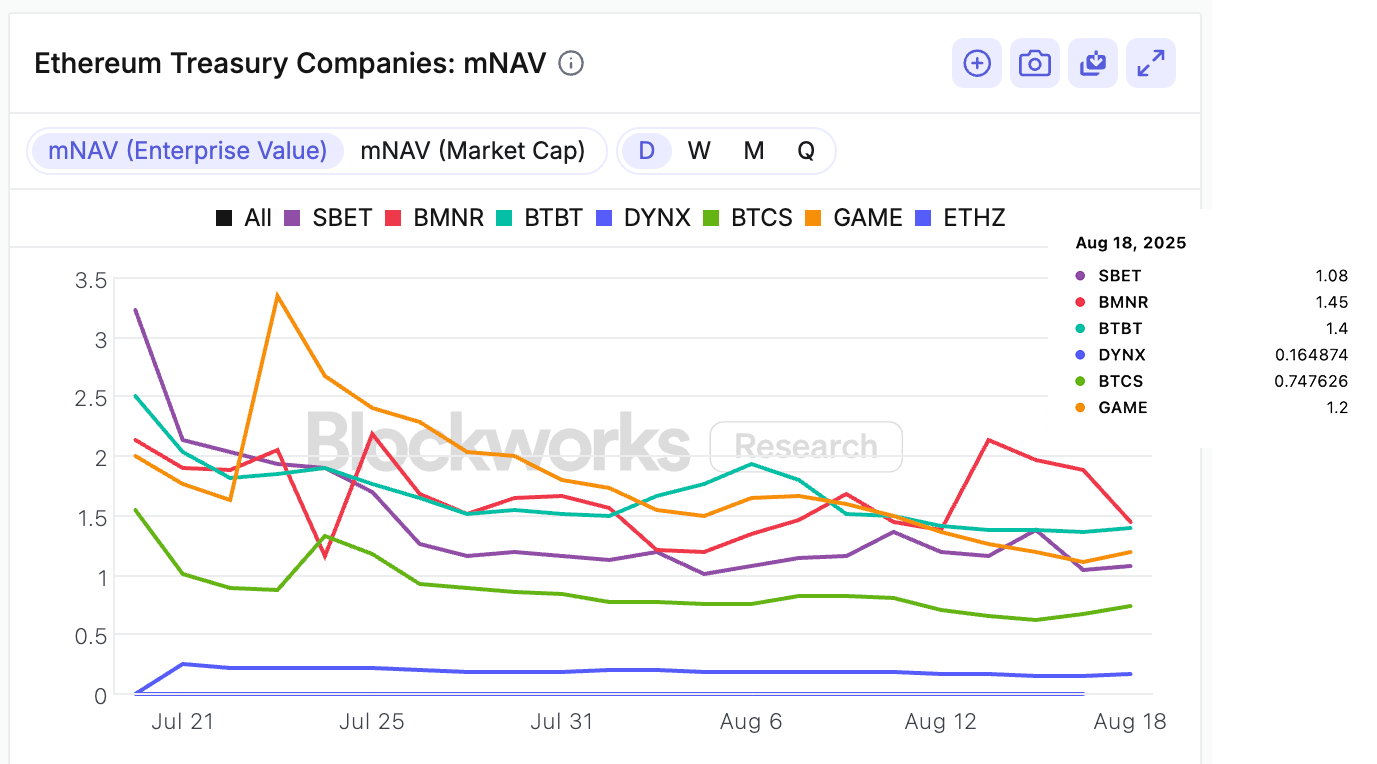

Framed as both a reward and a balance-sheet signal, the move arrives while BTCS trades below its asset base. Management points to a $4.41 share price on August 15 against roughly $6.65 per share in cash and digital assets. That valuation gap also shows up in Blockworks Research’s mNAV (enterprise value / net asset value) tracker of Ethereum-treasury peers.

Source: Blockworks Research

Source: Blockworks Research

As of Aug. 18, BTCS sat near the low end at ~0.75×, compared with SBET ~1.08×, GAME ~1.20×, and BMNR/BTBT ~1.40–1.45×; only DYNX was lower. In other words, the market is still assigning BTCS a below-peer multiple on its balance sheet.

CEO Charles Allen cast the program as both shareholder alignment and a shot across the bow against short sellers.

“As the largest shareholder of BTCS, let me be perfectly clear: my goal is to grow our market cap primarily through share price appreciation, not toxic dilution,” he wrote on X, adding that concentrating shares at the transfer agent is intended to make them harder to borrow for shorting.

Operationally, investors who want ETH must complete an opt-in at bividend.com and transfer shares to Equity Stock Transfer before the record date; otherwise, they’ll receive $0.05 in cash. The loyalty payment is paid after 120 days to those who keep shares in book entry for the full window.

Whether this closes BTCS’s valuation gap is the open question. The persistent mNAV discount suggests investors are still pricing execution risk around the company’s DeFi/TradFi “accretion flywheel,” ETH-denominated revenue exposure, and liquidity dynamics.

Still, paying out effectively a share dividend in ether is novel. If the program meaningfully shrinks lendable float and builds a stickier base, the multiple could drift toward peers. If not, BTCS will still have delivered a crypto-native distribution that puts real ETH in loyal holders’ wallets but, considering its shares have fallen about –40% over the past month, while ETH is up 20%, that may be a small consolation.

The record date for the “bividend” is Sept. 26, 2025. To qualify, you’d need to own shares by the close on Wed, Sept. 24 (or earlier).

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown : Decoding crypto and the markets. Daily.

- 0xResearch : Alpha in your inbox. Think like an analyst.

- Empire : Crypto news and analysis to start your day.

- Forward Guidance : The intersection of crypto, macro and policy.

- The Drop : Apps, games, memes and more.

- Lightspeed : All things Solana.

- Supply Shock : Bitcoin, bitcoin, bitcoin.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

US Treasury Confirms Holding $17B Bitcoins on Strategic Reserve

XRP Price Prediction — Ripple Eyes $5 as Market Analysts Project 40% ETF-Driven Upside

Democrats propose ‘restricted list’ for DeFi protocols, sparking outcry